Performance Update

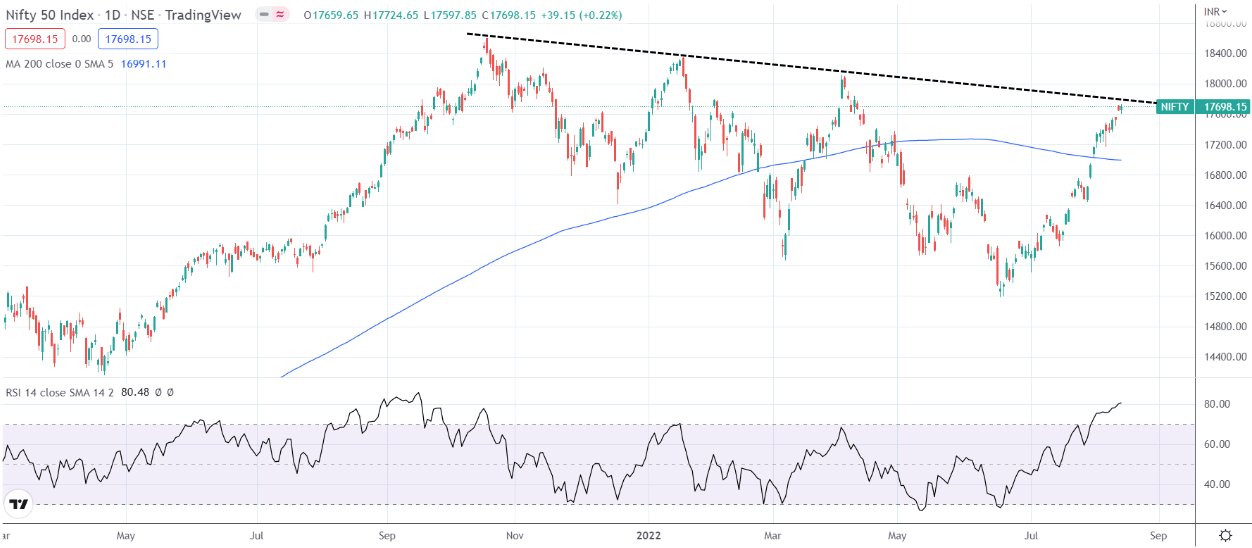

ONWARDS & UPWARDS ! The momentum seems to be very strong in this current upside rally that began around mid June. The RSI (Relative Strength Index) has crossed 70 and is entering the over bought territory for the first time in the current calendar year. If this continues, we can quickly make a new All Time High very soon. Nifty is up 10% in the past one month and is back in GREEN for FY 23. All indices except for Smallcap 250 are back in positive for the current FY. Coming to sectors, METALS have seen a tremendous rally delivering (+21%) in the last 30 days while BANKS, COMMODITIES & IT have stayed on par with Nifty clocking around (+10%) to (+12%). If you look at the FY 23 picture, we have AUTO (+22%) , PSU BANKS & FMCG (+17%) leading the charge. It should be very interesting to see which sectors lead this rally but as WeekendInvestors, we know that our strategies will certainly latch on to the most trending sectors at any given point in time.

WeekdndInvesting strategies have displayed a great bit of recovery from recent drawdowns. Mi ATH 2 (+15%) , Mi ST ATH (+12.4%), Mi NNF 10 (+11.8%) & Mi EverGreen (+11.5%) have all done extremely well in the past 30 days.

Note : You can use Code : IND15 to avail a 15% discount on all our strategies (valid till 15th Aug 2022)

Click on the link below to read the full review