Understanding the Historical Trends in Gold and Interest Rates

Another lesson in gold is here, and it’s crucial to understand its historical performance. Looking back at history can help us predict future trends. A strong correlation between gold prices and interest rates has been brought out by various studies. This relationship shows that gold prices tend to rise significantly when interest rates fall.

The Correlation Between Gold and Interest Rates

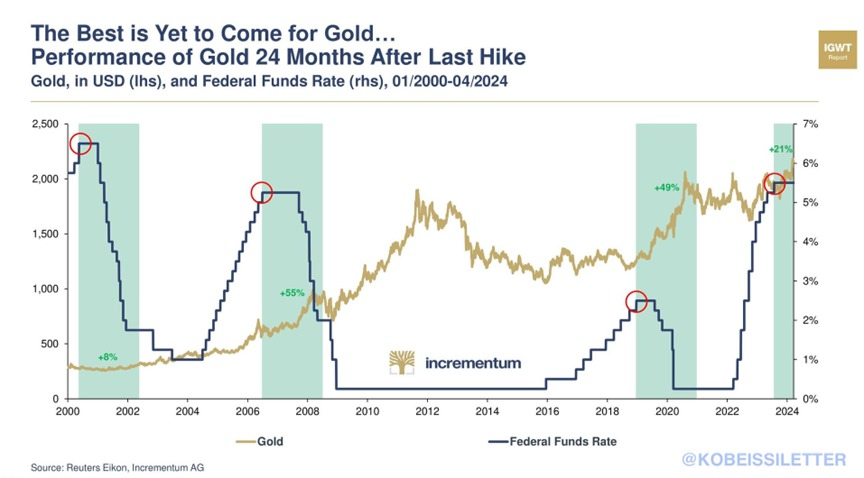

A chart from Incrementum AG, using Reuters data, illustrates this correlation. The dark line represents US Fed funds rates, while the golden line represents gold prices. Although the chart may not be very clear, it reveals an important trend. In every interest rate cycle, when the Fed stops hiking rates and starts lowering them, gold prices tend to soar. This has happened in three major instances over the past 23 years.

Historical Instances of Rising Gold Prices

2000 to 2005: During this period, the Fed was hiking interest rates. Once they stopped and started lowering them, gold prices surged by 85%.

2006: Interest rates peaked in the second or third quarter, remained flat for a while, and then started to drop. Gold prices increased by 135% during this time.

2019: After the Fed raised interest rates from 0.5% to nearly 2.5%, they peaked and then started to fall. Gold prices went up by 50%.

Current Market Scenario

We are now at a point where interest rates are flat and likely to go down. Historical trends suggest that gold prices will rise during this period. This has already started to happen in recent weeks. Gold is in a strong position and is expected to continue rising until the interest rates bottom out. After that, gold prices may stagnate.

The Golden Era of Gold

We are in a golden era for gold. Since 2016, many have been advised to add gold to their portfolios. While some have done so, others remain skeptical due to contrasting opinions from market analysts. However, central banks worldwide are accumulating gold in large quantities. They are not buying other commodities like silver, aluminum, or crude oil. There is a reason why gold is being accumulated by central banks.

Why Are Central Banks Buying Gold?

Central banks in countries like China, India, Singapore, Turkey, Uzbekistan, and Poland are buying gold. One-third of the global production of gold is now going into central bank reserves. This is a clear indication that gold is moving from weaker hands to stronger hands. The central banks see value in accumulating gold, suggesting a strong period ahead for this precious metal.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com