Understanding Interest Rates and Gold

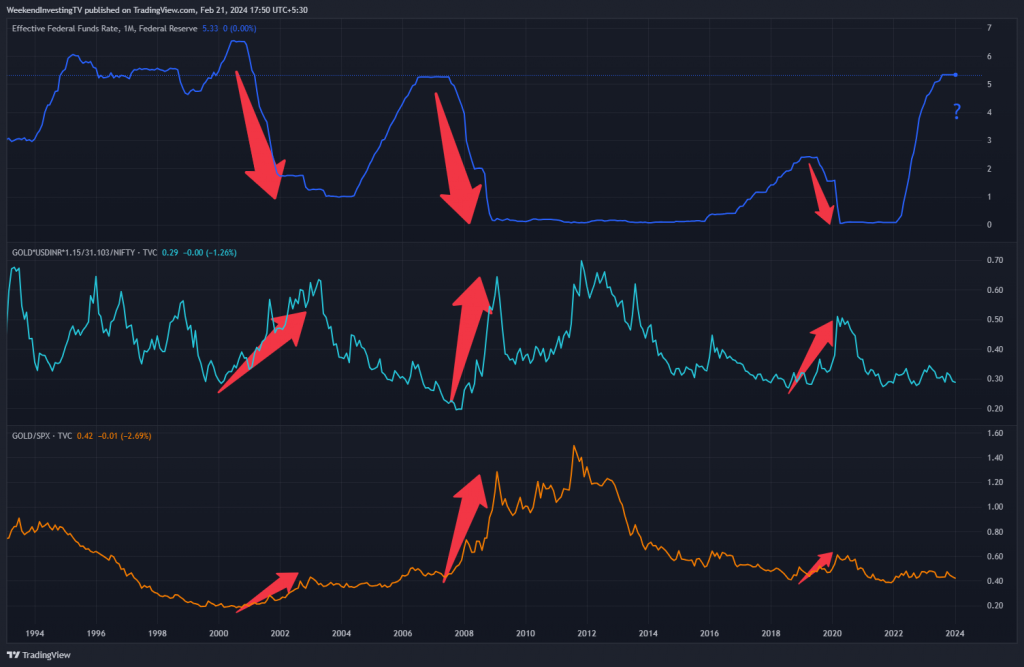

In this blog, we delve into a crucial aspect of market dynamics: the relationship between interest rates and gold. By closely examining historical data over the past 25 years, we uncover patterns that shed light on potential market movements and investment strategies. Understanding these dynamics is essential for investors looking to navigate changing market conditions effectively.

The Fed Funds Rate and Its Impact

At the heart of this analysis lies the Federal Reserve’s funds rate, a key indicator of monetary policy. Over the past two decades, we’ve witnessed three significant interest rate down cycles initiated by the Fed. Each time interest rates decreased, gold exhibited notable outperformance compared to equity indices like the Nifty and the S&P 500.

Gold’s Performance During Interest Rate Cycles

During periods of declining interest rates, gold tends to shine. We observe that when interest rates dropped sharply in 2000 and 2008, the ratio of gold to the Nifty and the S&P 500 surged significantly. In simple terms, while equities may experience downturns, gold often sees substantial gains, making it a valuable asset during these cycles.

Historical Trends and Future Implications

Looking at the historical data, we notice a consistent pattern: whenever interest rates decline, gold’s performance relative to equities tends to soar. With interest rates currently hovering at 5.25%, the next move is expected to be downwards, signaling a potential opportunity for gold investors. As interest rates decline, allocating to gold could prove to be a lucrative strategy for investors seeking to capitalize on this trend.

Understanding the interplay between interest rates and gold allows investors to make informed decisions about asset allocation. By strategically balancing investments in gold and equities, investors can position themselves to benefit from both asset classes’ performance, thereby optimizing their portfolio’s risk-return profile.

If you have any questions, please write to support@weekendinvesting.com