Story of the Day

It was a dull day today, but the good news from yesterday is that there is continuity of governance. Most of the ministries and portfolios have been distributed to the same people. I was myself expecting some juggling in the finance ministry, but that has not come through. And we have Madam Sitaraman back as FM.

Now, what does that do? It brings back the rhetoric from the last budget that there have been some internal discussions and studies suggesting that equity should be brought at par with other asset classes—not the other asset classes coming towards equity, but equity going towards them. Last time, people speculated that the long-term capital gain (LTCG), which currently has a twelve-month cap, might become a three-year cap.

Of course, all this is just speculation. There is no confirmation or insider information of any material evidence. But one thing is for sure: we need to see ourselves from somebody else’s perspective. While we in the market may feel that we are paying STT, short-term capital gains, or business income on F&O, with multiple taxations, SEBI charges, exchange transaction costs, and so on, from an outsider’s perspective, like a finance secretary a few years back, stock market people are seen as making money without doing much. This bureaucratic view holds that since the market has boomed in the last three or four years, especially since COVID, stock market investors shouldn’t receive any special tax status.

Why should a stock market investor pay 10% capital gains after one year versus someone who invested in real estate, gold, or art? This special status of the equity market has gradually been diluted. I remember when Mr. P. Chidambaram was FM, he introduced the Securities Transaction Tax (STT), and long-term capital gains were set to zero. It was said that instead of long-term capital gains, we are bringing in STT. That was the underlying thesis at that point in time, around 2004, if I’m not mistaken.

Then, gradually, STT was also set off against business income. So if you made money in options trading, for instance, you could take an expense of STT. Gradually, that was taken away, so STT could no longer be taken as an expense in your business proposition. That was gradually diluted, STT was increased in several steps to the current level, and then long-term capital gains were brought back without the removal of STT. While this happened over different governments, the intent of STT was initially just to track transactions. Now, it has become a profit center in itself, bringing in 20-30,000 crores per year.

Unless the government sees this rationally, I don’t think we will reverse this trend of additional taxation. If my fears are correct, even if STT is not touched, the LTCG rate could increase, the period required to claim STCG could increase, and short-term capital gains could also be tinkered with. There were rumors last year that STCG could be removed and merged with the income slab, which would be extremely harsh.

The continuity in government has dashed my hopes that a fresh view might be taken. The personal income tax collection department needs to be scrapped since only 2.5% of people pay income tax, while the rest don’t. If that army of income tax officers were directed to plug gaps in indirect tax collection, they might do a better job. But this is a discussion for another day.

Market Overview

I think the market has done whatever it needs to do from an elections perspective, and that is behind us. The story that will now play out from here until around 1 July, when the budget is expected, revolves around these rumors and speculations.

Where is the market headed? The market has recovered the entire fall but is now hesitant to move forward, so maybe some more time for consolidation is needed. Nifty was absolutely flat. It was up in the morning during the day but gave up most of the gains. So the strength to really advance from here needs some push, and for that, we need some trigger or news. That’s where we are.

Nifty Next 50

Nifty Junior is also absolutely flat at -0.09%. It can’t get flatter than that.

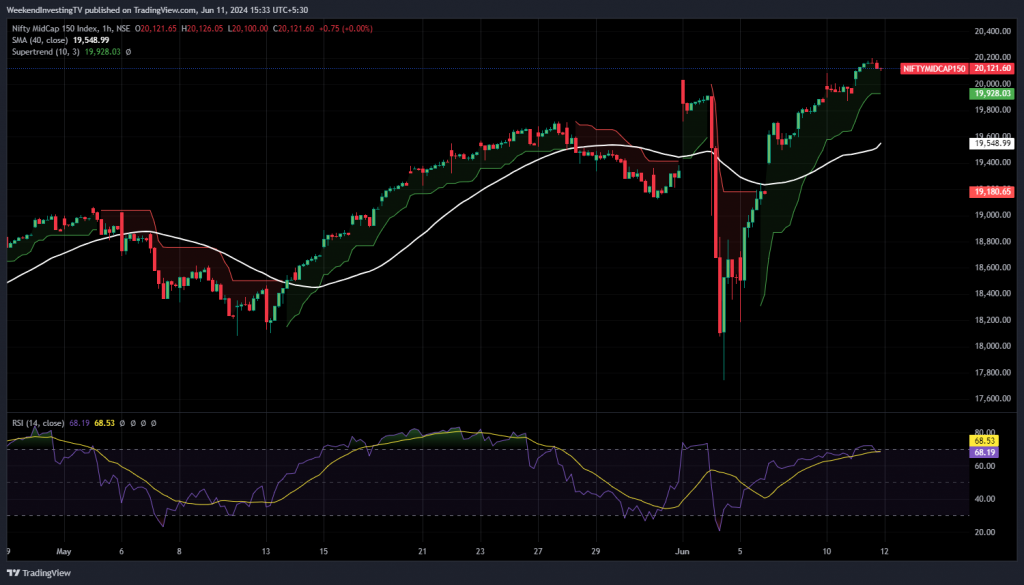

Nifty Mid and Small Cap

Mid caps were slightly in the green. Mid caps, along with small caps, were still leading the market and made a new high for the day. From that perspective, mid caps and the second part, or the second half of the market, if you may call it, have done reasonably better. The small cap index also gained 0.6%.

So, we are seeing that this entire resistance is nicely taken out. Maybe there will be a retracement to check support and then go up. But it looks like they have broken out from here.

Nifty Bank Overview

Nifty Bank index is not really going up. There was a sort of a false breakout that happened on exit polls. Beyond that, it has not been able to take out even its May high. So, Nifty Bank is still deterring against in this particular period and it needs new momentum to really, really make sure it goes up. I think around 50,000, the 50,000 round figure always serves as a sort of resistance point and that’s exactly what is happening.

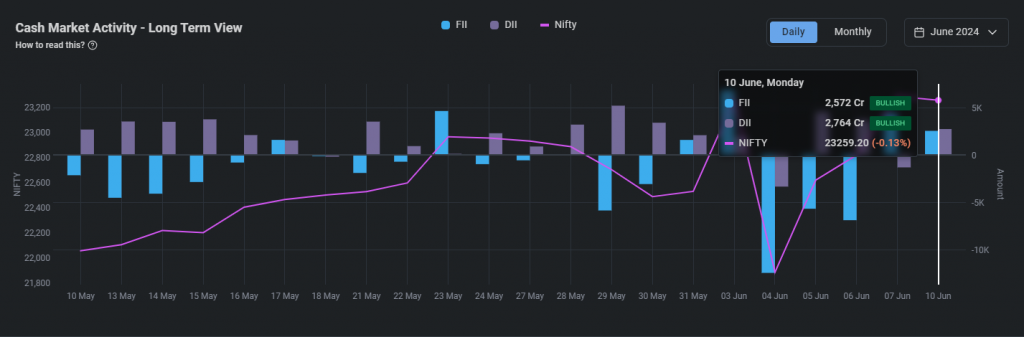

FIIs & DIIs

FIIs, at least in the last two sessions, have been on a buying spree. So, two and a half thousand crores. I think previous to that it was 4000 crores. It’s a good sign that both FIIs and DIIs are buying, although that is usually never the case. They often have opposing positions.

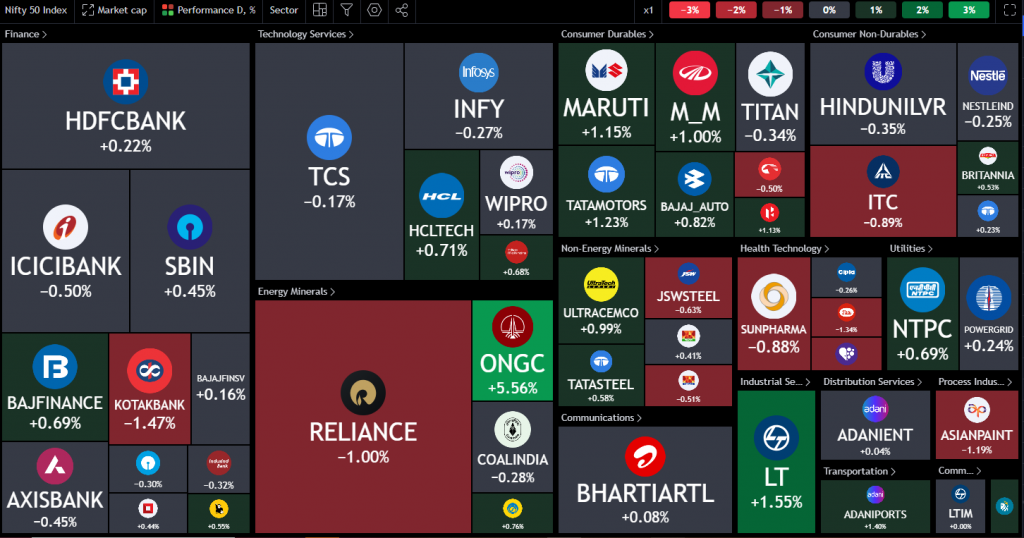

Nifty Heatmap

Nifty Heatmap was very dull.

You can see just two blocks of green here. ONGC raced up by 5.5%, and L&T was up by 1.5%. There were some gains in autos, but banking, FMCG, and energy were totally flat. There wasn’t much to talk about today.

Even the Nifty Next 50, which is usually more trending than the Nifty 50, showed more red today. Chola Finance, ICICI General Insurance, Dmart, Indigo, Adani Green, Havells, Motherson, Marico, and Dabur all lost some ground. However, GAIL, IRFC, LIC, Siemens, and HAL gained a little bit today.

Sectoral Overview

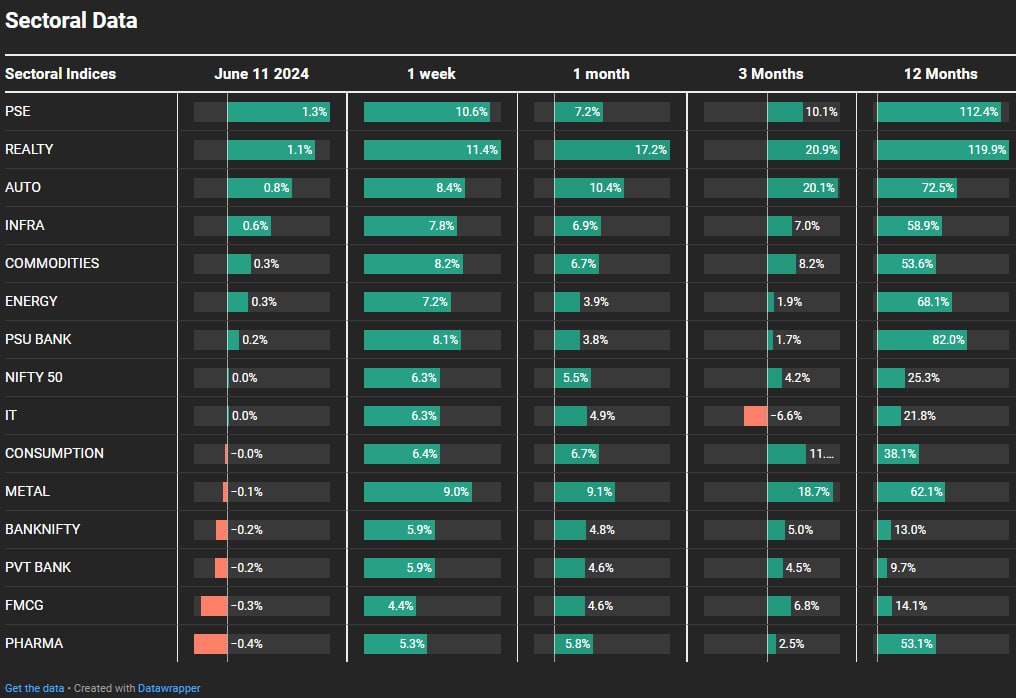

Public sector enterprise stocks again led the market with a gain of 1.3%. Real estate followed, gaining 1.1%, while autos gained 0.8%. Over the past week, real estate has performed remarkably well with an 11.4% increase, public sector enterprises at 10.6%, and metals at 9%. Although metals were flat today, they have done well overall for the week.

Real estate has consistently performed well over one week, one month, three months, and twelve months, making it the best-performing sector so far. The defensives, FMCG, and pharma, were down by 0.3% and 0.4% respectively. The market was generally flat without any significant momentum in either direction.

Sectors of the Day

Nifty PSE Index

Public sector enterprise stocks, which had broken out of a 14-year consolidation, continued to move up. When you see such long-term consolidations, the breakout is usually significant, which is exactly what has happened here.

Nifty Oil and Gas Index

The oil and gas index is looking good, although it hasn’t reached a new high yet. It has recovered well from its fall. There’s increasing talk about Saudi Arabia joining the BRICS party and the US petrodollar being in danger. These changes are slow-moving and happen over decades. There were news items, although not confirmed, about the 50-year contract between the US and Saudi Arabia on the petrodollar exchange being over. Russia and China are dealing in more non-US dollar petro transactions.

The oil and gas index had broken out after a long consolidation and is now consolidating again. It may continue above 12,000, making it a prospect for setups in stocks within this sector.

Stocks of the Day

Hindustan Construction

This stock has moved rapidly from a recent bottom of Rs 31 to Rs 47, breaking out to a new high. It was languishing in single digits before recent upgrades and now seems to be experiencing a resurgence.

The long-term trend from 2008 to 2020 saw the stock bottom out from Rs 110 down to Rs 3. From Rs 3, it is now at Rs 47, resembling the restructuring story of Suzlon. However, caution is advised as there could be unknown factors affecting the stock. If you are a discretionary trader, stocks making almost a twelve-year high are certainly worth looking at, provided you have strict stops and ways to protect your position.

ONGC

ONGC up 5.5%, looking good to go retest this particular resistance.

Gold Chart

Gold has indeed been experiencing a downturn since the 8th or 9th of this month. This movement is largely influenced by the anticipation of upcoming economic data from the US. The expectations around interest rate cuts have been fluctuating significantly. Initially, there were predictions of five rate cuts this year, which then reduced to three, followed by two, and now some speculate there might be no rate cuts at all. The only potential rate cut might occur just before the US election, mainly for symbolic reasons.

This uncertainty has dampened the excitement around gold. However, it’s important to note that even at its current level of around Rs 71,000, gold remains relatively strong, considering it was at Rs 63,000-64,000 just a few months ago. This suggests that while there may be short-term volatility, the long-term fundamentals for gold still appear robust. The upcoming US economic data and Federal Reserve decisions will be crucial in determining the next direction for gold prices.