Market Outlook

What a day it was! If you weren’t in the markets today, you’ll be shocked to see what Nifty did.

Nifty experienced huge volatility today. It opened with a gap up at 22,320, compared to yesterday’s close of 22,200—a 120-point gap up. From there, it lost a couple of hundred points, gained a couple of hundred points, then lost 300 points, and finally gained 400 points. An amazing roller coaster! Usually, you don’t see more than three legs in an intraday move, but we had four today. When the fourth leg comes, it’s very rare and very sharp because everyone is trapped. Only a small percentage of people actually make money in such a market. Most intraday traders likely lost money today. The last move was essentially a short-covering trigger that just kept going. Some options went from Rs1 to Rs150 in this move. Amazing volatility!

The market is signaling that it’s unwilling to go down. Despite breaking trend lines and two-day lows intraday, the market recovered. We are now within striking distance of a new all-time high once again. Today’s move, which could be called a slingshot move, has put short sellers and bears on the back foot. It will be very difficult for them to turn this story around now. The market will likely retest previous highs and potentially move forward, possibly seeing some short covering and profit-taking near the elections.

We are set for a good second half of May. It would be surprising if we break today’s low anytime soon. Today’s low should be your line in the sand—if it gets broken, all bets on the long side are off for the short term.

Nifty Heatmap

The Nifty Heat Map showed that the State Bank of India was down 1.5%, HDFC Bank was up 1.2%, Maruti was down 2.5%, and Tata Motors continued to bleed, down 1.9%. Bharti Airtel gained some ground, while NTPC and Power Grid lost some. In the Nifty Next 50, ABB, PFC, Torrent Pharma, Chola Finance, and REC performed well. Kendra Bank slumped 5% despite the split and dividend. VBL, Dabur, and Vedanta slipped, while Zomato gained slightly. Dmart, Trent, and Pidilite also gained slightly.

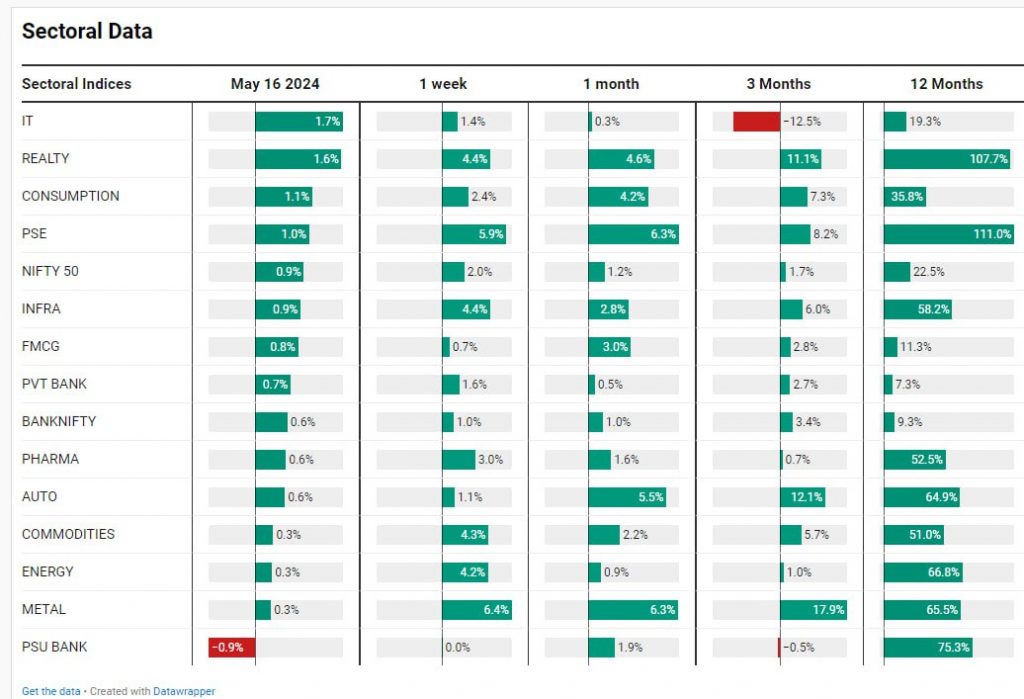

Sectoral Overview

Overall, IT was up 1.7%, real estate up 1.6%, and consumption stocks up 1.1%. Public sector enterprise stocks gained 1%, while infrastructure, FMCG, and private banks were also up nearly 1%. Nifty closed with a 0.9% gain.

PSU banks lost 0.9%, primarily due to the State Bank of India, while metals and energy stocks took a backseat. With today’s move, all sectors are either flat or in the green for the week, month, and the past three months. Only IT and PSU banks are lagging.

Nifty Mid and Small Cap

Mid-caps hit a new high, and the narrative in the market suggests sluggishness and falling numbers. However, the market indicates no major issues right now. Small caps are also gaining ground, not yet near all-time highs but still on the rise.

Nifty Bank Overview

The Nifty Bank showed a long-legged candle, a good sign that lower areas are not being sustained by bears. Buying comes in whenever the market is down, a positive sign for chart formations.

Nifty Next 50

The Nifty Next 50 also closed at a new all-time high, further reinforcing positive sentiment.

US Government Bonds

The main reason for this buoyancy is that US government bonds have suddenly started to drop, from a couple of days ago to 4.3%. There is an expectation of one or two rate cuts, which could be beneficial in the coming months.

Nifty FMCG Index

The FMCG sector also turned around after six to seven days of declines. Today saw a sharp down move, but a quick turnaround led to a close above the congestion zone, offering hope for a rebound.

Nifty IT Index

IT stocks made a small breakout; although the long-term trend is still down, it’s a positive start, especially with the Nasdaq running hard at a new all-time high. If Nasdaq continues to rally, Indian IT stocks cannot lag far behind.

Nifty REALTY Index

The real estate index is also near a new high, marking a good move in that sector.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz