Performance Update

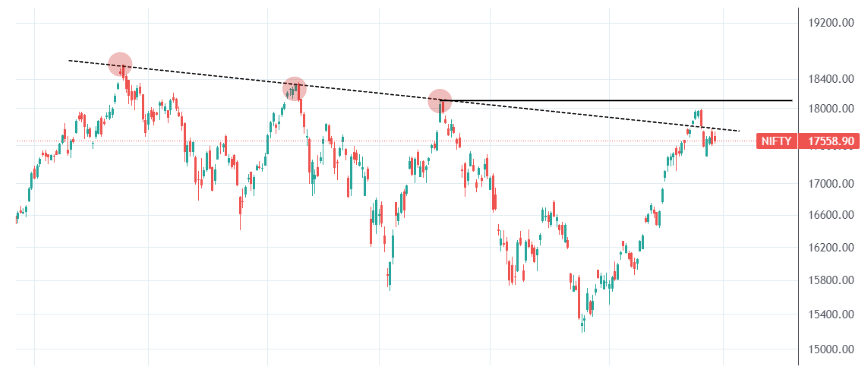

- This week goes to the Smallcaps which have shown some good relative strength compared to the larger caps after trailing the latter for quite a while. Smallcap 250 index clocked about 2% while Nifty 50 returned (-1.1%). Nifty 50 went through some massive volatility on the monthly expiry (25th Aug) as well and is currently seeing some consolidation happening around a very critical resistance zone.

- Despite having eclipsed the lower high trend line a while ago, Nifty 50 seems to be volleying around the same zone now & will have to comfortably surpass these resistance levels including the previous lower high of 18100 (Apr 2022) to see another leg of up trend.

- Coming to the sectors, PSU BANKS did well to clock (+4.4%) while others were quite flat. IT took some beating (-4.4%) losing some more steam. IT is also the worst performing sector this calendar year having done (-21%) while AUTO leads the charge at (+22%). All the more reasons to believe in momentum as we see a shift in sectoral flavor.

- WeekendInvesting strategies had a superb week despite the volatility in the benchmarks. Mi 25 (+4.7%) & Mi 35 (+3.8%) made some noise riding on the smallcaps upsurge (Mi ATH 2 has quietly been making a comeback clocking 19% in the last 3 months & also topping the charts for the past week. Mi NNF 10 continues to lead the pack returning a fantastic 20% in the past quarter. The performance is Update Below

Click on the link below to read the full report !