Performance Update

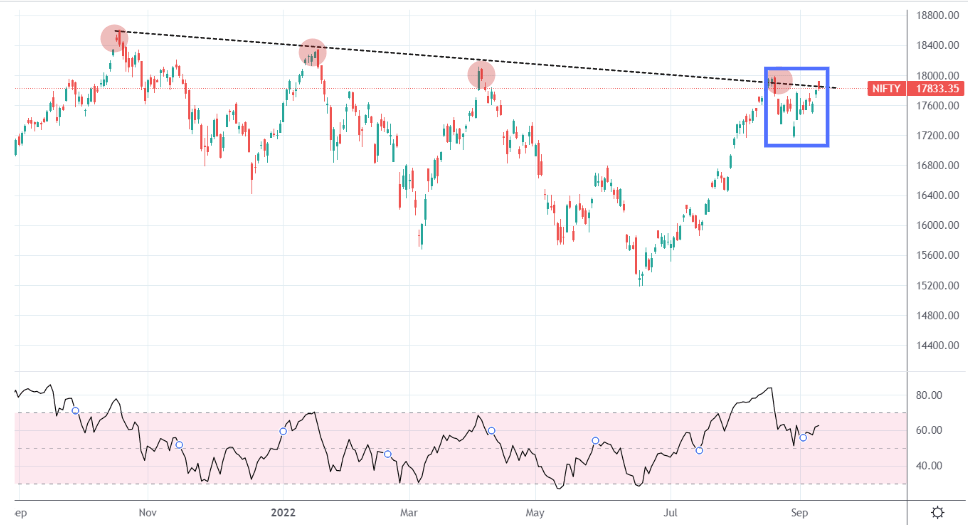

- After coming very close to 18000 levels around Mid-August, markets have been on a consolidation mode for about a fortnight. 18000 continues to be a very crucial resistance zone and the rally we saw in the current week must offer some more hope of crossing 18k and beyond in the coming days. Nifty’s relative strength is also below the over bought zone and is currently around the 60 levels.

- Smallcaps continue to be stronger than other benchmark indices. Smallcap 250 (+2.65%) & Mid-Small 400 (+2.36%) led the charge while others including Nifty 50 returned between (+1%) to (+1.75%). Smallcaps have shown great relative strength in the last one month returning (+7.13%) compared to Nifty 50 @ (+1.7%)

- AUTO stocks saw some consolidation this week amidst a great run in the recent past. PSU banks were excellent clocking (+4.3%) while almost all sectors ended this week in the green territory. PSU Banks have taken the limelight displaying great relative strength after a bout of superb run in the last month clocking (+11%) & also in the last quarter returning (+21%).

- It was yet another great week for WeekendInvesting with all strategies clocking between (+1%) & (+2.9%). Mi ATH 2 & Mi NNF 10 continue their great runs clocking (+12%) & (+9%) in the last 1 month & (+17% ) & (+24%) in the last 3 months.

Check out the full report below