- Introducing "The WeekendInvesting Newsletter"

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

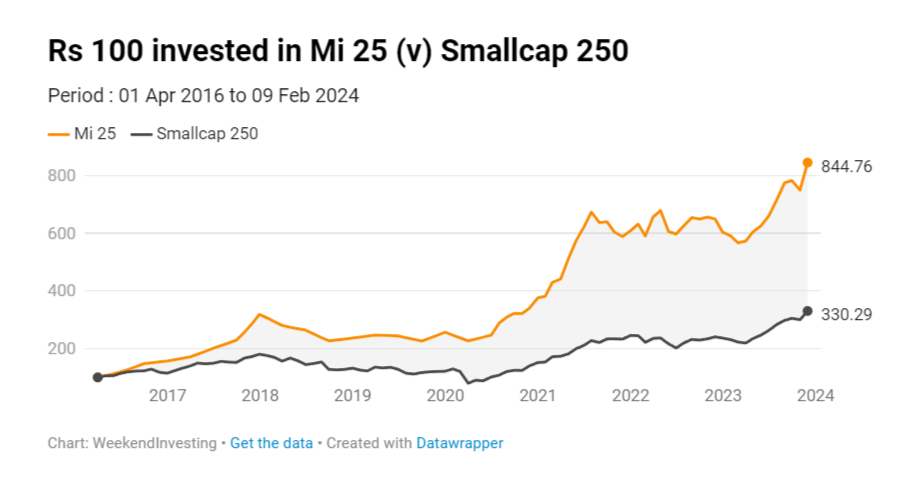

- Spotlight - OLECTRA scores 3x in Mi 25

- Rebalance Update

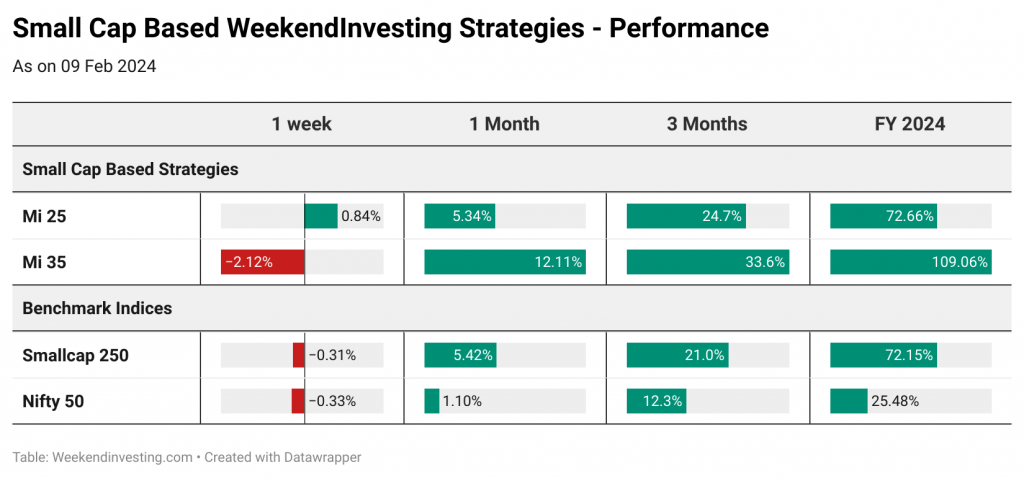

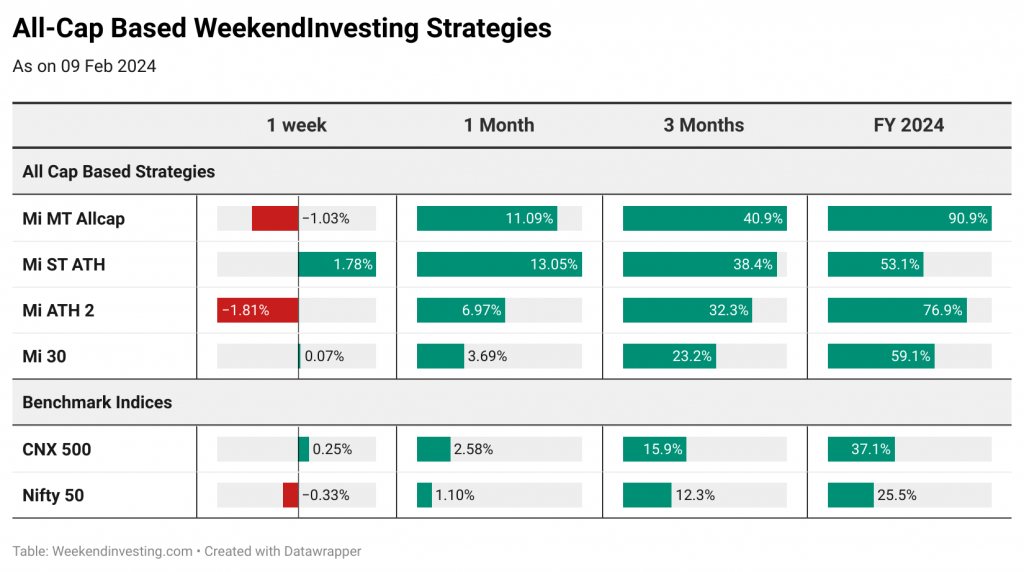

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

Learn how NHPC’s unique journey challenges conventional investment wisdom.

Don’t equate narrative to price performance : Case of Chinese markets

Uncover the hidden dynamics shaping investment success that go beyond earnings and market share. Discover why a broader perspective is essential for making informed decisions in the ever-changing market landscape. Join us as we explore unconventional paths to investment success.

Chinese stocks spooked by Trump

Unlock the mystery behind the sudden plunge in Chinese small-cap stocks! Explore the intriguing correlation between market volatility and Donald Trump’s political maneuvers. Join us as we delve into the complex interplay of global economics and political rhetoric shaping today’s investment landscape. Discover what lies beneath the surface of this dramatic market shift.

Why the average Smallcase performance is better than the average mutual fund

Discover why conventional strategies may be falling short in today’s dynamic market environment.

Process of natural selection of winners

Explore the captivating tale of two contrasting stock markets: China’s economic rise versus America’s stock market success! Uncover the mysteries behind China’s lackluster stock market performance despite its booming economy. Join us as we dissect the factors driving these divergent trajectories and reveal insights crucial for savvy investors navigating today’s global markets. Discover why understanding these market dynamics is essential for unlocking investment opportunities.

How PE ratio is designed to fool you

Join us as we unravel the mysteries behind China’s low P/E ratios amid its staggering economic growth, offering insights crucial for navigating today’s complex investment landscape.

Is your manager under 39 yrs of age ?

Unlock the secrets of market analysis with a revealing perspective from Puru Saxena! Explore historical insights into prolonged stagnation in the S&P 500 index, shared by this renowned Twitter account. Delve into the implications for today’s market landscape, offering vital lessons for navigating potential long bear markets. Join us as we unravel this intriguing analysis, essential for professionals preparing for uncertain economic climates.

Unravel the mysteries behind gold’s allure in uncertain times! Dive into the captivating analysis by Rashad Hajiyev, a renowned Twitter analyst, hinting at a possible repeat of gold’s historic surge in 2019. Explore the implications for investors seeking stability and protection amid economic uncertainty. Join us as we uncover the potential for gold to perform really well in the near term.

Learnings from 15+ year long Suzlon story

Embark on a thrilling journey through the highs and lows of stock market investing with Suzlon’s captivating tale! Uncover the invaluable lessons learned from this rollercoaster ride, guiding investors through turbulent market fluctuations. Join us as we delve into the fascinating stock journey of Suzlon, offering insights essential for making informed investment decisions in today’s volatile market landscape.

The correlation between Large and small caps

Join us as we explore the intricate relationship between small and large caps, revealing insights into their influence on the broader equity markets. Discover how understanding these dynamics can enhance your overall awareness about how people usually comprehend these benchmarks and how performance has unfolded in the past.

Markets this week

Nifty was dull this week oscillating between 21630 and 22130. This consolidation especially after such a strong really does not call for any complaints whatsoever as long as we don’t see a big move on the downside.

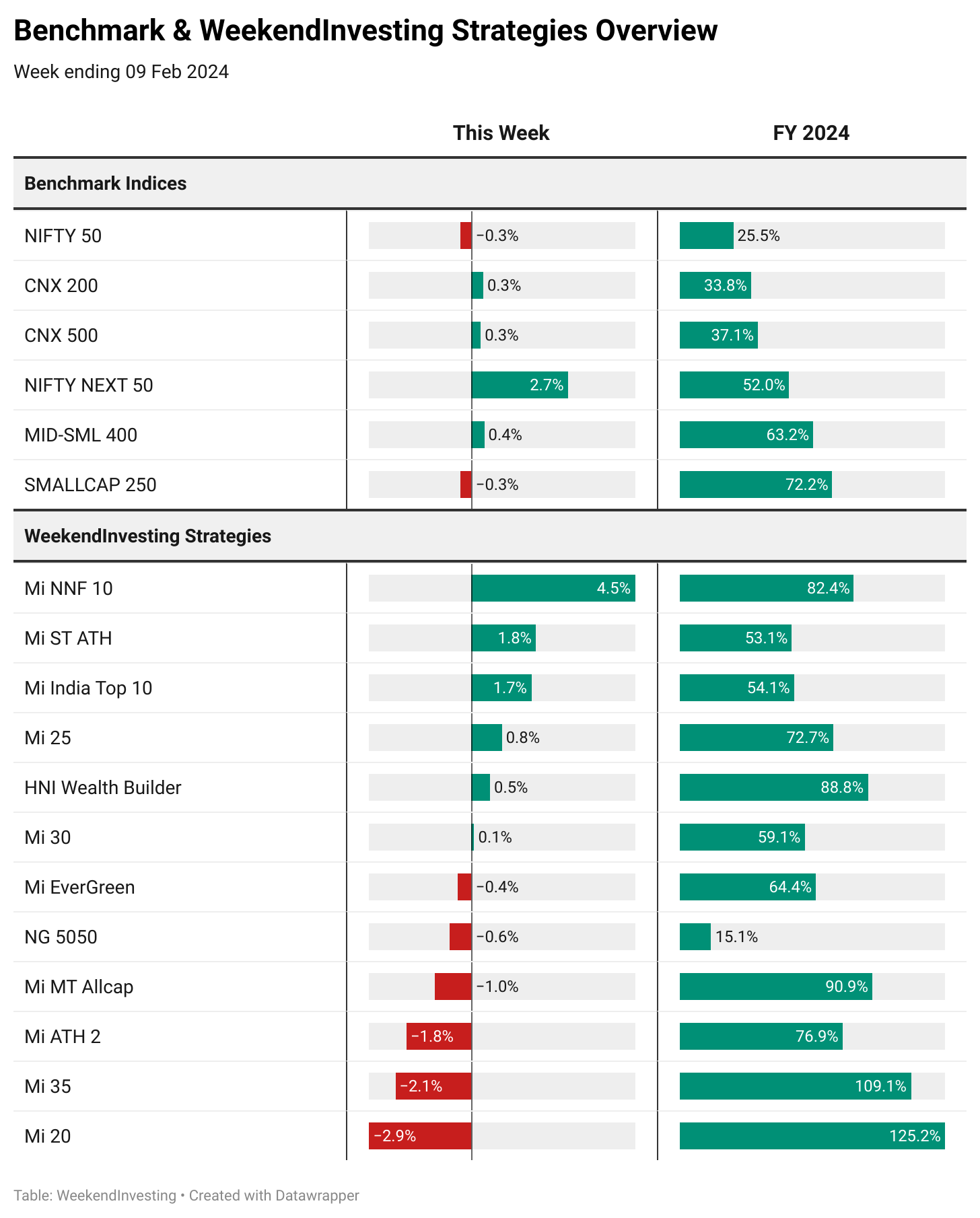

Benchmark Indices & WeekendInvesting Overview

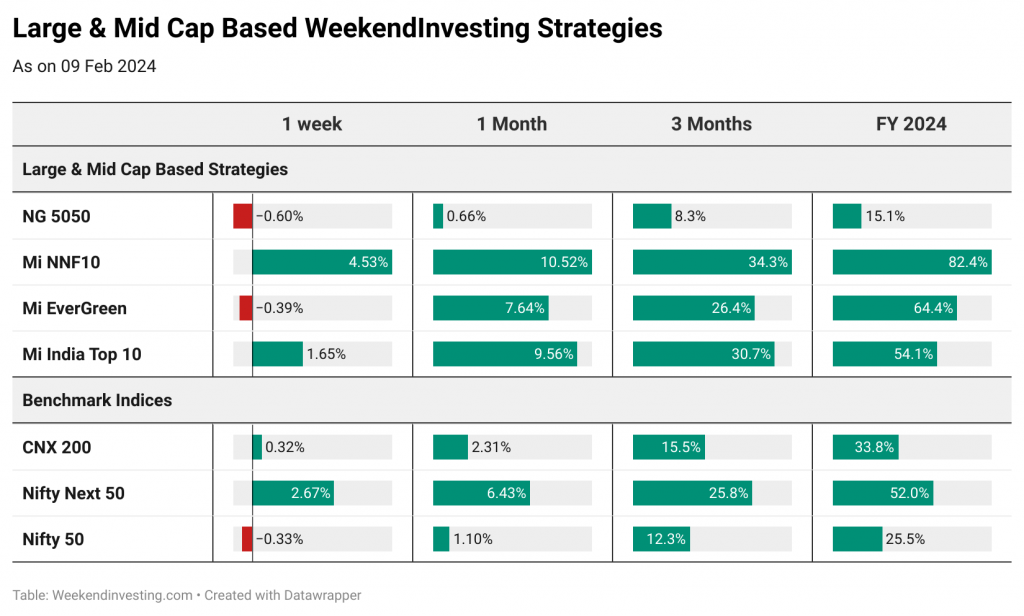

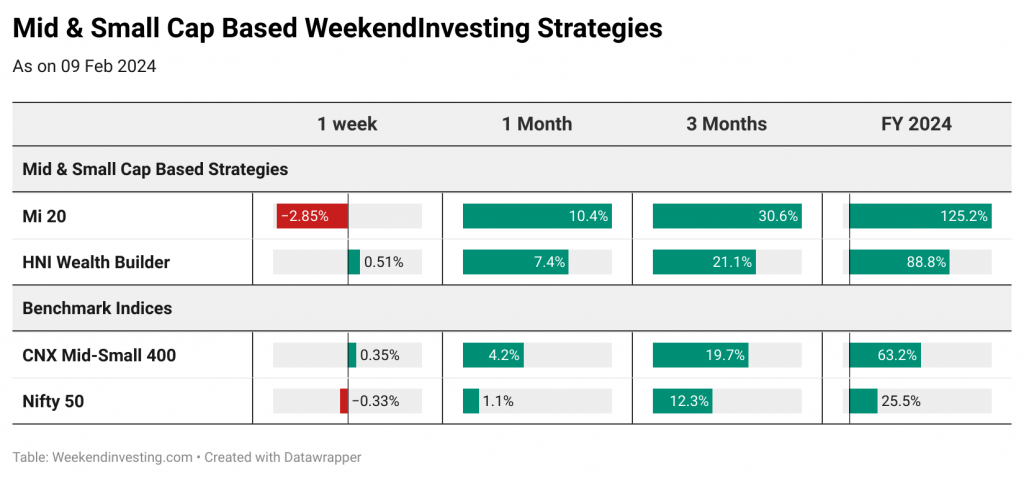

Nifty 50 was flat at -0.3% along with most other benchmark indices barring Nifty Next 50 which did really well to clock 2.7% achieving a significant outperformance. The index has also clocked 50% gains for FY 24 and looks very strong going forward too. Smallcaps and Midcaps lead the FY 24 chart clocking 72% and 63% respectively while Nifty is the least performing index at 25.5% gains.

Mi NNF 10 rode on the strong trend in Nifty Next 50 extracting as much as 4.5% gains for this week. This solid week takes Mi NNF 10’s FY 24 tally to a brilliant 82.4% compared to 52% on its benchmark, the Nifty Next 50 index. Rest of the strategies had a mixed outing this week with the likes of Mi India Top 10, Mi ST ATH and Mi 25 doing well as others had a below par outing. Despite losing almost 3% this week, Mi 20’s FY 24 returns stand at a majestic 125% winning appreciation from all corners of our community. Mi 35 has been the second strategy to score a century in FY 24 with Mi MT Allcap. HNI Wealth Builder and Mi NNF 10 fast approaching that mark.

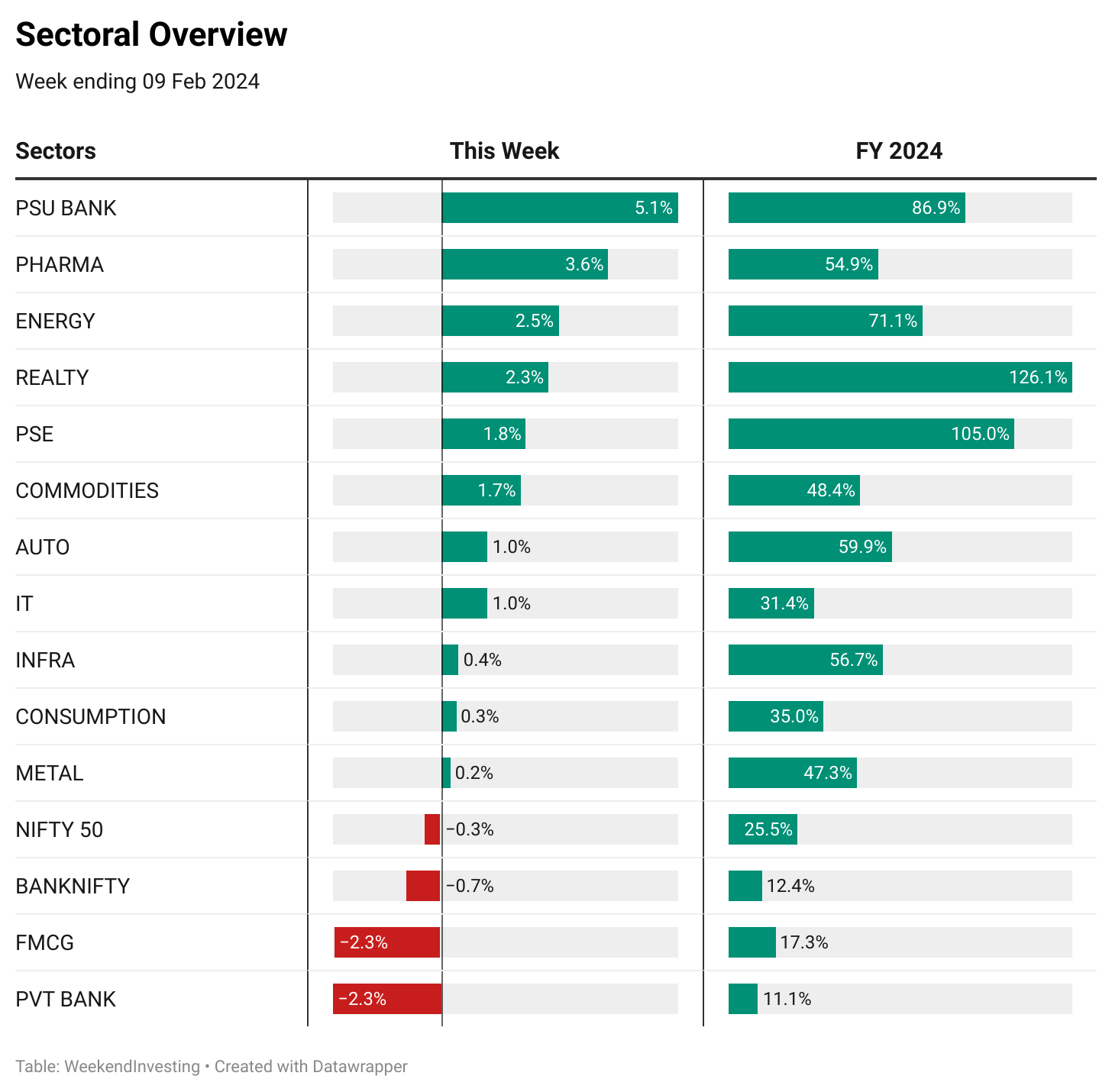

Sectoral Overview

PSU Banks continued on their exceptional momentum clocking 5% gains this week taking its FY 24 tally to 87% returns. REALTY did well this week to clock 2.3% to stage a decent recovery after a little bit of a slump in momentum recently. PSE gained 1% to hit a century in FY 24 while FMC and PVT Banks remained quite weak.

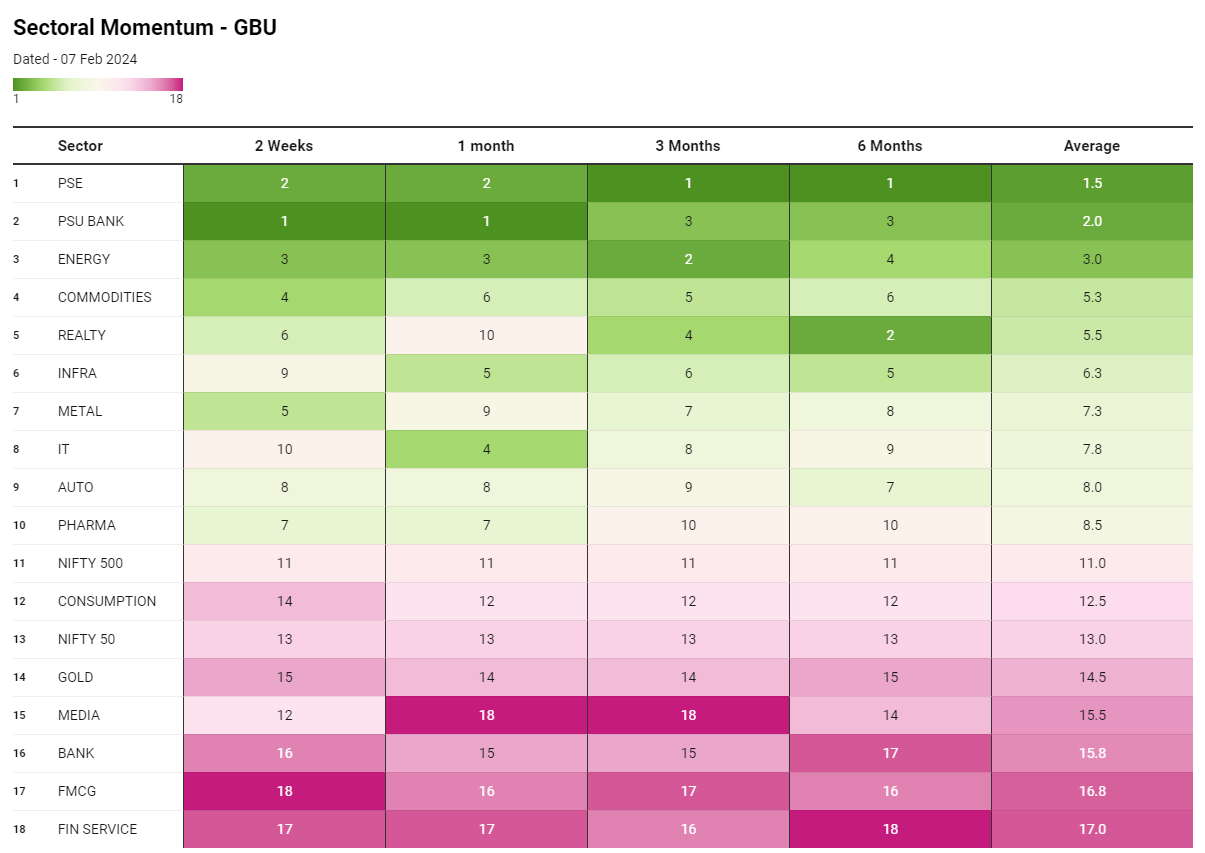

In terms of sectoral momentum ranking, PSE continues to perform splendidly retaining its position pretty firmly in the top 2 ranks across all time frames. PSU banks have also been extremely consistent securing sub #3 ranks across all timeframes. METALS and INFRA are slowly coming up the ranks while BANKS , FMCG, FIN SERVICES languish at the bottom. REALTY has lost some ground in the monthly ranking slipping to #10.

Spotlight – OLECTRA scores 3x in Mi 25

OLECTRA is the stock taking the spotlight this week having recorded 3x gains since coming into our Mi 25 strategy in March 2023.

Mi 25 went live on 01 Apr 2016 and has been a remarkable performer in the smallcap space having clocked 8.4x gains compared to about 3.3x on the benchmark – the Smallcap 250 index.

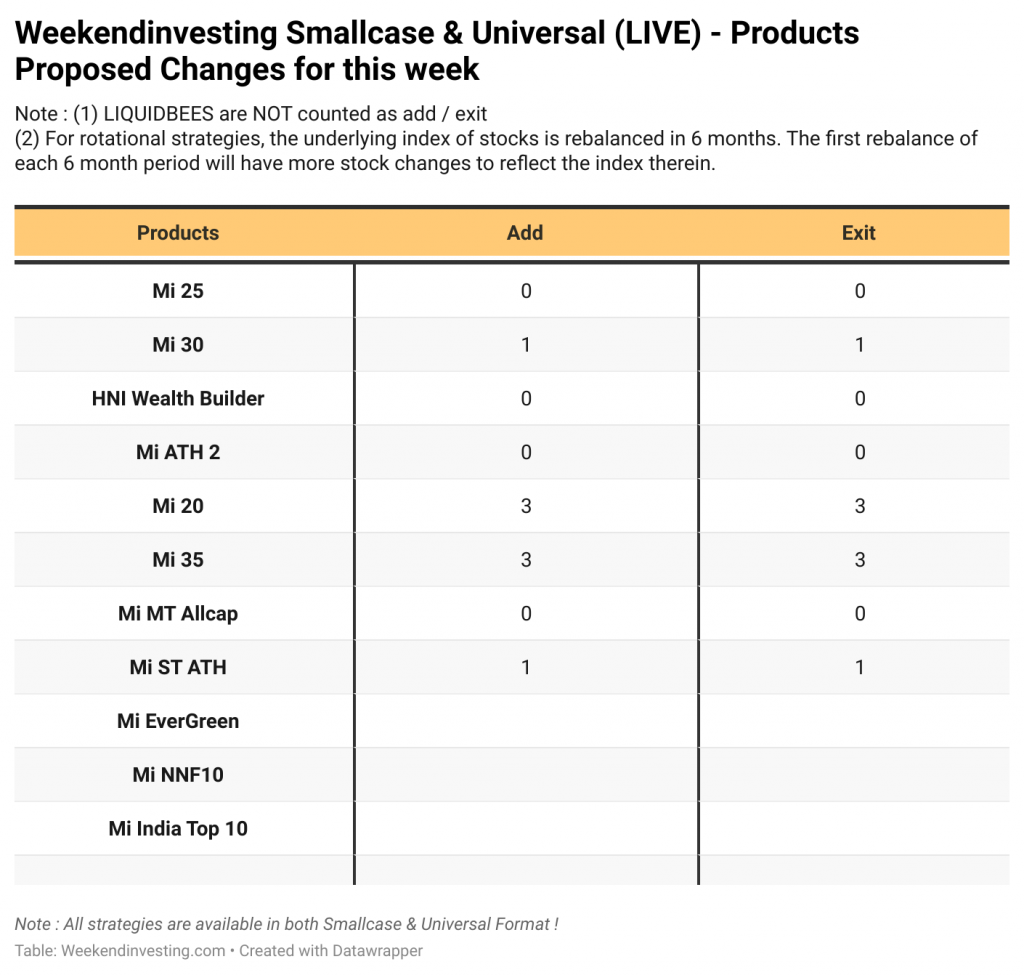

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report