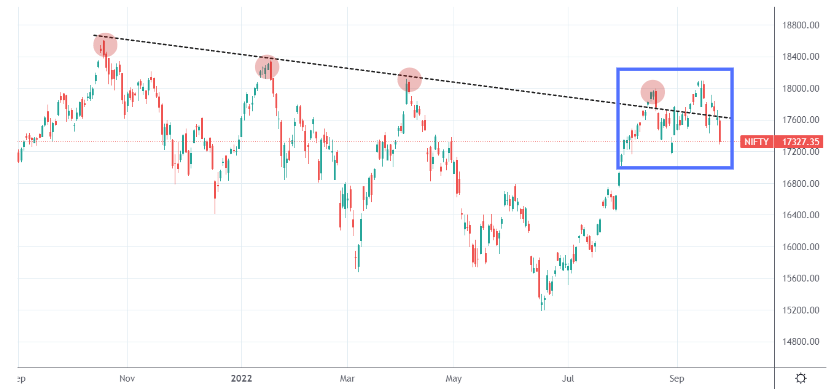

Nifty closed the current week at (-1.16%) while Nifty Next 50 (-1.54%) & Smallcap 250 (-1.64%) were the weakest. Despite doing quite good in the last 3 months, the performance in the last couple of months has been flat which isn’t a very encouraging sign particularly in the middle of a very solid rally that began around Mid June. Overall, Nifty Next 50 has remained the best performing index in the current FY clocking (+5.6%) while Nifty has stayed flat.

As we witness usually during times of weakness, money took shelter in sectors like PHARMA and FMCG which were the strongest this week returning (+2.1%) & (+3.8%) respectively while almost the rest of the entire pack remained weak. ENERGY & PSE lost (-4.4%) & (-4.9%) respectively. however on FY 23 basis, AUTO (+24%) , FMCG (+23%) & PSU Banks (+23%) have been the torch bearers.

WeekendInvesting Strategies performed relatively well compared to the respective benchmarks this week. Mi ATH 2 continues to do extremely well clocking (+1.42%) this week. This strategy also has been our best performing strategy in both last month (+9.6%) as well as in the last 3 months clocking (+33%) compared to (+14%) on it’s benchmark – the CNX 500 index.