Rise of India’s Options Market

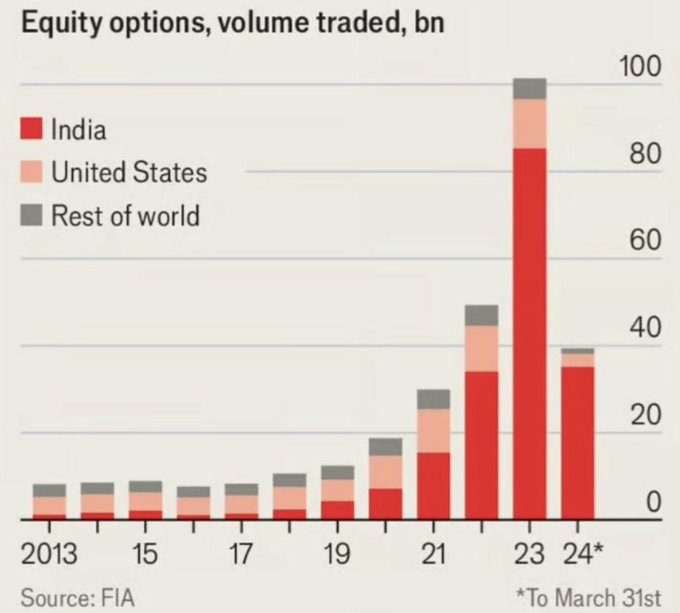

The Indian options market has seen a tremendous rise in trading volumes over the past decade. In 2013, India’s trading volumes were only a fraction of the U.S. market. However, from 2018 and 2019, India started gaining a significant share in the options market. The increase in trading volumes has been exponential, growing from less than 10 billion contracts to nearly 80 billion contracts. In 2024, within just three months, the volume reached close to 35 billion contracts. This surge is a noteworthy trend in the global financial markets.

Factors Behind the Growth

Several factors could be driving this explosive growth in the Indian options market. One possible reason is that Indian traders may have a more speculative mindset compared to those in other countries. The desire to make quick money, especially post-COVID, has led many to jump into the market. Additionally, since 2019, a significant increase in the number of Indians with rising income levels has contributed to the market’s growth. With more people earning higher incomes, more funds are being allocated to investing and trading.

Increased Income and Trading

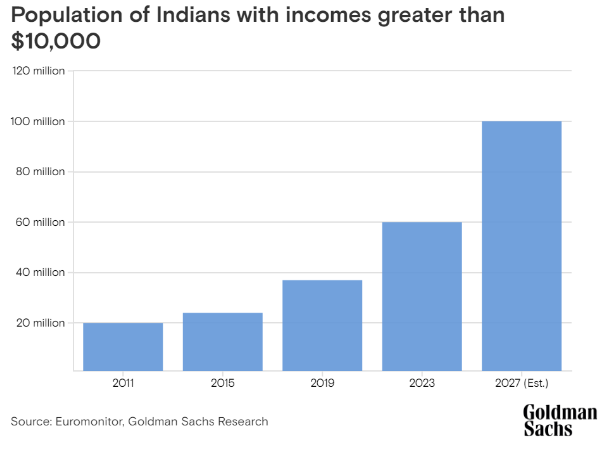

From 2019, the number of Indians earning around $10,000 a year has increased significantly. This income bracket has expanded from below 40 million to 60 million people, and in the next few years, it is expected to reach 100 million.

Even though $10,000 might not seem like a lot, it represents a growing middle class willing to invest in the markets. This rise in disposable income is a major factor fueling the increase in trading volumes.

Nifty 50 vs. S&P 500

A comparison between the Nifty 50 and the S&P 500 options volumes reveals interesting insights. The notional value of Nifty 50 options has surged since 2021, now matching that of the S&P 500 in terms of trading volume.

This is remarkable given that the S&P 500 has a much larger market capitalization. The global nature of the S&P 500 market, with investors from around the world, contrasts with the primarily domestic focus of the Nifty 50. Despite this, the Indian market is catching up in terms of options trading volume.

Risks and Concerns

However, this rapid growth in options trading is not without risks. Reports suggest that around 90% of retail investors in the Indian options market are losing money. This trend indicates that while trading volumes are increasing, the majority of small investors are not seeing profits. Algorithm-based trading by institutions is also on the rise, which can disadvantage individual retail investors. As more retail investors enter the market, there is a need for caution and better understanding of the risks involved.

Long-Term Investing vs. Trading

While options trading can generate short-term income, it is important to recognize that long-term wealth is usually built through sustained, disciplined investing. The volatility and risk associated with options trading can lead to significant losses, especially for inexperienced traders. It is crucial for new investors to understand that building wealth requires a well-thought-out investment strategy rather than relying on high-risk trading practices. Encouraging a shift towards regular investing can lead to more stable and substantial financial growth over time.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com