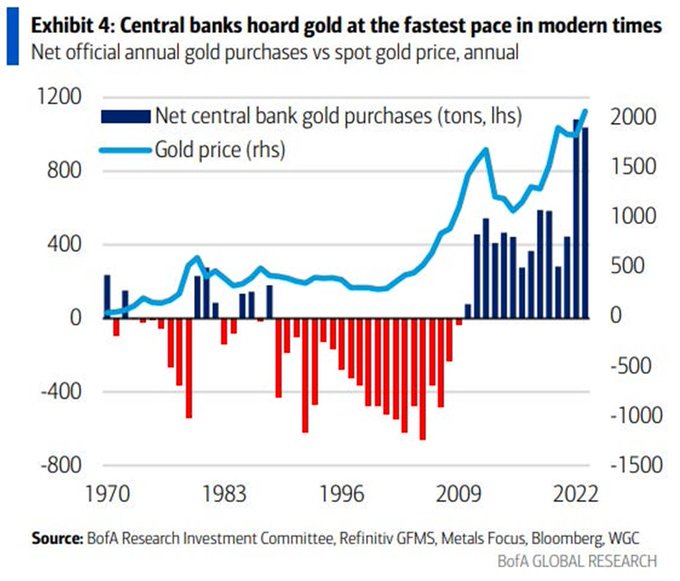

In recent years, central banks around the world have been on a gold-buying spree, and the numbers are staggering. According to data from Bank of America global research, their net purchases have skyrocketed, particularly since the 2008 Global Financial Crisis. What was once a modest 400 tons per year has now surged to nearly 2000 tons annually. This trend is hard to ignore, especially considering that total gold production worldwide amounts to only around 3000 tons.

Central banks play a pivotal role in managing global monetary systems. As institutions responsible for determining currency values and managing reserves, their actions carry significant weight. The rapid pace of gold accumulation suggests that something significant might be underway in the world of finance. While there are various theories about the implications of this gold rush, one thing is clear: the current financial system is under strain.

Mounting Debt and Economic Realities

The ballooning levels of debt across the globe paint a concerning picture of economic sustainability. With many countries operating at deficits, questions arise about the source of funding. It’s akin to an individual earning four lakh rupees but consistently spending six lakh rupees each month. The gap is bridged by borrowing, a practice that cannot endure indefinitely. The United States, for example, faces a significant disparity between tax revenues and expenditures, relying heavily on borrowing to sustain its spending habits.

Preparing for Uncertain Futures

In light of these economic realities, central banks and nations are hedging their bets by stockpiling gold. While the exact outcomes remain uncertain, the proactive accumulation of this precious metal suggests a degree of preparedness for potential financial upheavals. Whether it’s speculation about a return to a gold-backed currency or simply a hedge against economic instability, the message is clear: gold holds enduring value.

As individuals navigating these economic currents, it’s essential to heed the signals from central banks. While we may not have all the answers, prudence dictates that we consider diversifying our portfolios to include gold. Whether as a hedge against inflation, currency devaluation, or broader market volatility, gold offers a tangible asset in times of uncertainty. While the decision ultimately rests with each investor, it’s wise to reflect on the implications of these trends and act accordingly.

WeekendInvesting Strategy Spotlight

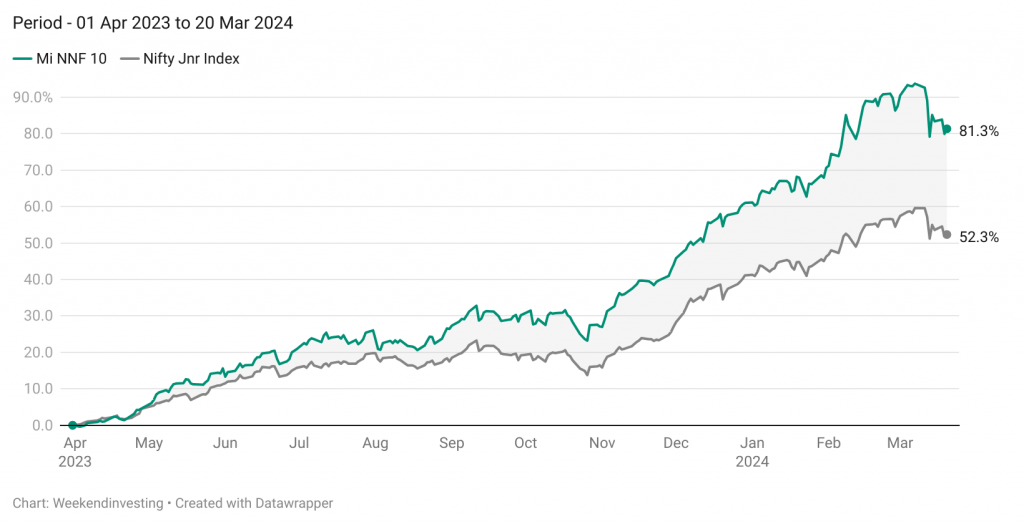

Mi NNF 10’s performance has been a great example to showcase the immense ability of a robust non discretionary, momentum strategy based on large caps, specifically – the Nifty Next 50 index.

With about a week to go for the end of FY 24, the strategy has achieved 81% gains so far compared to 52% on the Nifty Next 50 Index demonstrating solid outperformance. The CAGR since going LIVE (12 Nov 2020) stands at 31% compared to 22% on the Nifty Jnr Index.

The subscription fee for Mi NNF 10 shall be increased to Rs 9,999 from current fee of Rs 7,499 effective – 01 Apr 2024 onward. Go ahead and make use of this opportunity to subscribe to to Mi NNF 10 before the price increase.

If you have any questions, please write to support@weekendinvesting.com