Diverging Trends

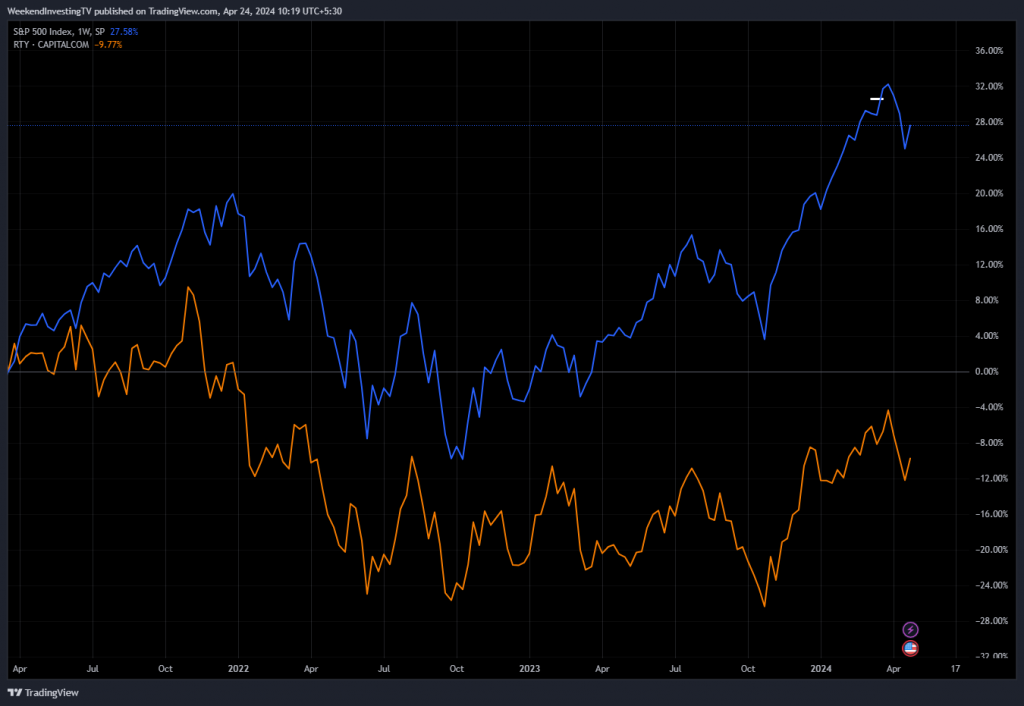

In this intriguing analysis, we’ll explore a fascinating phenomenon observed in the US and Indian markets over the past three years. We’ll delve into the performance of the S&P 500, representing large-cap stocks, and the Russell 2000, which tracks small-cap stocks. While the S&P 500 has surged by 28%, the Russell 2000 has experienced a downturn of 12%. This disparity has sparked discussions in the US market, attributing the small-cap decline to rising interest rates, which seem to have favored large-cap stocks.

Contrasting Market Dynamics

Now, let’s shift our focus to the Indian markets. Over the same three-year period, the Nifty, India’s benchmark index, has soared by 55%, while small-cap stocks, depicted by the blue line, have surged by an impressive 130%. Despite facing similar interest rate hikes, Indian small-cap stocks have thrived, attracting more domestic liquidity compared to large-cap counterparts. This divergence in market behavior between the US and India raises thought-provoking questions about the impact of interest rates on different market segments.

The stark differences between the US and Indian markets under similar interest rate regimes beg for plausible explanations. While large-cap dominance in the US may be attributed to significant interest rate hikes, the relatively moderate increase in interest rates in India could have contributed to the resilience of small-cap stocks. The increment in interest rates, both in terms of percentage and quantum, plays a crucial role in shaping market dynamics and investor sentiment.

Spotlight : The Casino Math behind Mi NNF 10

In today’s rapidly evolving world where the rate of emergence of new market leaders is at an all time high, having an agile strategy at work becomes an absolute must.

You might be good at identifying a good stock or a sector but what if it doesn’t turn out well ? What if another stock or a sector starts performing relatively better ?

Is your strategy agile enough to dump the sluggish stocks and identify new leaders ?

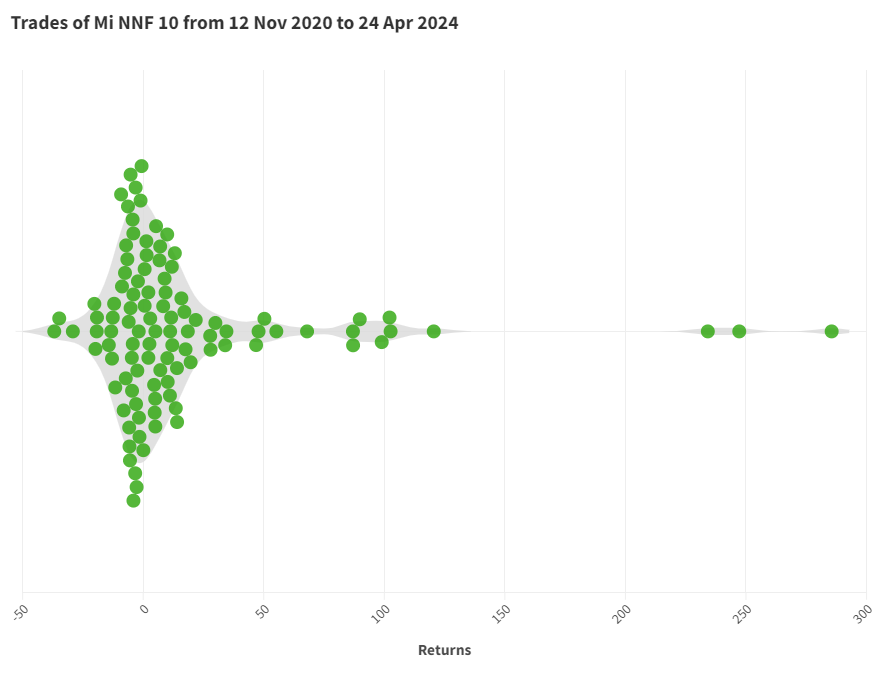

Below is a chart depicting the performance of all the trades that Mi NNF 10 has taken since going live on 12 Nov 2020 (till 24 Apr 2024)

Some of momentum investing’s core principles that can be evidently validated from this chart are ;

– Winners are allowed to run far while losers are discarded early. The biggest winner has clocked 285% while the biggest loser has returned (-37%).

– 44% of the trades are loss making while 56% are winners.

– 76% of the trades fall in this crowded zone of -20% to +20% but the stat that makes the strategy successful is that the average winner returns a healthy +39% while the average loser returns only -9%.

– This is the casino math that has enabled the strategy to outperform its benchmark by a very healthy margin.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com