The Rise of Moderna

Moderna is a name that became well-known during the COVID-19 pandemic. Before that, the company was not widely recognized. Between December 2018 and August 2021, Moderna’s stock price soared from around $10 to nearly $450, marking an astonishing 22-fold increase in just two and a half years.

This remarkable growth occurred because Moderna’s vaccine was approved and became one of the most widely used COVID-19 vaccines during the crisis.

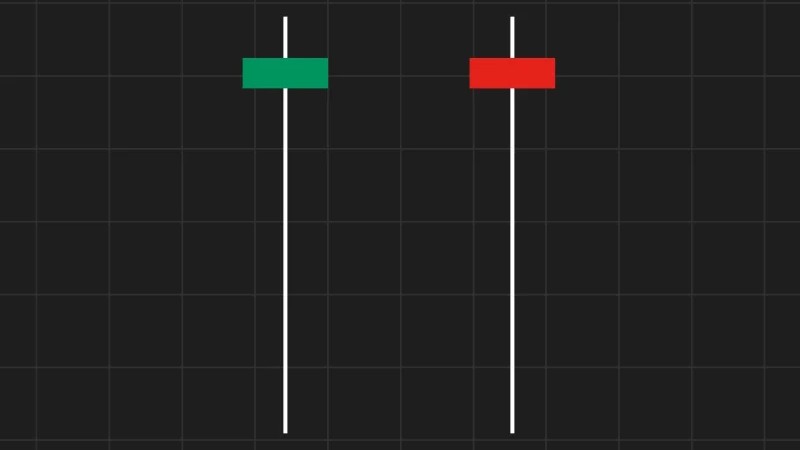

A Sudden Drop

After reaching its peak, Moderna’s stock experienced a sharp decline, dropping by about 95% and now trading around $27. While this price is still higher than where it started, it is significantly lower than the $450 mark. This illustrates how quickly a stock can rise and fall. The vaccine propelled Moderna’s growth, but as the demand for the vaccine waned, the company’s value also decreased.

Why the Stock Rose

The surge in Moderna’s stock was primarily due to an unforeseen event—COVID-19, the worst health crisis in a century. Many companies were attempting to develop a vaccine, but only a few received approval. Moderna was one of the fortunate ones. Its vaccine gained global approval, leading to a significant increase in both its business and stock price. This was a rare and powerful moment that worked in the company’s favor.

Every Trend Has an End

What happened with Moderna serves as a good example of how trends function in the stock market. Occasionally, a company’s stock can rise rapidly due to extraordinary events. However, those events are not permanent. Once the demand subsides, the growth typically halts. This was the case with Moderna: with the vaccine no longer in high demand, the stock has significantly decreased.

Be Ready to Change

This story imparts an important lesson: just because something is performing well today does not guarantee it will continue to do so. Every investor must be prepared for change. The key is to recognize when a trend begins and when it ends. Holding onto a stock for too long can lead to losses, so it’s crucial to pivot to the next promising opportunity at the right time.

Have you ever witnessed such a strong trend in a stock? What did you learn from it? Share your thoughts in the comments below! If you found this blog helpful, don’t forget to SHARE it with your friends!

WeekendInvesting launches – The Momentum Podcast

This episode of THE MOMENTUM PODCAST features Manubhav, a third-generation real estate professional, sharing his unique journey navigating both worlds.

Discover:

✅ FROM PROPERTY TO PORTFOLIO: Manubhav’s transition from his family’s established real estate business to exploring equity investments.

✅ MARKET WISDOM: His candid experiences with market swings, including COVID-19’s impact on his SIPs, and lessons learned from F&O and smallcase.

✅ THE BIG COMPARISON: A fascinating look at real estate vs. equity returns, featuring real-world numbers from his family’s 40-year property investment.

✅ UNCOMMON INSIGHTS: Why gold is a family favorite and the surprising state of equity investing in smaller Indian towns.