Many investors focus on maximizing their monthly SIP contributions or chasing high returns, but what truly drives wealth creation in the long run? This article explores the surprising answer: time and compounding.

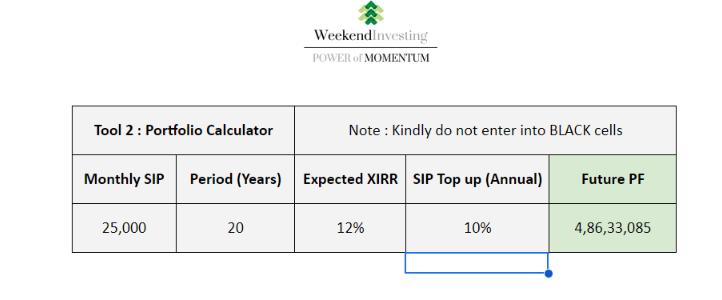

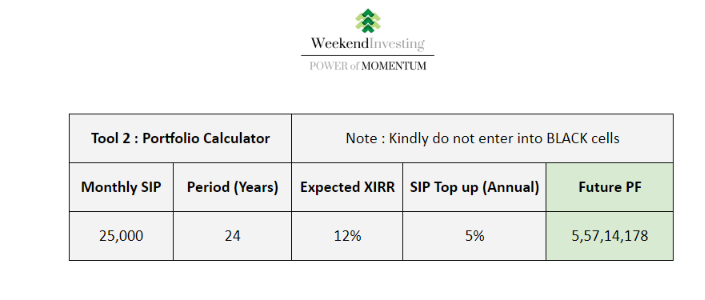

Using a simple SIP calculator, we analyze different scenarios to reveal the dramatic impact of extending the investment period. Increasing your SIP amount by 100% (from ₹25,000 to ₹50,000) doubles your future portfolio value. However, increasing the investment period by just 20% (from 20 to 24 years) nearly doubles it again, jumping from ₹3.25 crore to ₹5.57 crore!

Case a : 25k SIP for a period of 20 years at 12% XIRR with an annual step up of 5% in SIP Value

Case b : 25k SIP for a period of 20 years at 12% XIRR with an annual step up of 10% in SIP Value

Case c : 25k SIP for a period of 24 years at 12% XIRR with an annual step up of 5% in SIP Value

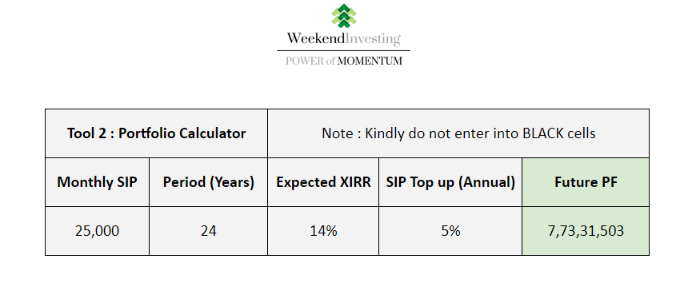

Case d : 25k SIP for a period of 24 years at 14% XIRR with an annual step up of 5% in SIP Value

This highlights the magic of compounding, where your returns snowball over time. Even moderate annual returns can lead to significant wealth accumulation if you stay invested for decades. Think Warren Buffett, whose long-term investing strategy over 70 years has generated remarkable returns.

While chasing higher returns can be tempting, the analysis shows that a decent 12% XIRR compounded over a longer period can outperform a slightly higher 14.5% XIRR with a shorter duration. Additionally, consistently increasing your SIP contributions by even a small percentage (5% in this example) can significantly boost your final corpus.

The key takeaway? Forget instant gratification and focus on building a long-term investment habit. Start early, stay invested, and let the power of compounding work its wonders. Even with moderate returns, you’ll be amazed at what you can achieve over time. Remember, it’s not about getting rich quick; it’s about playing the long game and letting your money grow steadily.

So, keep compounding, have a long-term view, and watch your wealth steadily climb towards your financial goals!

If you have any questions, please write to support@weekendinvesting.com