Leveraging the Momentum Factor for Outperformance

In this blog, we try to discuss how even if the majority of stocks in your portfolio perform averagely or even below average, having one or two exceptional winners can dramatically impact your overall returns. This principle holds true not only for individual investors but also for venture capitalists investing in startup companies.

The key concept here is that you don’t need all of your stocks to be high-performing assets. In fact, it’s highly unlikely that every stock in your portfolio will be a standout performer. By diversifying your risk across a selection of stocks, you can increase your chances of having one or two stocks that exceed expectations. This idea applies to both individual investors and venture capitalists.

Venture capitalists, for example, typically invest in a portfolio of 100 startups. Out of those 100 companies, it is expected that only a small fraction will truly succeed. Perhaps two or three may become incredibly successful and generate significant returns. Even if the majority of the investments fail, the overall portfolio can still perform well due to the outstanding performance of a few key stocks.

The same principle applies to individual investors. It is crucial to distribute your risk across a variety of stocks. Some may outperform, while others may underperform. By carefully managing your portfolio and regularly assessing the performance of your holdings, you can make informed decisions about when to sell and when to buy new stocks.

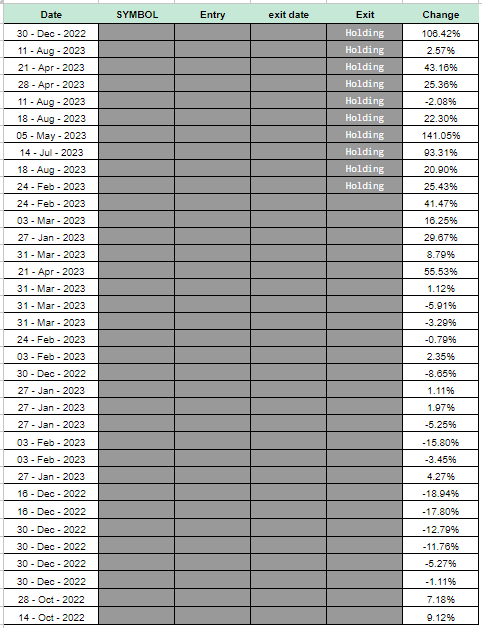

We would like to further demonstrate this with the example of one of our own strategies, Mi ATH 2. This strategy initially experienced a rough start but has recently made a remarkable comeback.

Let us try to understand the impact of a few winning stocks on the overall performance of the strategy.

In this particular portfolio, a few stocks stand out. One stock, purchased in December 2022, has soared by an impressive 106%. Another stock, acquired in May 2023, has experienced a remarkable 141% gain.

Additionally, a stock purchased in July has seen a 93% increase. These are the shining stars that demonstrate the potential of leveraging the momentum factor in investing.

What’s important to note is the significance of the stocks that are currently below the others in terms of performance. These stocks have already been sold and booked as gains. The stocks that are marked as “Holding” are the current holdings within the portfolio.

Casino Match at Play !

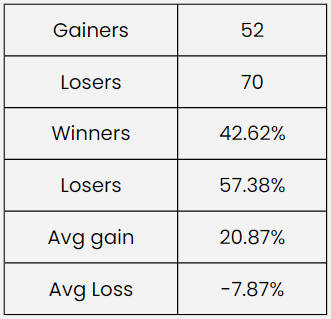

Over a span of approximately 25 months, the strategy has executed 122 transactions. Out of those transactions, only 42% were winners, while 57% resulted in losses. Despite the higher percentage of losing trades, the average gain on winning trades is an impressive 21%, compared to an average loss of 7.8% on losing trades.

This statistical analysis highlights the mathematical advantage of having a few high-performing stocks, even if the majority of your trades don’t yield exceptional returns. By maintaining an average gain higher than the average loss, the strategy can generate positive overall performance. It is essential to keep in mind that these calculations are based on a two-year timeframe. Over an extended period, the advantage becomes even more pronounced, potentially leading to significant outperformance.

Can you avoid these LOSERS though ?

It’s important to note that the speaker considers this strategy as a short-term approach that quickly exits stocks experiencing dips. While this strategy may not be suitable for short-term investors, it has proven successful in generating impressive returns over a longer period.

The focus on momentum plays a significant role in identifying stocks that have the potential for substantial growth within a compressed time frame.

We would like to emphasize on the importance of following your strategy without succumbing to emotions. By following this disciplined approach, investors can achieve remarkable results and enjoy substantial winners within their portfolios.

Download the WeekendInvesting App

If you have any questions for us. please write to us on support@weekendinvesting.com. You can also get on a 1-1 meeting with us should you need more clarity about the strategies or processes.