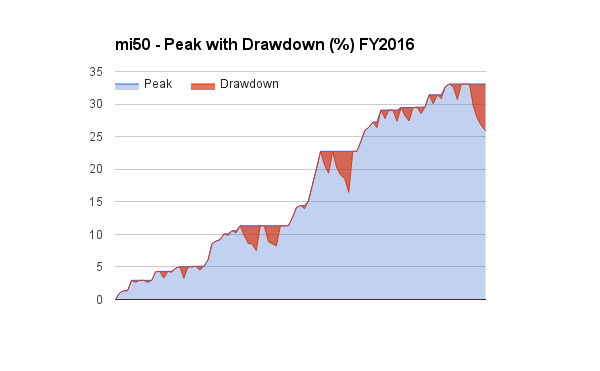

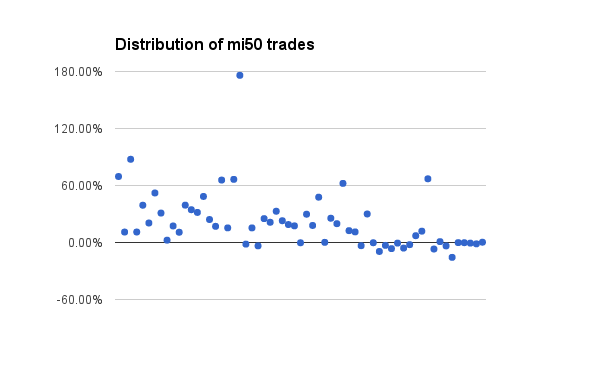

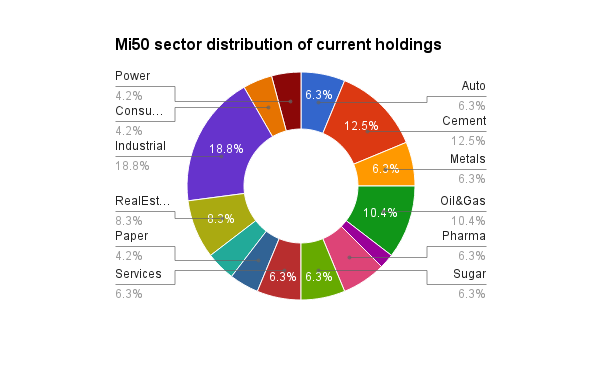

With many of the more volatile sugar stocks moving out, the under-performance of the mi50 portfolio was expected viz a viz the broader market. The strategy is at its deepest draw-down of about 7% since the start.

The stocks added are being added at 2% of current equity hence the position size of incremental additions is gaining.

ManaliPetro is the worst investment so far which lost 15% in two weeks. Outgoing Kakatiya cem made 68% gains on its position though much less than what was achieved meanwhile.

The internals from a Risk managment point of view still look amazing. So no reason for worry.

| Wins | Avg | Losses | Avg |

| 43.00 | 31.85% | 18 | -3.63% |

Mechanical strategies are best if left under-analysed..hence time to say goodbye.

Have a great weekend.