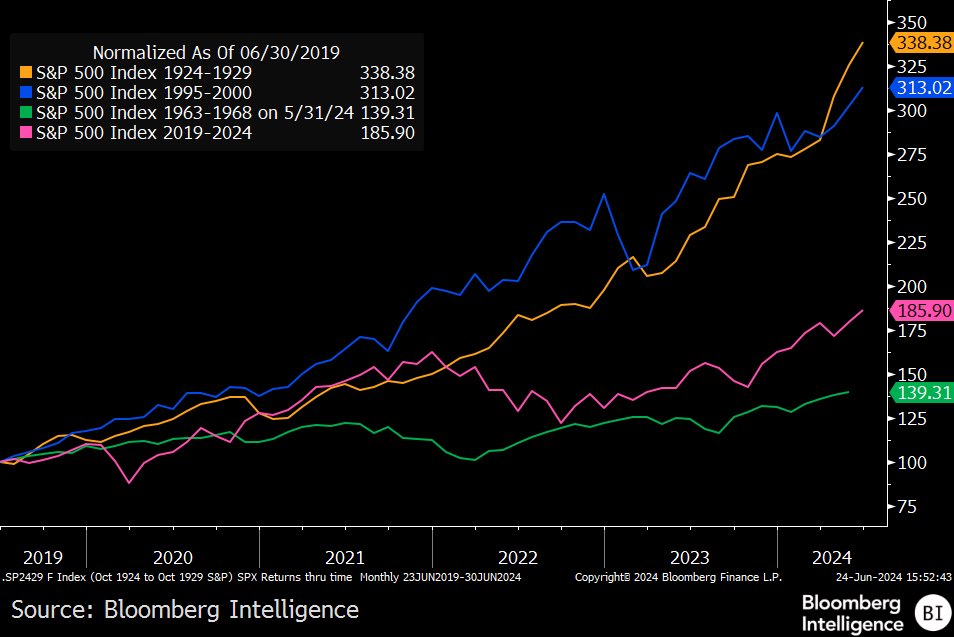

A fascinating chart from Bloomberg Intelligence shows how the S&P 500 has performed during four major bull runs over the past century. This chart compares the current bull run from 2019 to 2024 with three other significant periods: 1963 to 1968, 1995 to 2000, and 1924 to 1929. By normalizing these periods to the current market move, we can see some interesting trends and insights.

Comparing Bull Runs

The current bull run from 2019 to 2024 is represented by a pink line on the chart. So far, the market is up about 85%. The green line shows the 1963 to 1968 bull run, the blue line represents the 1995 to 2000 run, and the orange line illustrates the 1924 to 1929 rally before the Great Depression. Each of these periods has been indexed to 100, allowing for a clear comparison.

Historical Context

What the data reveals is that it’s not uncommon for the market to experience significant rallies over five-year periods. For instance, past bull runs have seen the market climb from 100 to as high as 338. In comparison, the current rally, even with the COVID-19 drop, has moved from 100 to 185. This shows that while the current market growth is impressive, it is not unprecedented.

Market Euphoria

Many people are talking about the current market rally as if it is extraordinary. However, looking at historical data, we can see that similar or even more extreme rallies have occurred before. The euphoria and excitement typically seen in a strong bull market are not as evident this time, especially in the US markets. The US market has only slightly exceeded its January 2020 peak, suggesting that there has been a lot of consolidation.

Room for Growth

Given the historical context, there seems to be considerable room for the US market to grow. The US market often leads global markets, and if there is potential for further growth in the US, other markets are unlikely to crash independently. From these data points, it appears that there is no immediate danger of the US markets collapsing.

Looking ahead, a major event for the US market will be the upcoming elections in November. Markets are likely to remain stable in anticipation of potential rate cuts and the outcomes of these elections. This could provide further support for the ongoing bull run.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com