The Importance of Time Horizon and Drawdowns in Investing

As an investor, there are two crucial factors that greatly impact our success in the market – time horizon and drawdowns. These might seem like simple concepts, but it is important to truly understand and acknowledge their significance in order to achieve success in investing.

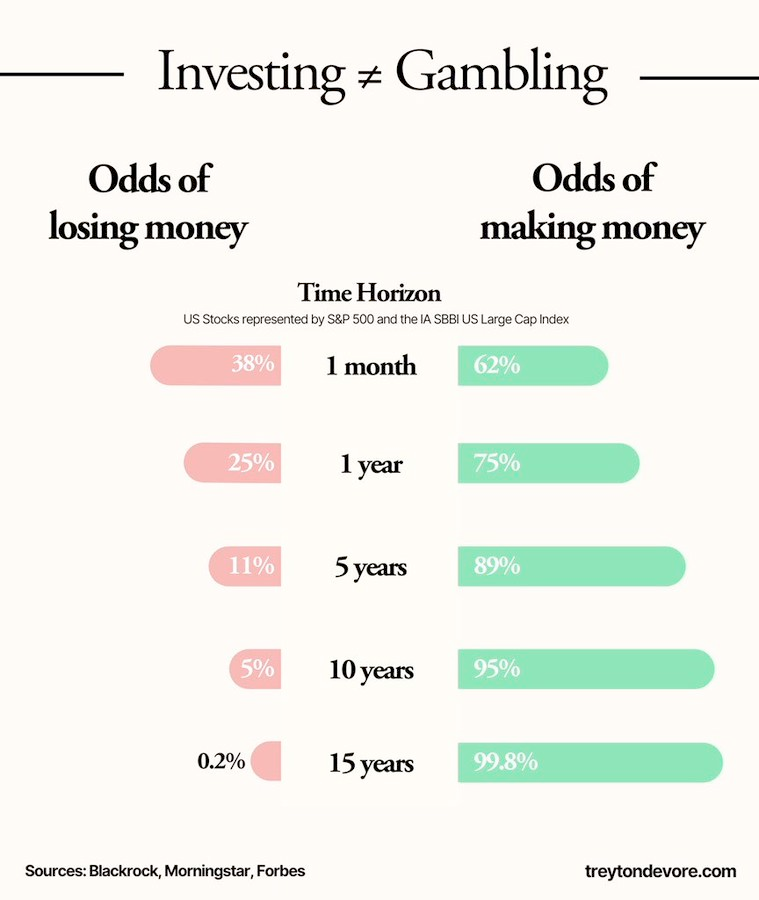

Let’s start by discussing the importance of time horizon in investing. A study by QCompounding on Twitter reveals some fascinating statistics based on the performance of the S&P 500 index. If you invested with a time horizon of one month, the probability of making money was still 62%. Even if you invest today and withdraw your investment after just one month, you are likely to make money 62% of the time.

As you extend your time horizon to one year, the probability of making money increases to 75%. Over a period of five years, the probability reaches an impressive 89%. Imagine that, by simply being in the market and holding your investments for five years, there is an 89% chance of making a profit. Extend this time frame to ten years, and the probability soars to 95%. And over a period of 15 years, the probability of making money virtually goes to 100%, reaching 99.8% to be precise.

Of course, it is essential to note that this statistic does not account for the period following World War II, during which there was a 20% decline in the market. However, the overall trend remains undeniable – the longer your time horizon, the higher your chances of success. These numbers are even higher in the context of the Indian market, and if you follow a structured strategy like weekend investing, your probabilities of success increase even further. In fact, it is highly likely that after just five years, you will hit 100% success potential with most strategies based on the available data.

What does this mean for investors? It emphasises the importance of staying in the market and avoiding attempts to time the market by constantly buying and selling. Trying to weave in and out of the market is fraught with risk and rarely leads to long-term success. Instead, adopting a long-term approach to investing is a fundamental principle that should guide your market approach.

The Drawdown Conundrum

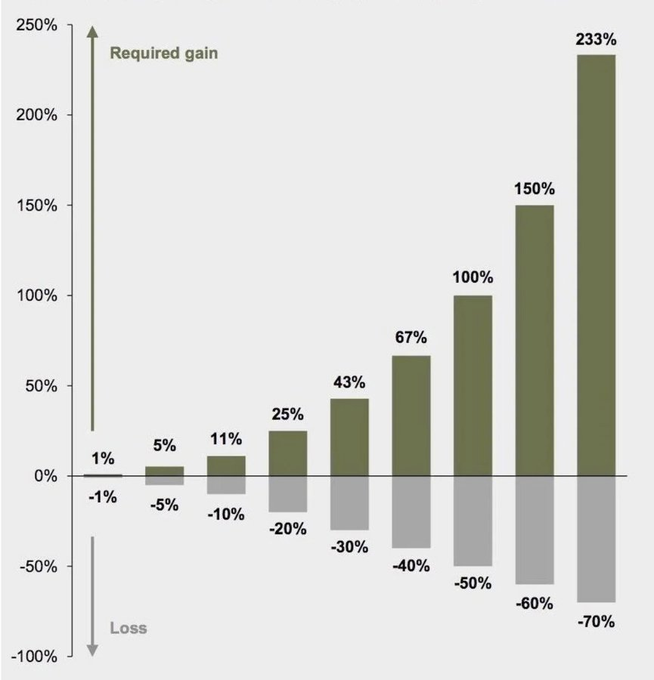

Now let’s shift our focus to the concept of drawdowns. Drawdown refers to the peak-to-trough decline experienced by a portfolio during a specific period. It is a measure of the loss suffered by an investment. While drawdowns are inevitable in investing, the key lies in understanding how to manage them effectively.

In various weekend investing strategies, for instance, the average drawdown typically ranges between 20% and 30%, even in worst-case scenarios. In the case of small-cap stocks, the drawdown can go up to 30% to 40%. However, these strategies aim to prevent the portfolio from experiencing drawdowns of 50%, 60%, or even 70%. Why? Because the deeper the drawdown, the more difficult it becomes to recover and return to profitability.

To illustrate this, consider the following: If your portfolio falls by 1%, you would need a gain of 1% to break even. With a 5% decline, a gain of 5.2% is required to recover the losses. However, a 30% drawdown necessitates a gain of 43% to climb out of the hole. If the drawdown reaches 60%, a staggering 150% gain is needed to recover, and a 70% drawdown would require a monumental 233% gain. These gains are not only challenging but are also unlikely to be achieved by design. While there may be instances where a stroke of luck delivers such gains, it is unwise to rely on chance to bail you out of substantial losses.

Therefore, it is crucial to nip losses in the bud and prevent drawdowns from spiralling out of control. Think of it as falling while running on a road. Falling into a two-metre ditch may be manageable, and you can still walk or run home. However, falling into a seven-metre ditch would make it incredibly difficult to climb out and continue your journey. Likewise, losses are a natural part of investing, but mitigating those losses is key to preserving capital and ensuring a swift rebound.

This principle applies not only to weekend investing strategies but to general investing as well. Whether you have invested in real estate or other assets like art pieces, it is essential to accept losses and cut them early. By doing so, you open yourself up to opportunities that can recover your lost capital elsewhere, allowing for a quicker rebound.

If you have any questions, please write to support@weekendinvesting.com