In this blog, we’ll be exploring a compelling story shared on Twitter that sheds light on the performance of stocks before and after they enter the Nifty 50 index. Strap in as we uncover some surprising insights into this intriguing phenomenon.

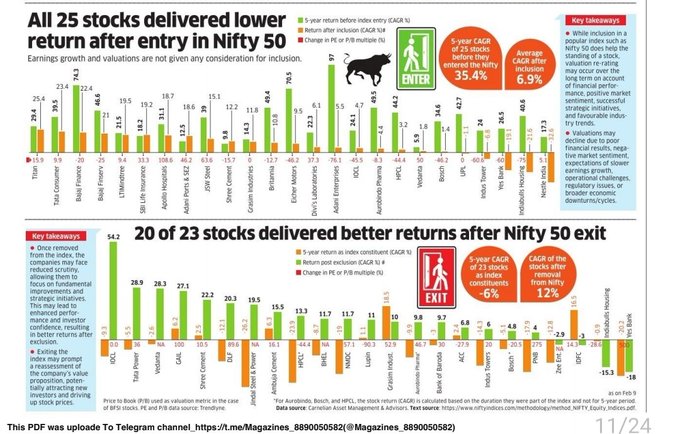

The data presented showcases the performance of 25 stocks prior to and following their inclusion in the Nifty index. Before making their Nifty debut, these stocks boasted an impressive average five-year CAGR of 35.4%. However, once included in the Nifty index, this CAGR plummeted to a mere 6.9%, marking a significant downturn in performance post-inclusion.

Exclusion from Nifty: A Blessing in Disguise?

But the plot thickens when we examine the fate of stocks excluded from the Nifty index. Surprisingly, 20 out of the 23 stocks that were removed from Nifty actually saw an improvement in performance post-exclusion. Their five-year CAGR, which was -6% while in Nifty, soared to a promising +12% after their exit from the index. This revelation challenges conventional wisdom and prompts us to question the dynamics at play within the Nifty universe.

So why does this trend occur? One plausible explanation is the market’s reaction to Nifty inclusion and exclusion announcements. Stocks slated for inclusion often experience a surge in price, inflating their pre-Nifty CAGR. Conversely, once admitted to the index, these stocks may face increased trading activity and volatility, dampening their performance. On the flip side, stocks removed from Nifty may undergo a temporary decline in price, only to rebound post-exclusion, thus boosting their CAGR.

A comparison between Nifty and Nifty Junior reveals an intriguing trend. Over a 15-16 year period, Nifty Junior has outperformed Nifty, signaling that stocks in the junior index may offer greater potential for growth. This insight underscores the importance of exploring investment opportunities beyond the confines of the Nifty index, particularly in strategies centered around Nifty Junior.

For investors seeking to capitalize on this trend, strategies focused on Nifty Junior, such our popular Mi NNF 10, offer a promising avenue for maximizing returns.

With large-cap stocks occupying both Nifty and Nifty Junior, the latter emerges as a solid option for consideration, providing an opportunity to tap into additional alpha and potentially superior performance.

If you have any questions, please write to support@weekendinvesting.com