Markets round-up

The markets opened week strong versus previous week but these steep declines were bought into and by mid week recovered all the way only to dip again and then up again till Friday. The larger trend in the markets remains UP and no short selling trend is sustaining. The sectors are also rotating with Metals and IT that had taken a back seat came back into action this week along with autos and sugar stocks. The markets remain near the top range of its all time highs and hence there is no deep weakness as yet.

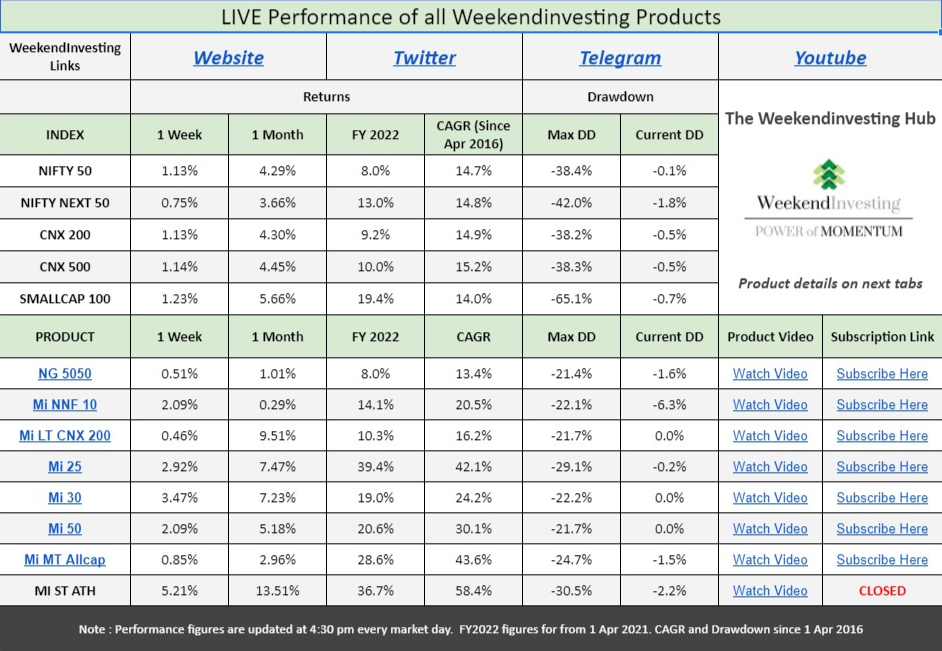

The WeekendInvesting HUB

We have launched a completely revamped weekendinvesting HUB that has ALL the details of all the products and their performance updated daily. Please click the link above. The key feature here is the LIVE current drawdown stat that can help you to add or reduce capital if you are trying to play an active manager with the the strategy.

WeekendInvesting Smallcases

The Weekendinvesting Smallcases have had a tremendous start to the FY22 and the last 5 years and 12 weeks have been a great testimonial to the strategies.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week.(except NNF10 which is monthly rebalanced.)

These are all long term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeating this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years it has been shown that much superior CAGR returns are possible than the benchmarks.

FY21 has been phenomenal and I will let the numbers speak for themselves. Consolidated FY21 report

We give an advance notice here on the upcoming changes in your smallcase for Monday . This advance notice can be used to ignore Monday update if there is no change. If there is a change indicated you can use the smallcase app or login to weekendinvesting.smallcase.com to see the rebalance. A back up email is sent by mid day Monday if you have not rebalanced by then and yet another one a day later.

The performance for the week and the month for all the smallcases

All details on the smallcase products is available at weekendinvesting.smallcase.com or you may write to us at support@weekendinvesting.com anytime

WeekendInvesting LIVE products

The LIVE products are a more suitable for large portfolios and those who have broker accounts that are not synced with the smallcase platform. Also the user here churns their portfolio at Fri 3 PM along with the model and there is no slip between the model the actual experience. The back end task of manual execution and record keeping of course is an additional chore. We recommend going for the LIVE products for portfolios >15 L as market order driven system of the smallcase platform is suited for smaller portfolios mostly.

Mi25 Mi30 and Mi50 are offered as LIVE productsAll details on the LIVE products is available at the HUB.

The weekly changes are the same as shown earlier and have been communicated to the users in LIVE markets today.

How to pick the right WeekendInvesting strategy

Please watch this video for more details

The selection of the smallcase/ LIVE strategy can be done based on

a. Sub Segment of the market : Mi25 for smallcap, Mi_All_cap for all round diversification OR LTCNX 200 for large caps only

b. Activity specific smallcase like Mi ST ATH which chases all time high stocks

c. Or more passive strategies like NNF10 and NG5050 which are monthly rebalanced ones best to replace index investing with or for asset allocation.

d. More diversified smallcases like Mi30 and Mi50 that suit portfolio size of 10L-25L

We have grouped strategies to their relevant benchmarks and presented the performance below:

WeekendInvesting Telegram Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and a YouTube channel for community learning of new topics. We look forward to having you all there.! We try to take up a new topic every day for a 10 min discussion.

What WeekendInvesting did with ADANI Stocks ?

Power of Combining Strategies ?

Rajdhani Express & Stock Markets

Sure Shot way to Win in Stock Markets

Sure Shot way to Win in Stock Markets – Part 2

________________________________________________

WeekendInvesting Testimonials

Last but not the least, we are over whelmed with the touching testimonials we receive on a almost a daily basis. Here are some Testimonials of the Week

_________________________________________________