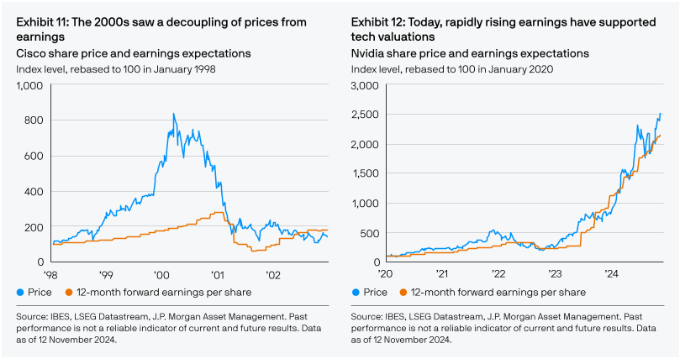

Comparing the Dot-Com Bubble and Today’s Tech Boom

The rise and fall of the dot-com bubble in the late 1990s is a well-known event in financial history. At the heart of that boom was Cisco, a tech company whose stock price soared to incredible heights before crashing. Many people see similarities between the dot-com era and the current tech boom, particularly with Nvidia, a leading stock in today’s market. However, when we dig deeper, there are some key differences.

Cisco and the Dot-Com Boom

During the dot-com bubble, Cisco’s stock price shot up rapidly, increasing by seven or eight times. However, this rise was not backed by actual earnings growth. The price of Cisco’s stock moved much faster than its earnings projections. This created a large gap between what investors expected in terms of profits and what the company could realistically deliver. As a result, when the market corrected, Cisco’s stock price collapsed, leaving many investors in significant losses.

Nvidia and the Current Tech Boom

Fast forward to today’s tech boom, Nvidia has become a central figure in the growth of technology stocks, particularly in areas like artificial intelligence and advanced computing. Like Cisco during the dot-com era, Nvidia’s stock price has seen significant gains. However, this time around, the earnings projections for Nvidia seem to be closely following its stock price. Unlike Cisco, where there was a huge gap between the price and earnings, Nvidia’s rise appears to be supported by strong earnings forecasts.

Earnings Expectations Matter

One of the reasons why people are more optimistic about today’s tech boom is the relationship between stock prices and earnings expectations. During the dot-com bubble, many companies had high stock prices but weak earnings growth. This was a sign of a bubble—investors were paying too much for companies that were not making enough profit. In contrast, today’s tech leaders like Nvidia are showing strong earnings potential that matches their rising stock prices. This suggests that the current market is not as overvalued as it was during the dot-com era.

Can Expectations Be Wrong?

Of course, earnings expectations are not guaranteed. Just because Nvidia’s earnings projections match its stock price now doesn’t mean those earnings will materialize in the future. There is always the risk that forecasts could be too optimistic, leading to a correction. But for now, the narrative is that the current tech boom is different from the dot-com bubble. The strong alignment between stock prices and earnings potential is what sets the two periods apart.

Is This a Bubble?

While some still question whether the current tech boom is a bubble, the comparison with the dot-com era suggests that this time may be different. The lack of a wide gap between stock prices and earnings expectations could indicate a more stable market. However, only time will tell if this optimism is justified.

WeekendInvesting launches – PortfolioMomentum Report

Momentum Score: See what percentage of your portfolio is in high vs. low momentum stocks, giving you a snapshot of its performance and health.

Weightage Skew: Discover if certain stocks are dominating your portfolio, affecting its performance and risk balance.

Why it matters

Weak momentum stocks can limit your gains, while high momentum stocks improve capital allocation, enhancing your chances of superior performance.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com