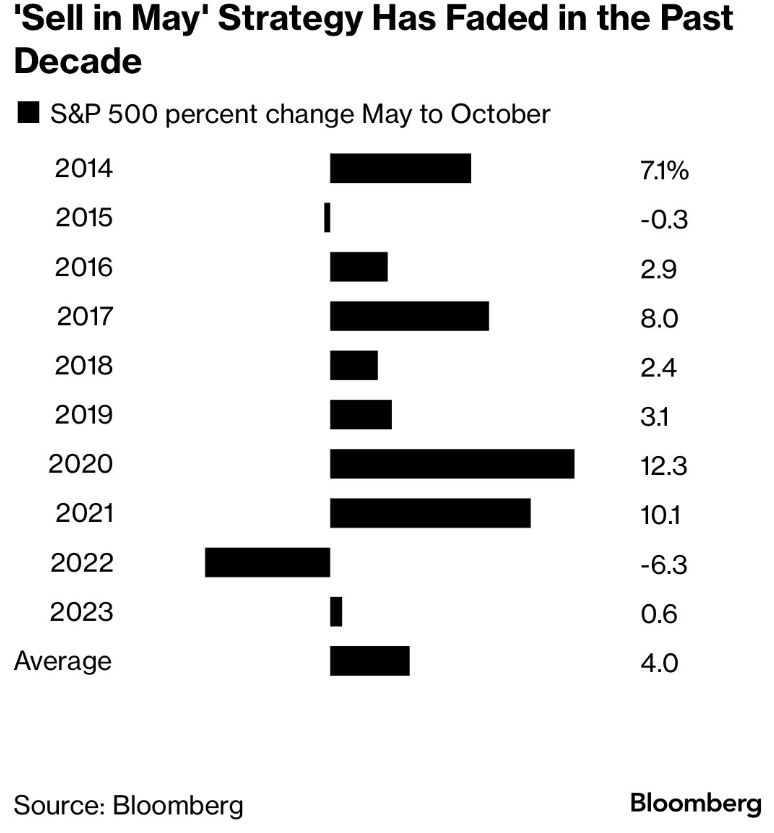

The adage “sell in May and go away” has been circulating for decades, suggesting that investors should exit the market in May and return later. However, recent data from Bloomberg challenges this notion. Over the past decade, the S&P 500 has been down from May to October only a few times, indicating that this strategy may not always hold true.

Market Talk vs. Reality

There’s often a disparity between market talk and actual market performance. While some advocate for holding onto stocks indefinitely, others, like Warren Buffett and his team, engage in regular stock rotation. It’s essential to differentiate between market adages and practical investment strategies.

Navigating Market Surprises

Markets are designed to be unpredictable, often surprising even seasoned investors. Despite advancements in technology and analytics, accurately predicting market movements remains a challenge. Instead of relying on historical sayings or predictions, investors should focus on understanding market trends and adapting accordingly.

The Dangers of Anchoring

One common pitfall for investors is anchoring—fixating on a specific price point and waiting for the market to return to it. Selling in May based on this adage and then struggling to re-enter the market at a lower price illustrates the risks of anchoring. Market dynamics can change rapidly, making it challenging to execute a predetermined strategy.

Adapting to Changing Realities

Rather than adhering rigidly to traditional market wisdom, investors should remain flexible and adaptable. Each year presents new challenges and opportunities, requiring a dynamic approach to investing. By staying informed and responsive to market shifts, investors can better navigate the ever-changing landscape.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com