Market Outlook

Today marked a significant shift as the market finally yielded to downward pressures, with the Nifty index declining by about 1%. This downturn revisits the breakout level from April 8th, potentially testing its strength. Should the market rebound from this point, it would confirm a successful retest and retracement; however, a continued decline would signal a failed breakout, necessitating anticipation for a new pattern or breakout opportunity.

The current sell-off is largely attributed to recent declines in the US market, driven by revised expectations from three to two rate cuts in FY 24 amid slight inflation increases and speculation that interest rate reductions may be delayed until closer to the US elections. This adjustment has left markets somewhat disappointed, though such events tend to have short-term impacts. Despite these global market movements, the Indian market remains relatively stable, with upcoming election results anticipated to sustain its strength without significant weakness. Nevertheless, the breakout level’s response will be closely monitored, alongside key pivot points at 21,721 and 21,500.

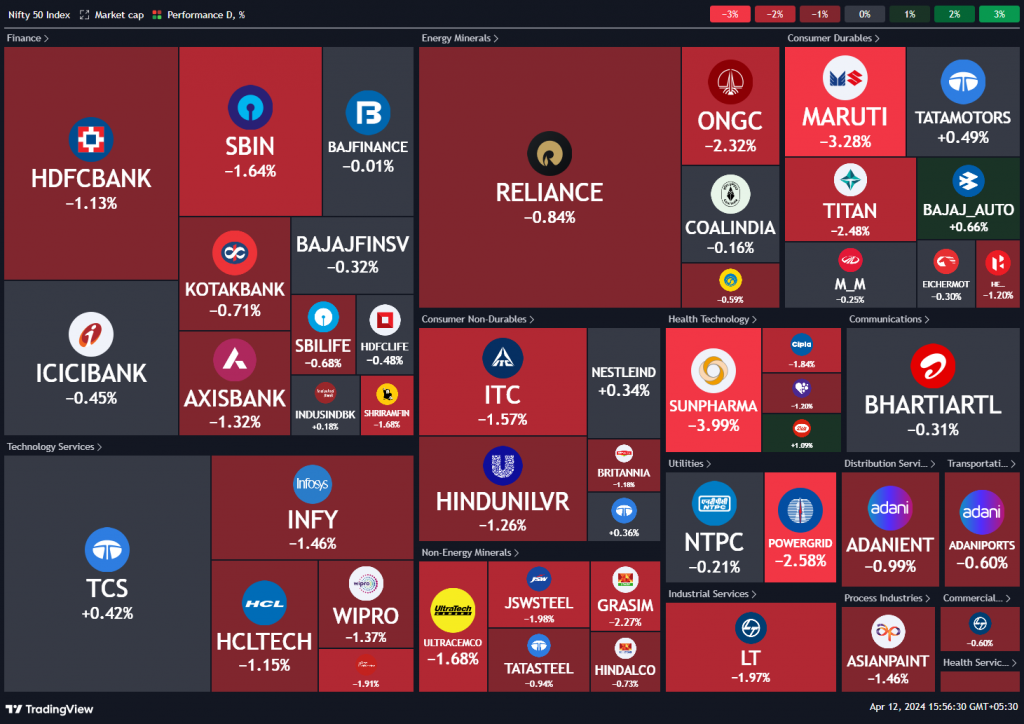

Nifty Heatmap

Today’s market saw widespread declines, with notable sell-offs in companies like Maruti, Power Grid, and Sun Pharma, among others. In contrast, Vedanta and Hindustan Aeronautics showcased significant gains, highlighting the resilience of public sector enterprises.

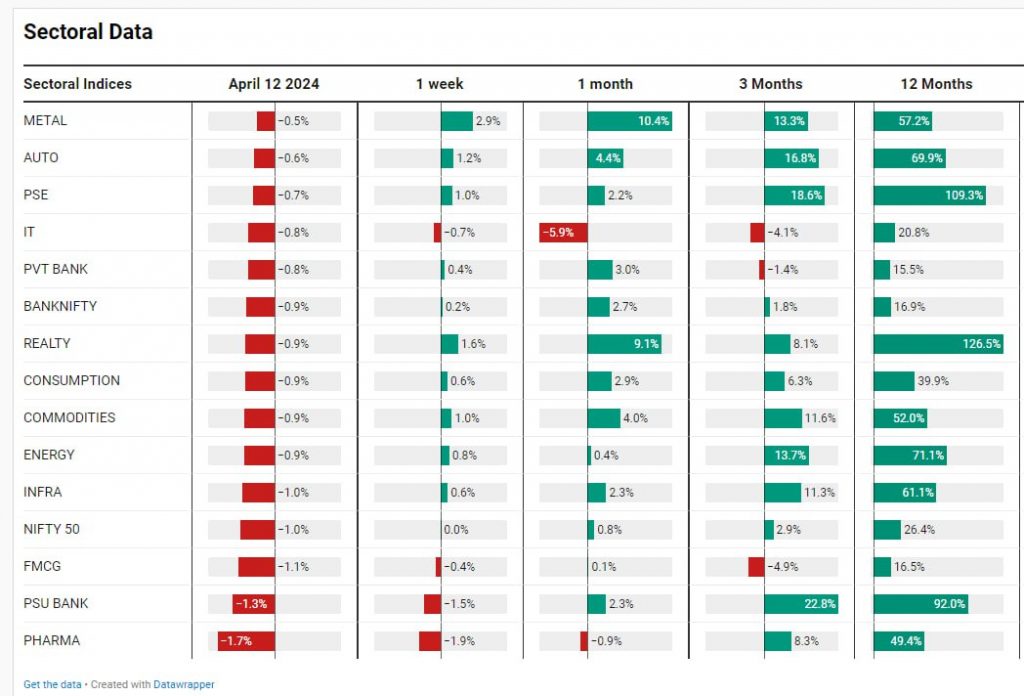

Sectoral Overview

Conversely, sectors such as metals, autos, and public enterprises faced the heaviest losses, with the pharma sector leading the downturn with a 1.7% decrease.

Mid & Small Cap Performance

Mid caps not so bad actually. Although the mid caps did make a new high, but returned back to yesterday’s open, so I would think still a decent day for that. Small caps also hitting a new couple of month high, but retracing back towards the end. So I still see no issues at all in both the mid cap and the small cap space. But let’s see how markets pan out in the next few days.

Nifty Bank Overview

Nifty bank has come off from this 49,000 plus levels to 48 500. But again, it is just about at the breakout point of the previous high.

Nifty Next 50

Nifty next 50, very well placed, closing within yesterday’s range. Not even closing this gap that was there two days back. So Nifty next 50 also looks so strong to me.

Nifty Pharma

Nifty Healthcare Index

Nifty Metal Index

Nifty Auto Index

Autos, I think, are doing really well. Two, three days have been down, but they have not even covered this one big move that happened four days ago so I think it is just consolidating here and metal index as I mentioned has just about cooled off after four days of run so these two indices look extremely bullish to me.

US Government Bonds

One thing which is very strange but which is happening is that us bond yields are going up, of course, as the rate cut narrative is getting reduced.

US Dollar Index

Dollar index is zooming up from 103 0.8 or something in two, three sessions to 105.8. So fantastic kind of gains. But whenever these two used to go up, gold used to come down, but gold is going up like crazy.

Gold INR

Gold INR is nearly 7,400 today. So there has been a relentless run in growth in gold. And this is very unusual, very, very unusual that dollar index goes up and gold is going up, us yield is going up and gold is going up.

Gold is smelling something else. I don’t know what that is, but if there is truth in the fact that there is some event or some outcome that is going to come, it will not be good for equities, it seems. So. From that perspective, allocation to gold would have really paid off very well, or will pay off very well if there is an event of this kind coming back to the markets. Autos, I think, are doing really well. Two, three days have been down, but they have not even covered this one big move that happened four days ago so I think it is just consolidating here and metal index as I mentioned has just about cooled off after four days of run so these two indices look extremely bullish to me.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz