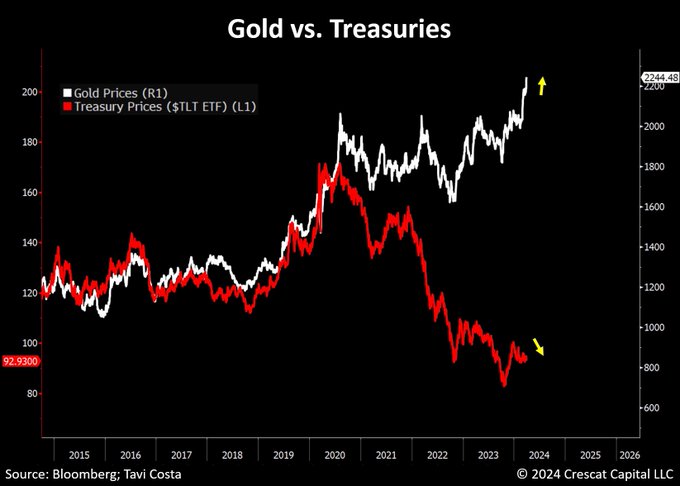

In a recent analysis by Tavi Costa from Crescat Capital, an intriguing observation sheds light on a significant shift in the global monetary system. The comparison between the gold price (depicted by the white line) and treasury prices (illustrated by the red line) unveils a divergence that has emerged in the past couple of years. Traditionally, these two metrics moved in tandem, yet since 2020, an unprecedented anomaly has unfolded.

Historically, the gold price and treasury prices exhibited a close correlation, moving in sync with each other. From 2014 until the onset of the COVID-19 crisis in 2020, this correlation remained intact, with both metrics following similar trajectories. However, a notable deviation occurred thereafter, marking a departure from the established norm.

Contrary to conventional wisdom, wherein gold typically surges when interest rates or yields decline, an unexpected phenomenon transpired. Despite rising yields, gold prices soared, defying the anticipated trend. This divergence has sparked speculation regarding underlying shifts in the monetary landscape and central bank strategies.

Central Banks’ Strategic Gold Accumulation

The perplexing divergence between gold and treasury prices hints at strategic maneuvers by central banks worldwide. Despite stagnant or rising yields, central banks have been bolstering their balance sheets by accumulating significant gold reserves. This strategic shift raises questions about undisclosed changes in monetary policies and potential disruptions on the horizon.

The divergence between gold and treasury prices underscores the need for caution and preparedness in the financial markets. While the exact implications of this divergence remain unclear, it serves as a cautionary signal for investors to adopt a more hedged approach and avoid excessive leverage, particularly in equities. As uncertainties loom, prudence and vigilance become paramount.

WeekendInvesting Strategy Spotlight

A strategy to overcome this problem !

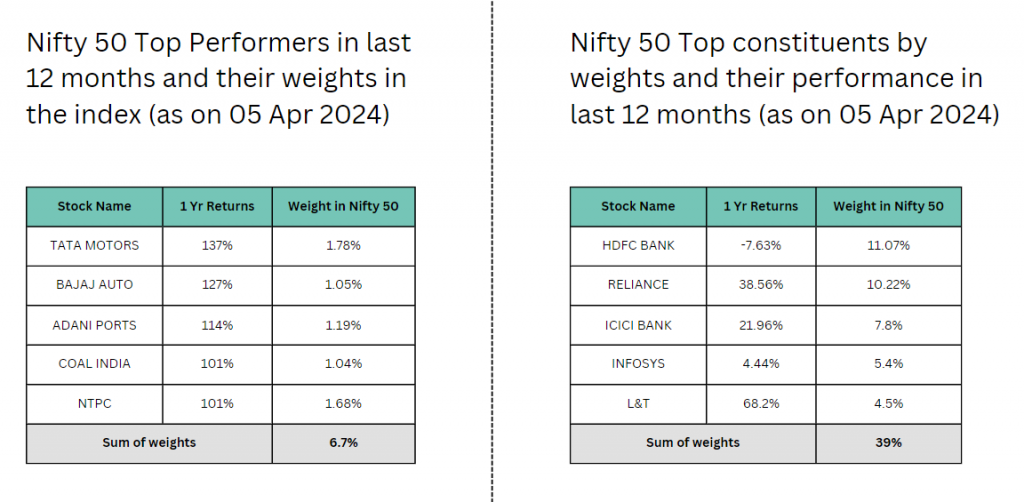

Here’s an interesting data point for your better understanding of how index performance works.

The table on the left denotes the stocks with highest gains within the Nifty 50 universe in FY 2024 & their corresponding weightages in the index.

The table on the right denotes the list of largest weighted stocks in Nifty 50 and their corresponding performances in FY 2024.

It is rather surprising to note that all top 5 performing stocks from Nifty 50 have clocked in excess of 100% gains collectively hold only a mere 6.7% weightage in Nifty 50.

Whereas, the top weighted stocks which occupy almost 40% weights in Nifty 50 have had mixed results in FY 2024.

What this suggests is that – For Nifty 50 to do well, the heavyweights (HDFC BANK, RELIANCE, ICICI BANK< INFOSYS & LT) need to put on a great show.

The spirited performances clocked by the likes of TATA MOTORS, BAJAJ AUTO, COAL INDIA , ADANI PORTS & NTPC have not been able to impact Nifty 50 in a major way owing to their miniscule weightages.

Is there a way to ;

– Determine the strongest stocks within the Nifty 50 universe ?

– Allocate a bias free equal weights to all strongest stocks ?

Mi India Top 10 does exactly that

Use code FY2025 to subscribe to Mi India Top 10 at a flat 25% discount.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com