The WeekendInvesting App !

The biggest event of the week is the launch of the Weekend Investing app. This app brings everything about Weekend Investing to one place and is available for both Android and iOS users. By subscribing to strategies through the app, users can access exclusive content and stay updated on market trends. Additionally, the app offers chat functionality, where users can engage with the Weekend Investing team, book meetings, and receive personalised assistance. This app aims to enhance user experience and provide better understanding and support for investors. Download the app using the links below if you haven’t already !

In terms of market performance, Nifty has been hovering around 19300 levelsfor over a month, but for the first time, it closed below this level. The US markets’ weakness, driven by the possibility of rate hikes, has affected market sentiment. Despite good results from companies like Nvidia, the overall market remained flat for the week. However, the broader market, including mid and small caps, has shown resilience and remained positive over the long term.

Among the sectors, private banks, public sector enterprises, and IT stocks performed the best, with gains ranging from 0.9% to 1.6%. Meanwhile, pharma and energy sectors experienced losses. Overall, most sectors performed well for FY 2024, with solid double-digit growth. This indicates a healthy market trend and reflects the potential for growth in the coming months.

Spotlight – MULTIBAGGER <MAZDOCK from Mi 35>

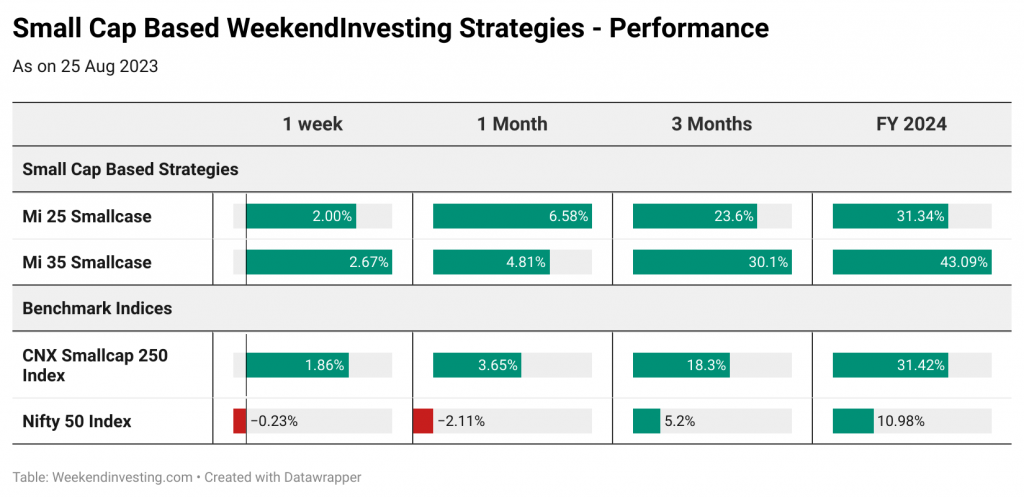

Mi 35, a weekly rebalance strategy focusing on 35 stocks, has consistently performed well in the small-cap space. Diversification plays a crucial role in small-cap strategies due to the higher risk associated with individual stocks. By rotating into the strongest portion of the universe, this strategy demonstrates the power of adaptive investing and has outperformed broader small-cap indices.

A case study from the winners of this strategy highlights the journey of the stock MAZDOCK, which has delivered significant gains since its inclusion in the portfolio. Despite concerns about entering at the top of the move, the stock’s price has risen from 354 levels to 1839 levels, showcasing a remarkable 419% gain. This demonstrates the importance of following the momentum of stocks rather than trying to predict their tops or bottoms. Momentum investing allows the strategy to determine the right time to buy and exit, ensuring maximum returns for investors.

It is crucial to have a long-term vision when investing in strategies. The Weekend Investing strategies have consistently delivered strong returns over the years. Mi 35, for example, has gained 64% since going live, outperforming the index despite having a diversified portfolio of 35 stocks. This highlights the power of momentum strategies and the potential for significant returns over time.

A SHORT COURSE to Help you Stay Calm in All Market Conditions

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important question we often get asked is whether markets will crash from here. Should we exit? and a few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except Mi NNF10, Mi EverGreen & Mi India Top 10 which is monthly rebalanced)

These are all long-term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeat this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years, it has been shown that much superior CAGR returns are possible than the benchmarks.

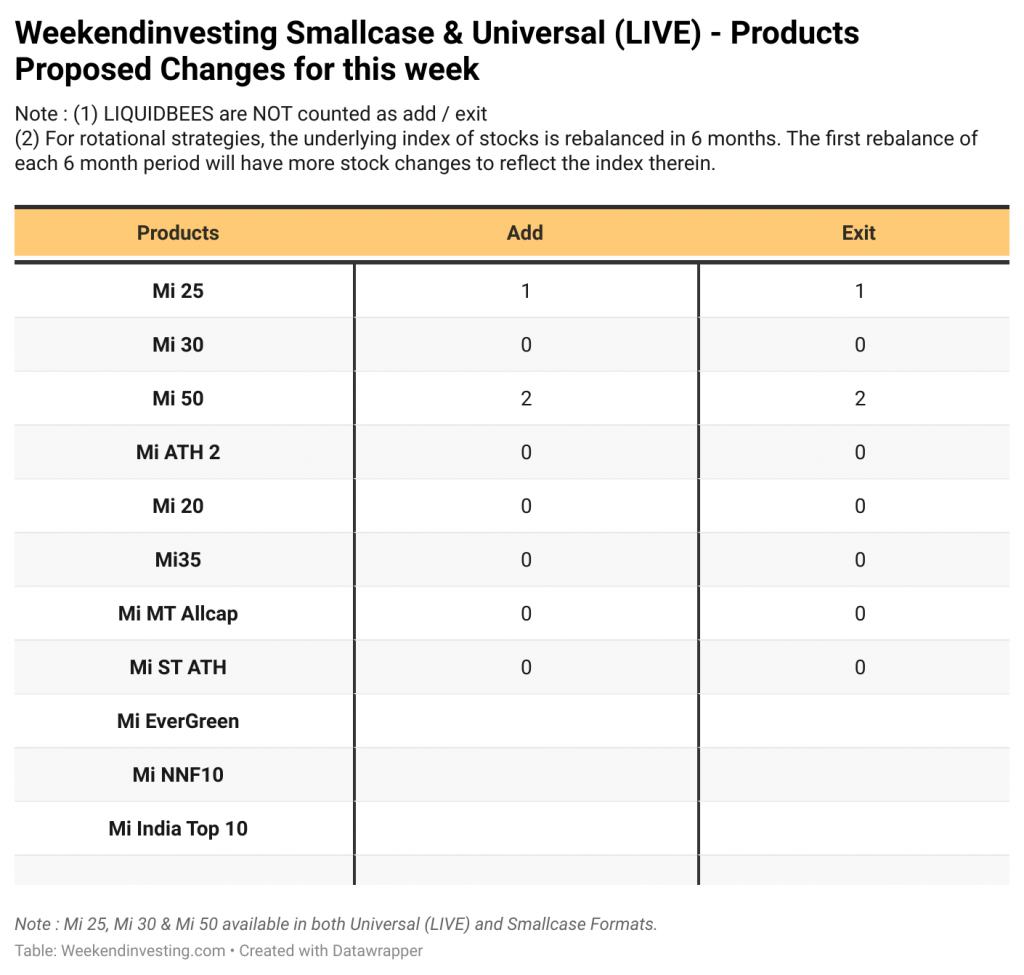

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

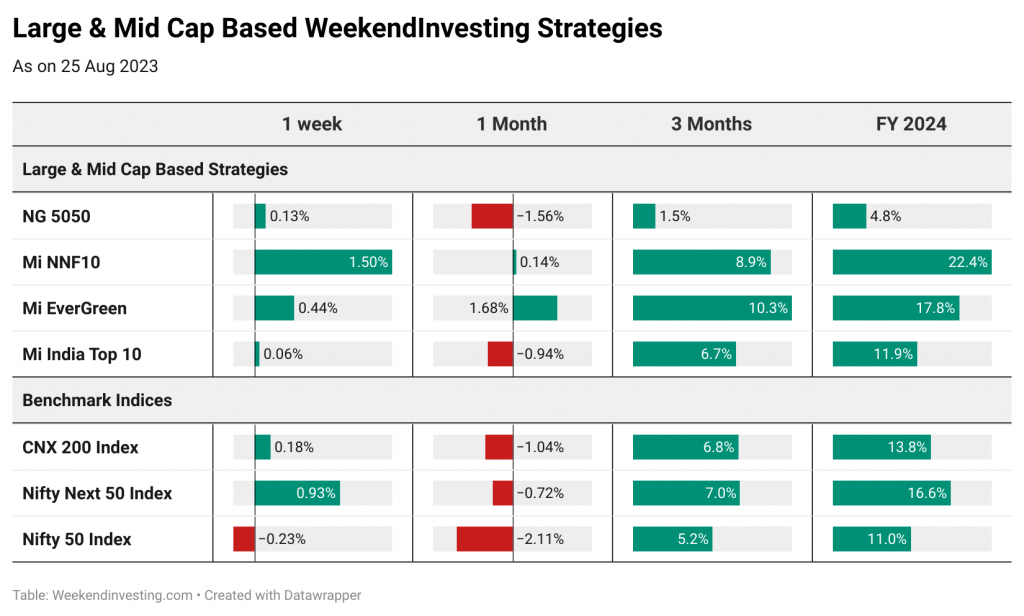

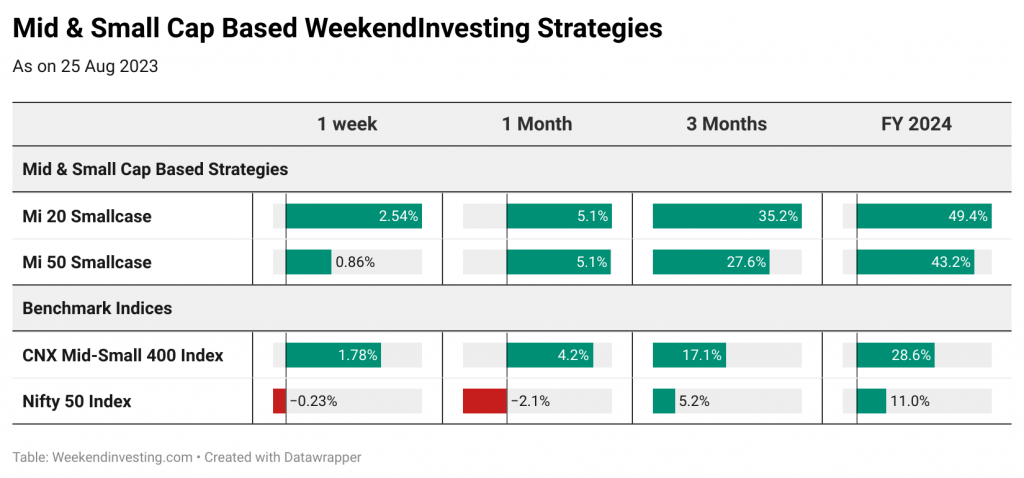

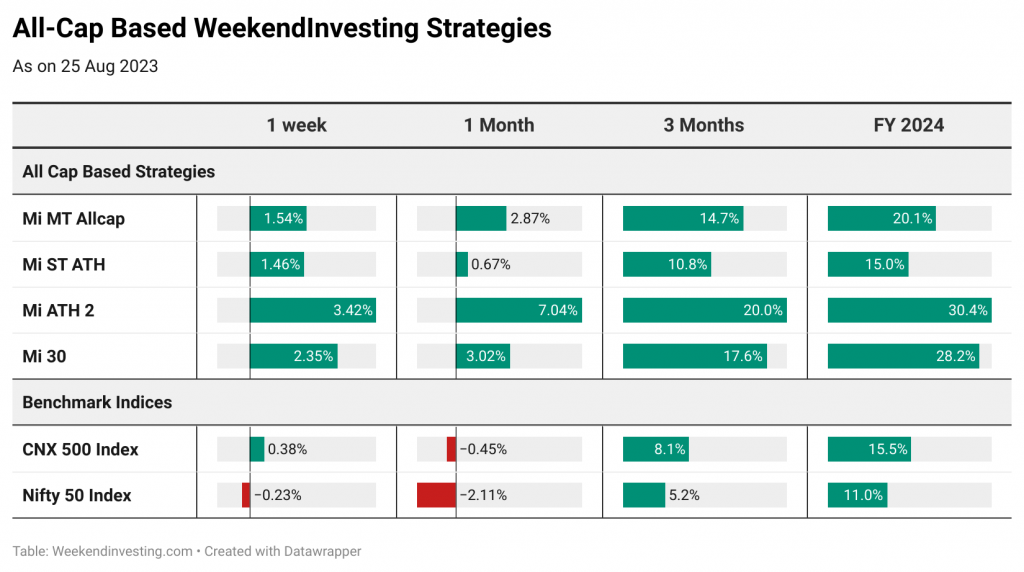

The performance of all strategies across various timeframes are listed below.

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

Testimonials

That’s it for this week. See you in the next week’s edition !