Market Outlook

I would say it’s a dead cat bounce. So far, we really can’t say that markets have turned, but yes, a bounce nevertheless. The market has kept faith in this trend line for the fourth time, finding support here until a breakdown occurs.

Optimism should be maintained that this trend line will hold at some point, considering the consolidation over the past four months. Excessive positions haven’t been built into the system, so a dramatic 20% drop seems unlikely even with reasonable bad news.

There’s a narrative of numbers coming down in the election outcome, but speculating websites aren’t adjusting their rates accordingly. Even if the numbers are down by 5%, it won’t prevent government formation. Within 15 days of government formation, such concerns will likely be forgotten.

Regarding market positioning, I’m gradually bringing in money over the next six months, maintaining a balanced asset allocation with gold as a hedge against volatility. We don’t know where the market will go. But I’ve made sure that the asset allocation to gold is fantastic so that all this volatility can have a very good counterbalance. And we are seeing that evidence today. Also, I’ll show you the gold chart, how it is counterbalancing this. So as long as you are well positioned, you don’t have to worry about individual asset classes going up and down.

Nifty Heatmap

Nifty heat map, very green today. Good recovery from the pessimism of yesterday. You had energy stocks, steel stocks, utilities, FMCG, automotive, all going up. Little bit of redness on tcs, Infosys, Wipro, it stocks, HDFC bank is usually read anyways. Mahindra, Mahindra is down. Kotak bank was down a little bit

Nifty next 50 heat map also saw reasonably good gain. So you can see that some of these stocks, the first opportunity of some gain, these stocks are always in the limelight. So Chola Finance, Vedanta, Zomato, ABB recently, with any decent update, you will find these stocks are running ahead. This is telling you that these stocks have relatively good positive momentum versus others. And the first opportunity that these stocks get, they run.

DLF despite good news of project selling off is doing profit taking. So everything is already discounted there and people have already built the positions earlier than the outcome.

For instance, bank of Baroda, PNB, Canara bank in a very mixed kind of situation. Some PSU banks going up, others coming down. The power utilities, power Finance company, Rec Limited, flat confused. You had HAL also seeing marginal gains. So again, marginal gains in the market, not yet a U turn, I would think, but a potential u turn for sure. Uh, a dead cat bounce. If we break today’s low now, going forward, that will be a bit of red on the screen.

Sectoral Overview

Top sectors, energy, metals, public sector, enterprise stocks, commodities, FMCG consumption, infra, all gaining 1% or more. Autos also 0.9% along with pharma Nifty itself gaining 0.4%. So you can see that the jump in Nifty or the bounce in Nifty is very limited, 0.4% bounce after, you know, dropping two, three, 4% in recent history. Bank Nifty, not even doing that. Bank Nifty, 0.1% down. Real estate down 0.4% down. It is now down 6.7% just within a month and 12% in three months. This is certainly very telling of some sectors which are totally out of flavor. You know, there are others which are bobbing in and out, you know pharma is three months is zero so you don’t know which way it is going. You know FMCG is 2.6 so it is kind of this way, that way on different days. But it is singularly in the red. Tells you a lot about that state of that current sector right now.

Nifty Mid and Small Cap

Mid caps very good. I would say recovery. Long legged candle here above the the breakout line. I think this chart is at least looking optimistic. Small caps also taking support. Long lead candle again, although not covering yesterday’s move by a major margin, but still this distance covered from the bottom is significant to 300 400 points. Of course we will go down very badly to maybe nearly 13,400 if this breaks because there is a now a left shoulder and a head and if this right shoulder gets made we will reach here with reasonable probability.

Nifty Bank Overview

Nifty bank continuing to bleed 8th day of a red candle. I don’t know what it will take to get Nifty bank going but Nifty bank is definitely oversold. Yesterday was good news for State bank of India results but that did not help the Nifty bank.

Nifty Next 50

Nifty next 50 also just hanging in there again. Long legged candle coming back up through the day and saving this trend line reasonably strong I would say. It has basically bounced off also from the previous high which is a very good trend formation.

Gold in USD terms

You can see after resting for a couple of weeks in the last two sessions gold has come remarkably strongly back to 2375. We are hardly 1% away from all time high. If that gets taken out I think we are headed towards 2500.

Gold in INR terms

The same thing is happening on USD INR gold. From a high of nearly 7500 /gram we had dropped to nearly 7000. And now suddenly we are at 7300 plus. So very very strong charts I would say. And because you have at least those who have been listening to me since 2016, probably got sick of me talking about gold but were smart enough to allocate, would have seen their portfolios not have that kind of volatility.

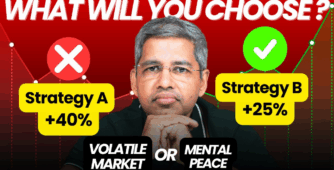

Now I’m seeing in my own portfolio with very little volatility. I mean equity markets get smashed, we go down a bit, gold goes up on the other side. So this is the benefit. There is a reason why you buy a hedge. It is not to, you know, improve your overall returns but to improve your sleep if you want to look at it that way. But if you don’t want to improve your sleep, you want to maximize your returns. Then, of course, go all in, into the most riskiest of instruments in the equity market, or cryptos, or for that matter.

Nifty Auto Index

You can see that yesterday’s candle also, it came off because of the rest of the market. But today it has closed at a new all time high. So in a market where the Nifty is about to make some breakdowns, Nifty auto index is making new highs. That tells you the relative strength of the Nifty auto index. So look for setups in the auto space if you are a discretionary investor, and that will give you the most, the best setups within the, within that space.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz