Volatility and Falling Trend Line

This week, ending on August 11th, the Nifty experienced significant volatility during the initial couple of days. However, for the following three days, it appeared that the Nifty might bounce back and overcome the falling trend line. Unfortunately, in the last two sessions, the market lost its momentum.

Factors Affecting Market Sentiment in the Short Term

The decline in market sentiment can be attributed to two key factors. Firstly, after the Federal Reserve’s announcement indicating that they might take longer than expected to reduce interest rates, if they choose to do so at all within the next twelve months, investors grew cautious. Secondly, the Reserve Bank of India (RBI) expressed concerns about the persistence of inflation, suggesting that interest rates in India would likely remain unchanged for the near future. These factors combined had a negative impact on the market, unsettling investors.

Natural Correction and Future Outlook

Considering the recent upswing from approximately 17,000 to nearly 20,000, a significant correction was expected at some point. It is possible that the recent decline marks the beginning of this correction. While it remains uncertain whether the market will reverse and regain its upward momentum, it is prudent to adopt a conservative approach. The previous top at around 18,800 could be considered the worst-case scenario unless there are notable changes in the market.

Sectoral Overview

Despite the market downturn, certain sectors managed to retain their growth. In particular, the public sector banks observed a positive trend, experiencing a 3.1% increase. Additionally, financial stocks performed well, with a remarkable 22% gain. The metals industry also showed promise, as did the pharmaceutical sector, which saw a notable increase of nearly 28% this financial year. However, the private banking, real estate, and FMCG sectors were the hardest hit, experiencing significant losses.

Benchmark Indices Overview

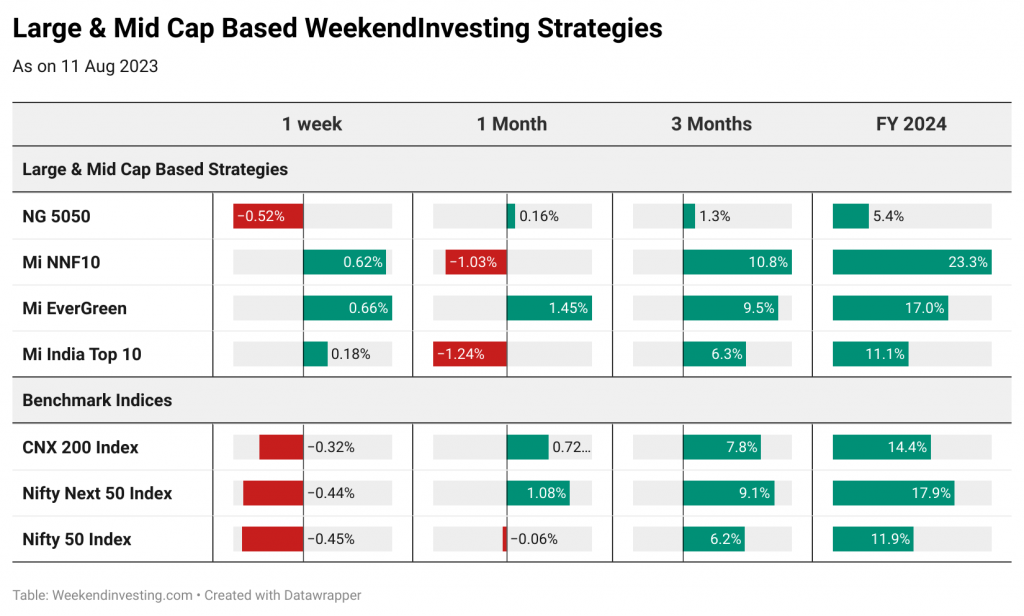

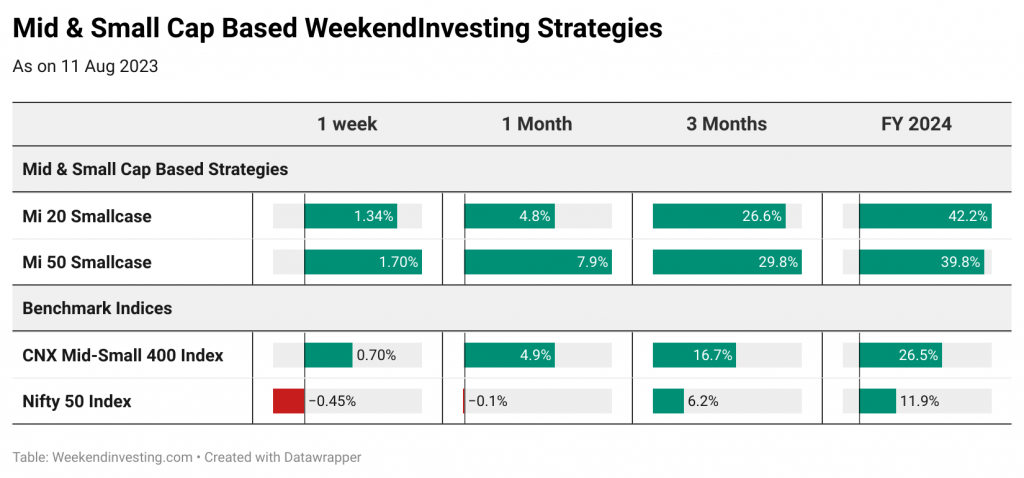

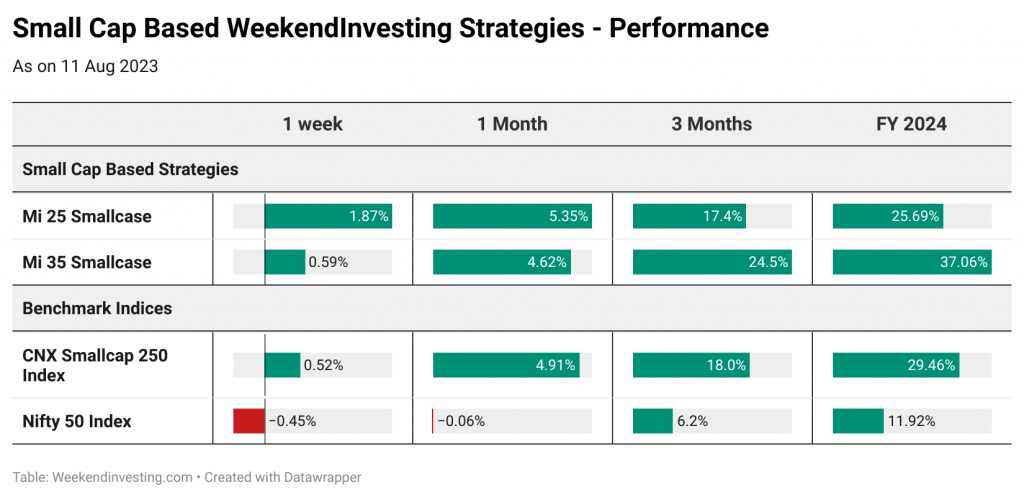

Although there was some damage, it was relatively limited when viewed on a weekly basis. The Nifty observed a decrease of less than half a percent, while the CNX 200 and CNX 500 indices experienced declines of 0.3% and 0.2%, respectively. In contrast, small-cap and mid-cap stocks held their ground, with gains of 0.5% and 0.7%, respectively. Despite the challenges faced by the market, these figures suggest a positive performance.

WeekendInvesting Overview

Mi 50, Mi 25, and Mi 20 portfolios have been particularly successful. Notably, Mi 20 has emerged as the top performer, yielding an impressive growth rate of 42.2% since the beginning of the financial year. This performance disproves the notion that larger portfolios with a greater number of stocks inherently underperform. Rather, Mi 50, with a growth rate exceeding 40%, highlights the success of diversified portfolios.

Conclusion and Outlook

In conclusion, despite the challenging week, the overall market sentiment remains reasonably bullish. Notably, mid-cap and small-cap stocks have withstood the market pressure, indicating resilience. It is essential to note that while certain sectors, such as public sector banks and pharmaceuticals, have shown positive growth, others, like private banking, real estate, and FMCG, have experienced significant losses. Looking ahead, it is wise to approach the market cautiously and remain vigilant for any surprises or shifts in trends.

As we wrap up this week’s report review, I would like to wish you a fantastic weekend ahead! Let’s await the upcoming week with anticipation, as perhaps it will bring unexpected surprises. Thank you for joining me, and until next time, take care and stay informed !

Happy Independence Day !

Team WeekendInvesting wishes you and your family a happy Independence day !

We have a special offer for the special day. Use code FREEDOM20 to avail a special 20% discount on any WeekendInvesting strategy

Code valid till end of 15 Aug 2023

Alok’s Journey after completing his Bachelors !

A SHORT COURSE to Help you Stay Calm in All Market Conditions

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important question we often get asked is whether markets will crash from here. Should we exit? and a few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except Mi NNF10, Mi EverGreen & Mi India Top 10 which is monthly rebalanced)

These are all long-term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeat this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years, it has been shown that much superior CAGR returns are possible than the benchmarks.

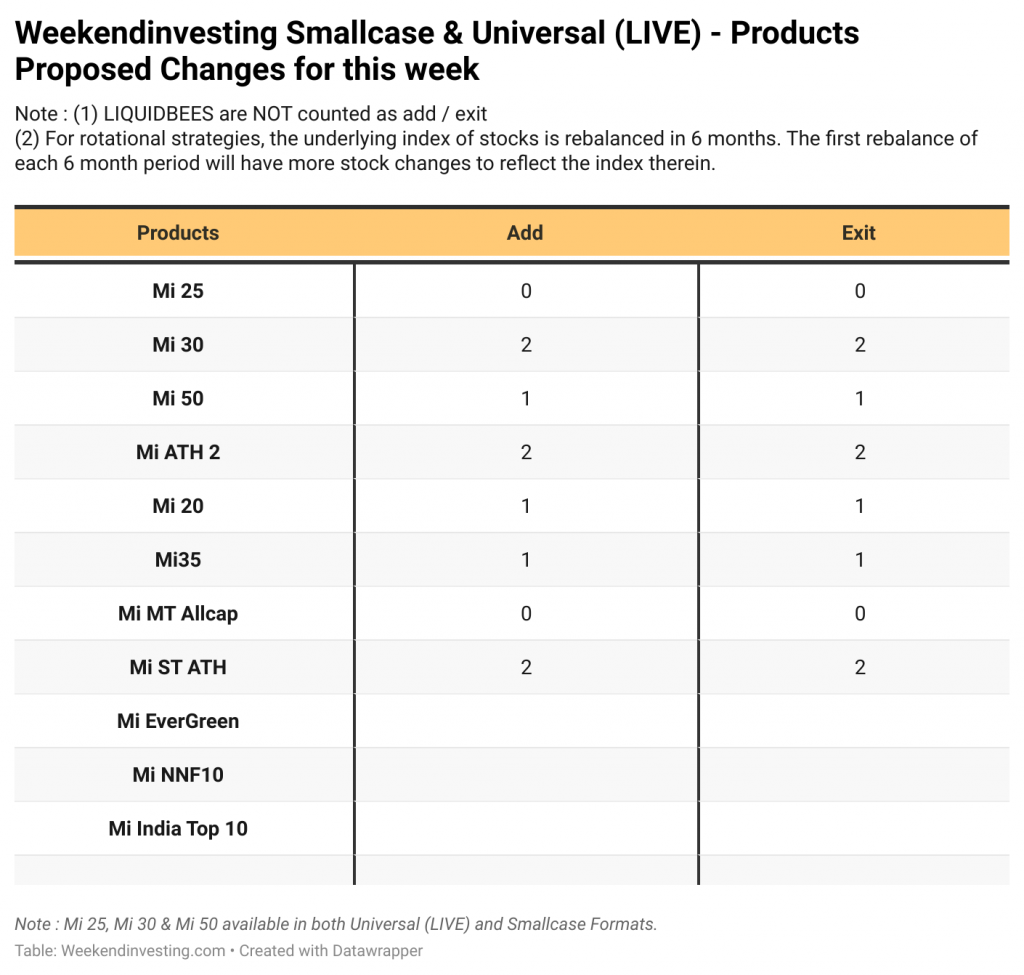

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

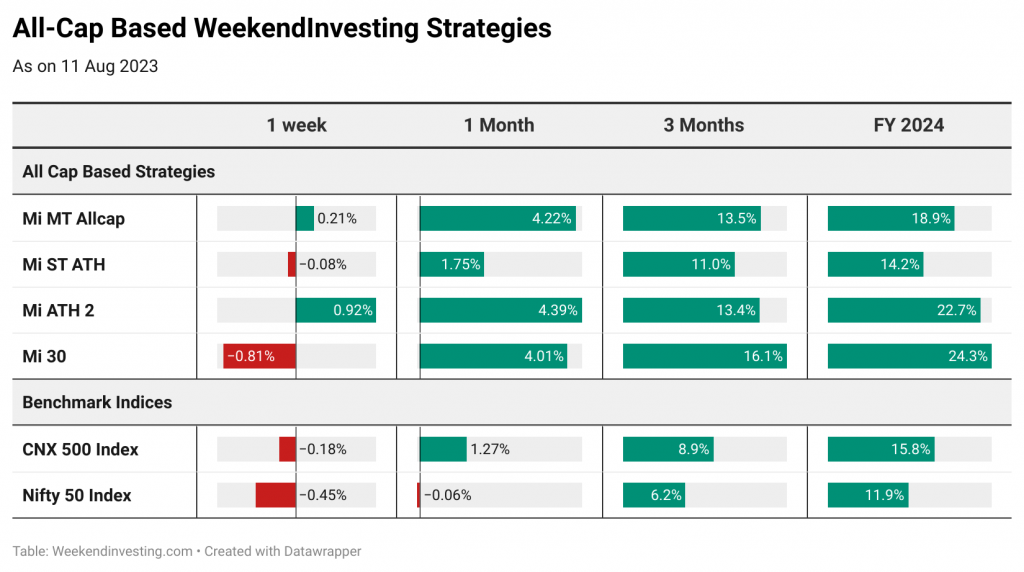

The performance of all strategies across various timeframes are listed below.

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.