In the world of investing, stock price movements often lead investors to believe that a trend will persist for an extended period. Take Tesla’s chart on Nasdaq, for example. From 2014 to 2020, the stock remained relatively flat, hovering around $20. Then, there was a sudden surge to $80 before plummeting back to $20 amid the pre-COVID period. This rollercoaster ride left many investors uncertain about their positions.

Navigating Market Volatility

Following the collapse, Tesla embarked on a remarkable journey, soaring to $400 within two years. This meteoric rise elevated Tesla to the top ranks, with Elon Musk becoming one of the wealthiest individuals globally. However, fast forward two years, and the stock is back at $170, leaving those who entered during the rally stranded. The volatile nature of stocks like Tesla underscores the importance of strategic investing.

Similar scenarios unfold with other stocks like Alibaba, which has seen its value decline significantly over the years. Despite the potential for double-digit gains in the market, holding onto losing positions can be detrimental. Every moment invested in a stagnant stock represents an opportunity cost, hindering the potential for greater returns elsewhere.

To mitigate risks, investors should adopt a price-based approach that aligns with their beliefs. Buying into a stock when the price validates your conviction is prudent. Conversely, holding onto a position as hope dwindles can lead to prolonged losses.

Avoiding common mistakes in investing is paramount to improving returns. Mixing market narratives with price movements, or letting capital remain idle, can hinder investment success. By staying vigilant and adhering to disciplined strategies, investors can navigate market volatility and enhance their overall returns.

WeekendInvesting Strategy Spotlight

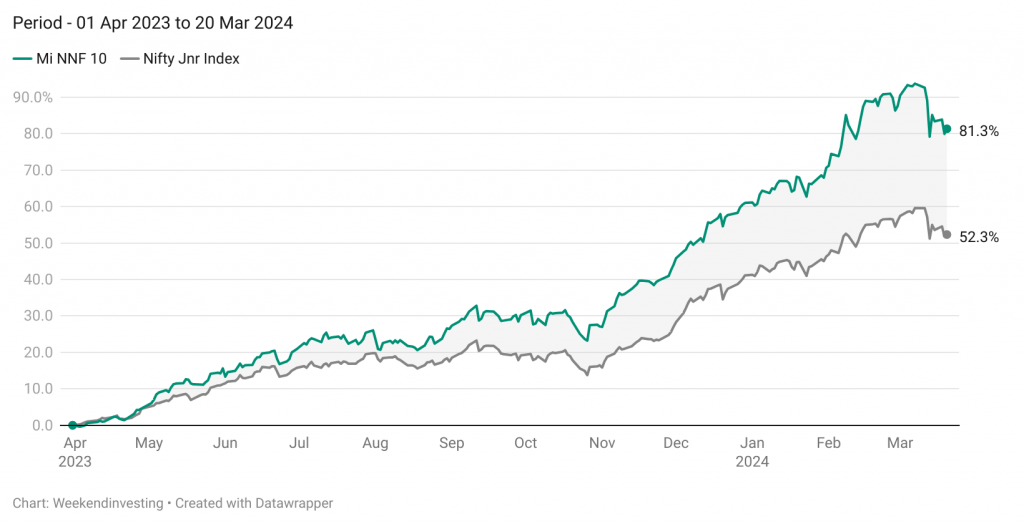

Mi NNF 10’s performance has been a great example to showcase the immense ability of a robust non discretionary, momentum strategy based on large caps, specifically – the Nifty Next 50 index.

With about a week to go for the end of FY 24, the strategy has achieved 81% gains so far compared to 52% on the Nifty Next 50 Index demonstrating solid outperformance. The CAGR since going LIVE (12 Nov 2020) stands at 31% compared to 22% on the Nifty Jnr Index.

The subscription fee for Mi NNF 10 shall be increased to Rs 9,999 from current fee of Rs 7,499 effective – 01 Apr 2024 onward. Go ahead and make use of this opportunity to subscribe to to Mi NNF 10 before the price increase.

If you have any questions, please write to support@weekendinvesting.com