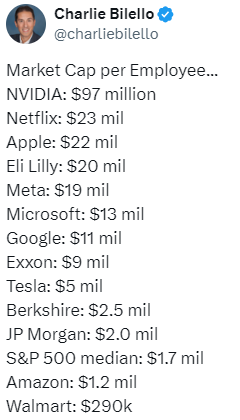

Understanding Market Cap Per Employee

Market cap per employee is an interesting metric that can reveal how much value a company generates for each person working there. For example, Nvidia leads this list with a market cap of around $97 million per employee, even after a recent drop in stock value. Following Nvidia, Netflix sits at $23 million, while Apple comes in at $22 million. On the other hand, Walmart, which is known for its large workforce, has a market cap of $290,000 per employee. This comparison highlights the difference between tech companies and more traditional businesses when it comes to the value they create for their workforce.

Luck Plays a Role in Stock Market Success

For employees working in companies with strong stock market performance, there can be a huge advantage. Some workers may feel lucky when they join a company during a period of significant stock price growth. This boost can add value to their overall compensation package, especially when they hold stock options or other equity-based incentives. It is often a matter of timing and luck, as not all companies perform equally in the market. One employee may be fortunate enough to see the stock of their company soar, while another might find themselves in a company where the stock price remains stagnant.

Generational Wealth Through Stock Options

Many people have been able to build generational wealth through stock options provided by their companies. In India, companies like TCS, Wipro, Infosys, and Mahindra & Mahindra have created immense wealth for their employees over time. These employees not only earned their regular salaries but also benefited from stock options that appreciated significantly in value. This form of wealth accumulation can be life-changing, particularly when the stock experiences a substantial revaluation during an employee’s tenure at the company.

Stock Options as a Life-Changing Opportunity

Stock options are often part of an employee’s compensation package, especially in large or growing companies. When these options are offered at a lower price and the stock later experiences a significant rise, the financial gains can be enormous. This is especially true when employees are rewarded generously with stock options or other equity-based compensation. Sometimes, employees unknowingly find themselves in the right place at the right time, reaping the benefits of a stock price surge. It’s a reminder that stock options can sometimes be more valuable than expected, adding considerably to an employee’s financial well-being.

Choosing Between Organizations: Stock Market Success Matters

When deciding between two job offers where all other factors are equal, I’d probably consider the potential stock market performance of the companies involved. A company with a history of stock price growth or one poised for future success in the market can offer significant financial advantages through stock options. While it’s impossible to fully predict the future of any stock, choosing an organization that appears likely to perform well in the stock market can be a life-changing decision. For many employees, a company’s stock market success has turned into substantial financial gains over time.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com