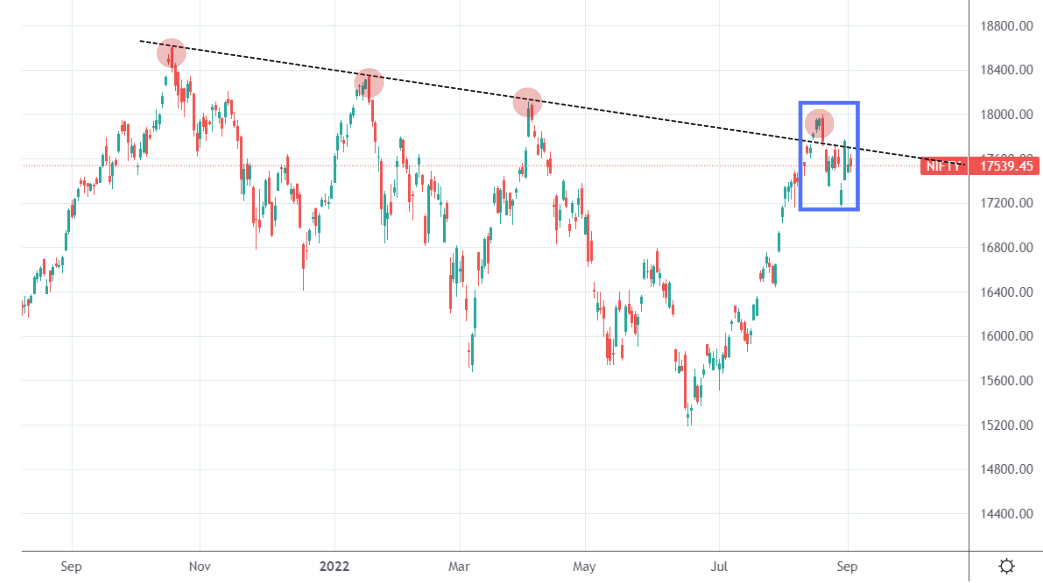

Performance Update

– Lower cap stocks continue to show relative strength after underperforming for quite a while. Smallcap 250 index (+1.16%) & Mid-Small 400 (+1.15%) did well along with Nifty Jnr (+1.4%). Nifty 50 remained flat at (-0.11%). Nifty Jnr has been the best performer amongst the benchmarks in the last three months clocking (+12.4%).

– REALTY , AUTO & FMCG all did well clocking more than (+2%) this week while IT continues to remain extremely weak clocking (-3.3%). IT is also the weakest sector looking at FY 23 returns @ (-23%) while AUTO (+25%) & FMCG (+20%) lead the pack. All the more reasons to stick with the trend !

– WeekendInvesting Strategies did quite well with Mi ATH 2 continuing on it’s strong comeback trail clocking an outstanding (+4.61%) followed by Mi 20 @ (+3.5%) & Mi NNF 10 @ (+2.49%). In the last 1 month, Mi ATH 2 – our absolute momentum strategy of 10 stocks has been the best performer (+11.4%) while Mi NNF 10 has been nothing short of remarkable in the last 3 months clocking a superb (+21.4%).

Click on the link below to read the full report !