The Reality of Business Survival: Understanding the Importance of Adaptation and Momentum Investing

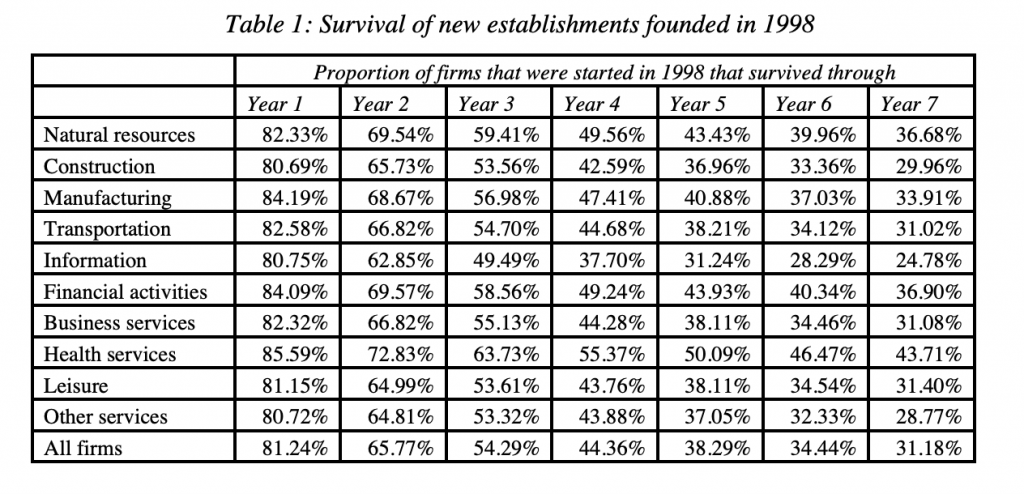

In the ever-evolving landscape of business, the ability to adapt and thrive is crucial for long-term survival. A chart depicting the survivorship of companies founded in 1998 offers a sobering realisation of the challenges businesses face. The data, compiled by Brian Feroldi, highlights the stark reality that only a fraction of companies survive beyond seven years in various industries. Natural resource companies see a survival rate of 36%, construction companies at 30%, and manufacturing at 33%, to name a few. Overall, the average survival rate across all industries stands at a mere 31% over a seven-year period.

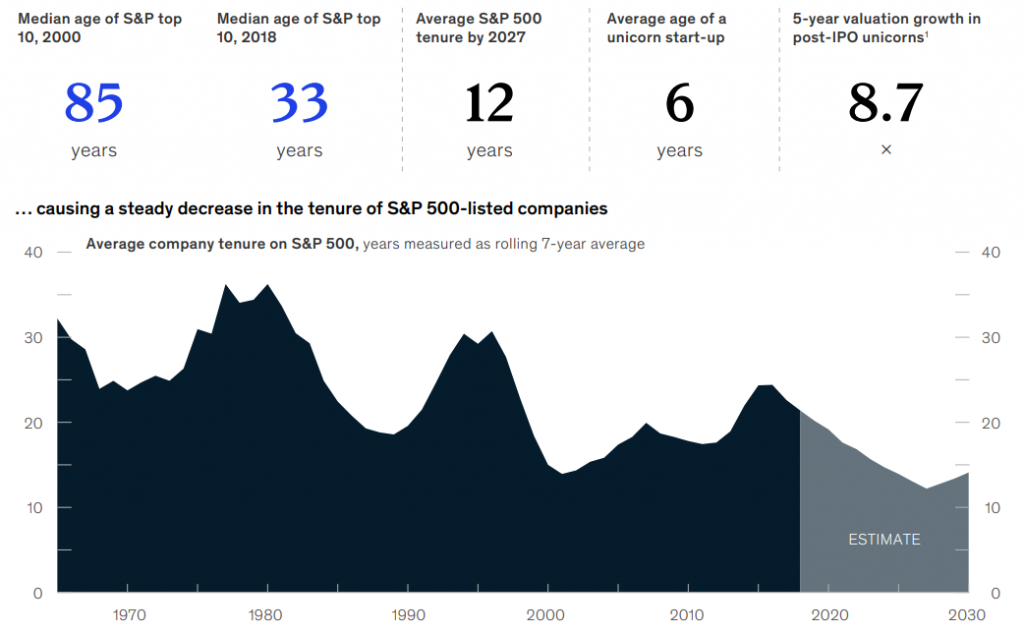

These numbers indicate the level of competitiveness and volatility businesses encounter in today’s dynamic marketplace. Even industries experiencing a technological boom can face periods of slumping demand. It is a continuous cycle of disruption that compels us to reevaluate our investment strategies and adopt a more adaptable approach. To illustrate the ever-shortening lifespan of companies, a McKinsey study notes that the average lifespan of an S&P company has decreased from 30 to 40 years after World War II to the mid-twenties. Predictably, by the end of this decade, it is projected to dwindle further into the teens.

Source : McKinsey Report on Traditional company, new businesses: The pairing that can ensure an incumbent’s survival

This state of affairs emphasises the need for investors to reassess their long-held beliefs in buy-and-hold strategies. In an era defined by disruption, relying on the promises of business leaders to secure long-term success has become wishful thinking

The environment has become increasingly hostile, nullifying the significance of management quality or market leadership in determining a company’s longevity. To put it simply, investing in a company today that will survive and thrive for the next 20 years is akin to throwing a dart blindfolded.

As someone who has experienced the intensifying competitive landscape firsthand over the past three decades, I can attest to the ever-growing need for businesses to adapt swiftly. Consider the brokerage industry, which witnessed commission rates drop from 1.5% in 1995 to essentially zero today. This trend is evident across industries, emphasising that traditional markers of success, such as capital and infrastructure, have taken a backseat to the primary driver of sustainability—demand acquisition.

Looking towards the future, the rise of artificial intelligence (AI) will undoubtedly fuel further disruption. As AI becomes more mainstream, the pace of change and competition will only escalate. Established companies that struggle to reinvent themselves in response to these challenges will inevitably fail, making room for new companies to emerge and flourish. This reality is widely acknowledged, underscoring the outdated nature of the buy-and-hold forever strategy.

It is vital to recognize that success in today’s environment necessitates a proactive approach focused on following the winners. Momentum investing, where investors remain aligned with companies demonstrating consistent success, is gaining prominence. The core principle of this strategy is to adapt and adjust investment positions based on the evolving market landscape. Just as one would bet on different horses during a derby based on their performance, so too should investors continually reassess their holdings.

The Beauty of Momentum Investing

Momentum investing emphasises the importance of remaining with the winners, even amidst disruptive forces. Through this approach, the rotation into new players occurs naturally, while underperforming companies are automatically discarded. This flexibility and adaptability to changing market dynamics is the beauty of momentum investing. Whether implementing a complete momentum strategy or incorporating elements of it into a broader investment approach, understanding and embracing this concept is vital in today’s competitive landscape.

Of course, it is crucial to exercise caution and conduct thorough research when making investment decisions. Blindly following winning stocks without a comprehensive plan on when to exit can lead to potential risks. While it is necessary to embrace adaptability, investors must strike a balance between momentum investing and a sound investment thesis.

If you have any questions, please write to support@weekendinvesting.com