We’re currently anticipating the portfolio allocations by the newly sworn-in cabinet. While the specific allocations may impact the market tomorrow, the overall effect of the election results has already been largely discounted by the market. Only a significant negative surprise, such as key ministries being given to non-BJP ministers or to individuals perceived as incapable, might cause a short-term impact.

In recent sessions, the market has shown that it is looking forward to upcoming events, such as the likely budget announcement on July 1st. Once the portfolio allocations are completed, the market’s focus will likely shift to potential changes in capital gains tax. This topic is expected to become hotly debated, given the government’s perspective on taxing market gains more heavily. Concerns about increasing taxes on market gains reflect the sentiment that equity should not be favored over other asset classes like real estate and gold.

There are rumors that Nirmala Sitharaman might not retain the Finance Minister position, with Piyush Goyal or Amit Shah being potential candidates. If Piyush Goyal is appointed, it is expected to be positively received by the market due to his financial expertise.

Story of the Day

In today’s market, IT stocks took a break after a strong rally over the past few sessions. Key stocks like Infosys, Tech Mahindra, and TCS saw declines, indicating a corrective phase rather than a trend reversal. This could present a buying opportunity for investors looking to enter the IT sector. Some small and mid-cap IT stocks, like Datamatics, have also shown strong performance.

Overall, the market remains optimistic, looking ahead to the budget and potential changes in capital gains tax, while maintaining a positive outlook on sectors like IT, real estate, and aviation.

Market Overview

Nifty remains in positive territory according to short-term indicators on the hourly candle, with a base support level at 22,964 for the current movement. We’ve observed a double top formation on the exit poll high day and today’s average at the top, suggesting a potential consolidation phase. However, a breakout above this top is anticipated later this week, a scenario that appears likely based on current trends.

Nifty Next 50

You had Nifty Junior, which has not yet challenged the previous all-time high set on the exit poll day, indicating there is more room for growth. Despite this, Nifty Junior is showing strong support at its current levels. The RSI is softening but remains comfortably in the sixties, suggesting there is no immediate cause for concern. This indicates the index still has upward potential and maintains a solid foundation.

Nifty Mid and Small Cap

Mid caps showed minimal movement today, ending up 0.36%, indicating a resting phase for the day. However, small caps demonstrated significant action. In the first hour, they broke out of the previous high and surged from nearly 14,000 to 16,200 within four sessions. The gap-up today without closing the gap signifies the robust strength in small caps at the moment. Normally, with the overall market being flattish, small caps would have closed the gap, but they didn’t, showcasing their current resilience. They have recently broken through significant resistance, suggesting the potential for further run-ups.

Nifty Bank Overview

The Nifty Bank index has been up over the week but remained flat today. It appears to need a significant push to break out of its current range. The index has been languishing within a broad range, and its movement is crucial for the overall Nifty index to make substantial gains. Until the Bank Nifty shows decisive movement, it is unlikely that the Nifty will experience a notable upward trend.

Gold Chart

Gold experienced a sharp decline a couple of days ago, which I mentioned in the last update. It is now consolidating at its current level. The market was disappointed with China not buying any gold in May, as there was an expectation for China to increase its gold purchases. However, India has been buying gold, reportedly acquiring three to four tons in May. If residual buying from other central banks materializes, this could support the gold market.

Gold purchasing is typically seasonal, with two major periods each year. The second half of the year, which includes the festive season of Dussehra and the marriage season in India, tends to have a significant impact on gold demand. Despite the recent drop, gold has performed well overall, rising from 63-64,000 to 72,000. A few weeks or months of consolidation at this level will not be detrimental.

FIIs & DIIs

The good news on the FII front is that yesterday, FIIs bought a substantial ₹4,300 crores worth of stocks. Conversely, DIIs are typically on the opposite side of these transactions. Many people don’t fully understand these dynamics. Having some experience as an institutional dealer in the late nineties, I can shed some light on this. When an FII wants to buy a significant amount of stock, say ₹500 crores or ₹1,000 crores worth, it isn’t readily available in the market. They need another institution on the other side, either another FII looking to sell or a DII.

An FII purchase usually involves at least some components coming from a DII. This means that when FIIs are buying big, DIIs are generally selling, and vice versa. This dynamic exists because only institutions can handle such large lot sizes. The market isn’t deep enough to accommodate such large purchases or sales without significantly affecting the price.

If an FII wanted to buy ₹1,000 crores of a mid-cap stock, they would likely push the price up by 20-30%. Therefore, institutions play a crucial role in these transactions. It’s encouraging that despite three big days of FII selling, FIIs bought on June 7. We’ll see how the numbers look for Monday later today.

Nifty Heatmap

Overall, the heat map for the Nifty showed a relatively flat to red trend. Autos were down, and the IT sector, as previously mentioned, also saw a decline. The FMCG sector was a mixed bag, while some cement stocks were performing well. There were also gains in some power stocks, but no significant moves overall in the Nifty.

In contrast, the Nifty Next 50 had more green indicators. Public sector enterprises, PSU banks, and cement stocks were performing well. IndiGo continued to do well, and some consumption stocks were also up. Motherson, a recent addition to one of our strategies, was performing quite well. Overall, the outlook appears more positive when looking at the trends in the Nifty Next 50.

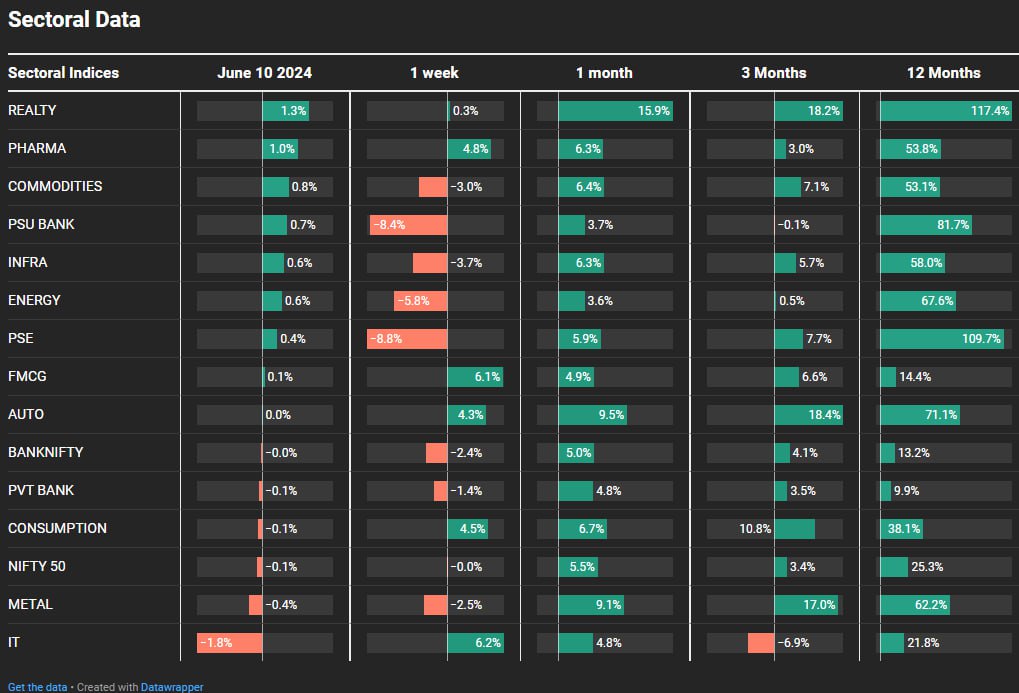

Sectoral Overview

In terms of the sectors, real estate showed a notable comeback with a 1.3% increase for the day and a significant 16% rise over the past month. While there isn’t always a direct correlation between stock performance and real estate activity on the ground, a sustained rise in real estate stocks often indicates positive movement in the sector overall. Real estate has been the best-performing sector over the last twelve months and continues to show strength, making it an attractive area for discretionary investors and traders to explore for opportunities.

Pharma also performed well, rising by 1% today and 6.3% for the month. Commodity stocks and PSU banks managed to eke out some gains, although these sectors, along with public sector enterprise stocks, energy, and infrastructure, have not yet recovered from the recent downturn and still lag behind other sectors in filling the election day gap.

Most other sectors remained flat today. FMCG was up by 0.1%, while autos showed no significant change. Despite news of stock accumulation in companies like Maruti and Hyundai, the auto sector’s stock prices haven’t yet reflected this. This could be due to the market expecting these stocks to clear during the upcoming festival quarter.

IT stocks experienced a corrective day rather than a reversal, and metals and consumption stocks were also somewhat soft.

Sectors of the Day

Nifty REALTY Index

The Nifty real estate index fully recovered from the election day drop and closed at a new high. Looking at the long-term picture, real estate stocks have undergone a prolonged consolidation phase since the 2008 crash and only started recovering post-COVID in 2020. This kind of extended consolidation often leads to significant long-term rallies once the move begins. Real estate stocks have already increased sixfold since the COVID bottom, demonstrating the potential for substantial gains in this sector, which can sometimes go unnoticed during periods of low optimism.

Stocks of the Day

Indigo

In terms of some stock spotlights, InterGlobe Aviation (IndiGo) broke out again, continuing its impressive performance over the last six months. The stock has nearly doubled from around 2300 to 4600, including a 4.4% increase today. This surge is partly due to rumors that several new airports will be announced in the first hundred days of the new administration, positioning IndiGo to benefit significantly as the leading player in the aviation industry. The long-term chart shows IndiGo moving from a range-bound phase into a strong upward trajectory.

Dhanuka Agritech

Dhanuka Agritech is another stock performing well recently. From lows of around 700 in 2023, the stock has nearly doubled over the past year, with an 11.1% gain today. This indicates strong market sentiment and buying interest on dips. The long-term picture shows a substantial run-up from 2016 to 2017, followed by a decade-long consolidation. The recent breakout from this consolidation suggests potential for further gains, though it’s important to maintain stop-loss levels and adhere to trading systems.

Rashtriya Chem

RCF (Rashtriya Chemicals and Fertilizers) has also shown strong performance. After rising from Rs 80-90 to Rs 190 in 2023 and undergoing a corrective phase, the stock is now making a strong comeback. It appears poised to challenge previous highs and possibly surpass them. The long-term view shows significant consolidation, indicating the potential for a sustained upward move.