The Impact of Rising Interest Rates on Bond Performance

Interest rates play a crucial role in shaping the performance of different financial instruments. In this article, we will explore the relationship between rising interest rates and the performance of long-term US government bonds. We will analyze historical data and discuss the potential implications for investors.

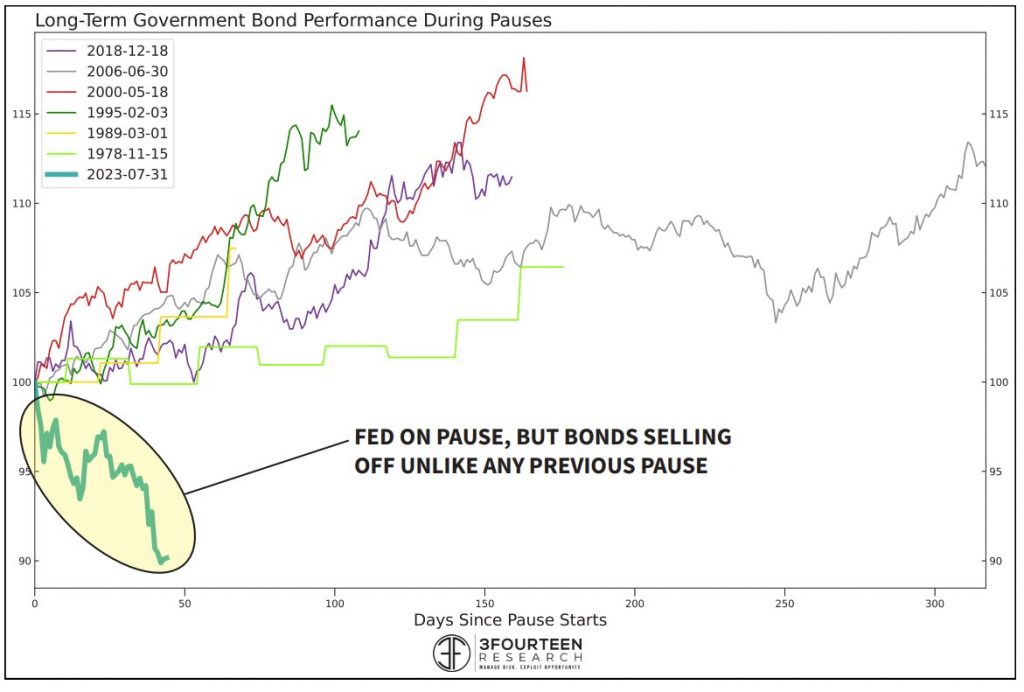

A chart from 3fourteen Research presents the bond performance of long-term US government bonds during periods when the Federal Reserve has paused interest rate changes. By observing the past three decades, we can discern a consistent pattern: whenever the Federal Reserve has paused, bond yields have rallied. This means that bond prices have increased, leading to a decrease in yields.

However, the current situation is peculiar. Despite the Federal Reserve’s recent pause in interest rate hikes, bond prices have been falling instead of rallying. This trend is concerning, as it suggests that interest rates may continue to rise in the future. Additionally, it has repercussions for various sectors of the economy.

Impact on Investors

The prospect of rising interest rates has significant implications for investors. Those accustomed to low yields, such as the 0% to 2% range, may find it enticing to shift their investments towards bonds with yields of 5% to 6%. This shift could prompt a decrease in stock market investments and potentially disrupt the equanimity of the economy.

Historically, the average returns on the S&P 500 have been in the high single-digit range. If debt returns were to reach 7%, as suggested by Jamie Dimon, CEO of JPMorgan Chase, many investors may be tempted to invest in bonds instead. The current fall in bond prices indicates that there may be further pain to come and that yields will continue to rise.

The Crisis Indicator

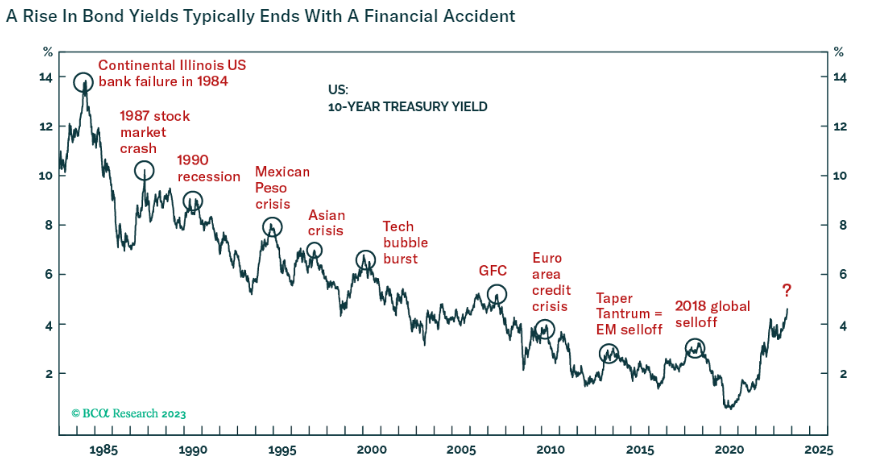

Another chart, this time from BC Alpha Research, demonstrates a correlation between significant spikes in yields and subsequent crises.

The chart shows various crisis events, such as the Illinois Bank failure in 1984, the stock market crash in 1987, and the global financial crisis in 2008. Each of these crises was preceded by a notable increase in yields.

While the current yield levels may not be inherently problematic (as we have experienced higher yields in the past), the last decade has conditioned investors to a different landscape. The sudden shift to higher yields, even if still within historically normal levels, requires adjustments and can create difficulties for businesses relying on borrowed capital.

The Impact on Borrowing

Higher interest rates can have severe consequences for borrowers. Consider a business owner who has taken a variable business loan, assuming they would be paying an interest rate of 2% to 4%. If interest rates suddenly rise to 8% to 9%, which is still historically reasonable, the increased cost of servicing their debt could lead to business failure.

Similarly, homeowners in the US who have locked in low fixed home loan rates for 30 years are fortunate. However, prospective buyers are facing significantly higher rates, making it more challenging to afford larger homes and thereby impacting the real estate market. These scenarios highlight the pressures and challenges associated with rising interest rates.

Potential Implications for India

While India has not been directly impacted by rising interest rates thus far, it is important to note the potential ripple effects of a crisis in the Western world. If the economy of major global players begins to falter, India may not remain unaffected. The real estate market, which is currently steady, and the overall consumption demand could face hardships.

Preparing for the Future

Given the uncertainty surrounding the future trajectory of interest rates and the potential for crises, it is prudent for investors and individuals to always be prepared for potentially challenging times ahead if that happens. One cannot rely on the assumption that past returns will necessarily continue in the future.

Download the WeekendInvesting App

If you have any questions, please write to support@weekendinvesting.com