The markets continued their rally forward. Today, we will discuss PE ratios and whether we are being misled by them or making bad decisions based on them. We will delve into this topic in the second half of the video.

Market Overview

Nifty carried on after Friday’s mild pullback, closing at 24,141, up 0.5%. Watching Nifty go up has become almost tiring for those patiently sitting with their portfolios, avoiding any churning or action. Those who tried to time the market post-elections and missed the dip day after the election results have been waiting longer as the market pulls further away from the averages. The long-term 50-day moving average is at 22,800, while the current market is at 24,141. Although a pullback might occur at some point, the market currently shows no signs of it.

Nifty Next 50

Nifty Junior gained 1% today, building momentum and potentially reaching a new high

Nifty Mid and Small Cap

Mid-caps also broke out of their range, adding another 1% to reach 21,000. However, different stocks are rallying after this consolidation, mostly those that haven’t rallied so far, making the market slightly riskier. Small caps performed fantastically, gaining 1.5% and moving out of their recent range.

Nifty Bank Overview

Nifty Bank Index also rose by 0.44%, showing a good recovery despite not moving as much as other large-cap indices.

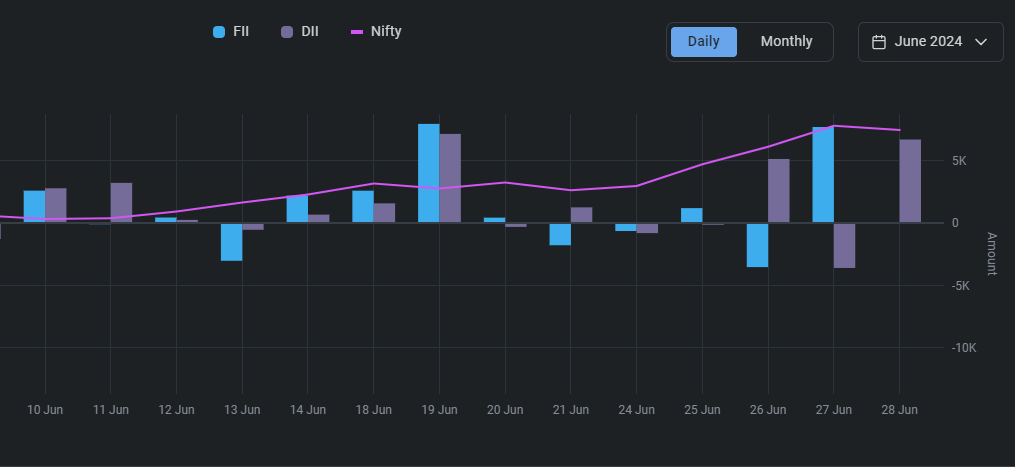

FIIS and DIIS

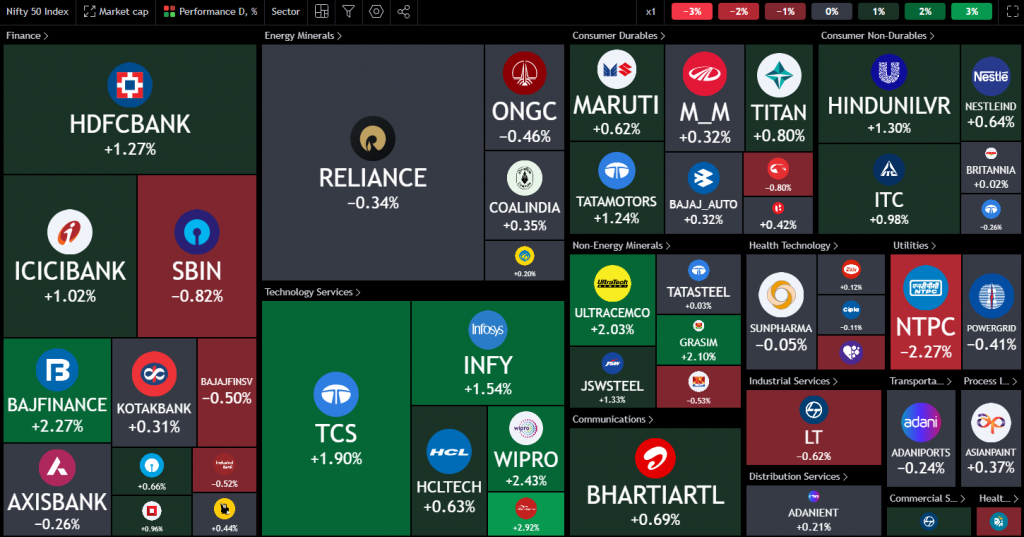

Nifty Heatmap

In today’s heat map, HDFC Bank led with a 1.2% gain, while Bajaj Finance was up 2.2%. IT stocks like TCS, Infosys, and Wipro performed well, along with cement stocks like UltraTech Cement and Grasim. Public sector enterprise stocks, capital goods, and cement stocks like Ambuja Cements and Shree Cement showed gains, while some public sector banks and companies like Canara Bank, PNB, and Bank of Baroda experienced losses. Tata Power, IRFC, and Pidilite also saw declines. FIIs were virtually absent, with a net of -23 crore, but DIIs were very active, buying almost 6600 crores.

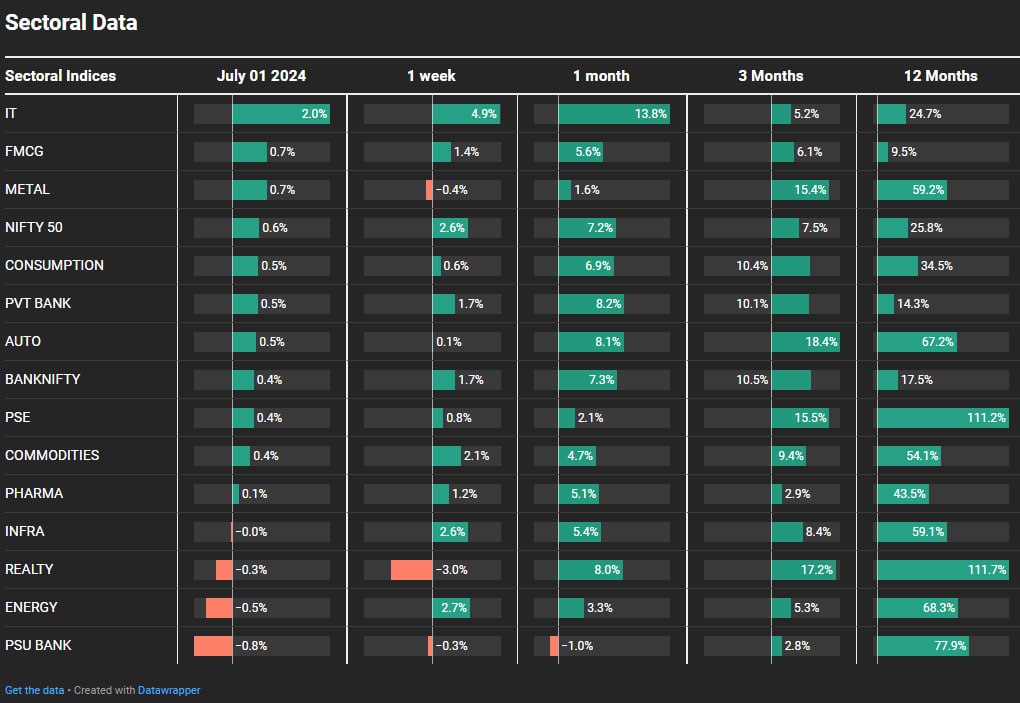

Sectoral Overview

Sectorally, PSU banks lost 0.8% and have not made gains in the last month, while private banks gained 8.2% within a month. Real estate lost 3% in the last week, and energy stocks were down 0.5% today, gaining only 3% in the last month. IT stocks were the flavor of the week and month, up 13.8% and 2% today. FMCG and metals were up 0.7%. Consumption stocks increased by 0.5% due to budget-related news, while auto stocks rose in anticipation of auto numbers. Public sector enterprise stocks also increased by 0.4% in the last week.

Sectors of the Day

Nifty IT Index

The Nifty IT index showed a sharp rise, gaining nearly 20% in the last few weeks. On a longer-term timeframe, it is rallying towards the top and has more room to grow.

Nifty MNC Index

The Nifty MNC index has been rising rapidly, except for a range-bound rest period between October 2021 and March 2023.

Stocks of the Day

Cholamandalam Finance

Cholamandalam Finance was a standout performer, up 11% and creating a nice consolidation pattern. It rallied from Rs500 to Rs1200, consolidated for a year, and then broke out, reaching Rs1609.

Gold Chart

Story of the Day

Now, let’s discuss PE ratios. Many investors focus on PE ratios to make investment decisions. However, PE ratios can be misleading. In 2021-22, the calculation method for Nifty PE ratios changed from standalone to consolidated, making current ratios incomparable to past ones. The median PE ratio has been around 21, but the range has shifted from 15-18 to 20-30 in recent years.

The S&P 500’s PE ratio has also shifted, now ranging between 20 and 45, whereas it used to range between 10 and 22. This shift indicates that absolute PE numbers have become less meaningful. High PE ratios often indicate high growth stocks that can deliver significant profits, while low PE stocks may not perform well.

The key takeaway is not to worry about PE ratios but to focus on trends and have an exit plan. Whether a stock has a PE ratio of 20, 40, 60, or even higher, what matters is its performance and your investment strategy.