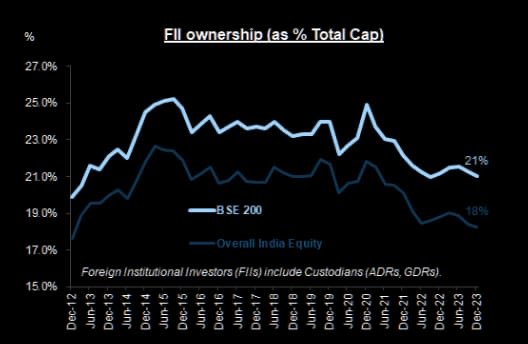

The chart of Foreign Institutional Investor (FII) ownership as a percentage of total market capitalization reveals interesting trends. About a decade ago, FII ownership in the BSE 200 and overall Indian equity market showed a similar pattern. From December 2012 to mid-2015, FII ownership increased from around 17% to 22% in total equity and from 20% to 25% in the BSE 200. This was a very healthy increase, indicating strong foreign interest in the Indian market.

Decline and Recovery in FII Ownership

After mid-2015, FII ownership began to decline gradually, falling from 25% to about 22% by the time COVID-19 struck. Post-COVID, there was a rise again to 25%. However, since December 2023, FII ownership has been steadily declining from 25% towards 21% in the BSE 200. This sharp decline over the last three years marks the highest level of selling by FIIs in the past twelve years. Previously, such a decline was more gradual, spanning five to six years and only reducing by 2%.

Domestic Buying Resurgence

Despite the significant FII outflow, the market has remained elevated, thanks to a strong resurgence in domestic buying. Domestic investors have stepped in to fill the gap left by the FIIs, ensuring that the markets do not suffer from the lack of foreign investments. This robust domestic buying has been crucial in maintaining market stability and has prevented a steep decline in stock prices.

Potential FII Comeback

Imagine a scenario where FIIs decide to come back and increase their ownership back to 25%. The inflow required to achieve this would be massive, especially since the prices are now much higher than before. As FIIs attempt to re-enter, the market may not offer stocks at low prices, making it even more challenging for them to regain their previous levels of ownership.

Market Cushion from Low FII Ownership

The current low level of FII ownership provides a significant cushion for the market. In the event of a global crash or any major market disturbance, this lower FII ownership could prevent the market from plunging steeply. The fact that FII ownership is lower than its historical highs suggests that there is room for increased foreign investment, which could help stabilize the market in turbulent times.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com