Story of the Day

The Nifty is relatively stagnant with no significant movement, similarly mirrored by the bank Nifty. However, there’s notable activity in other parts of the market, which we’ll discuss.

Our focus today is on a particular index that has been performing exceptionally well. Ignoring this index could be a missed opportunity. If you look at the ratio chart of this index against the Nifty 50, it had a significant run-up in the 1990s, another substantial rise from 2002 to 2018, and now it’s climbing again. If you haven’t guessed which index this is, we’ll reveal it towards the end of the session.

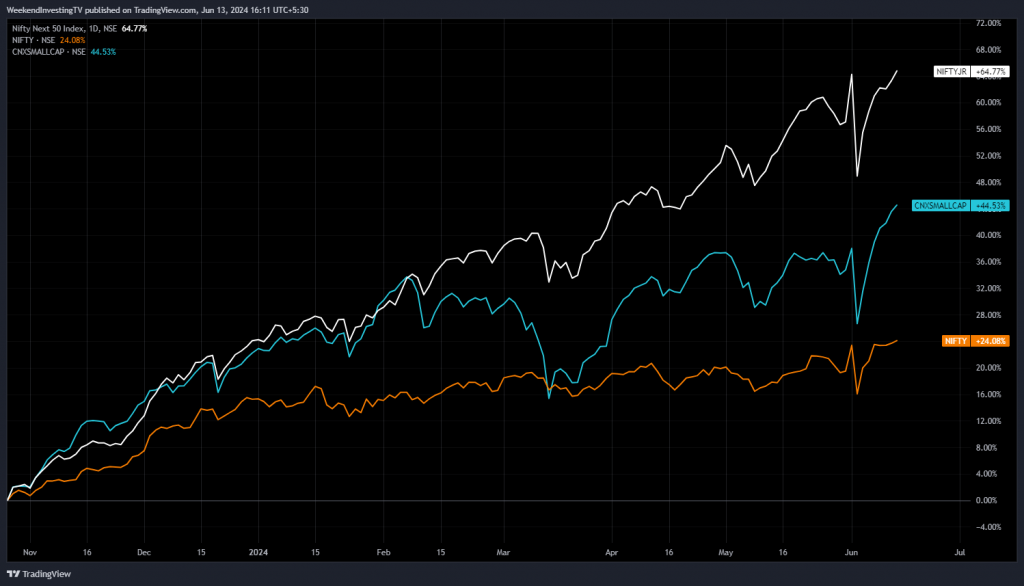

This index has shown a strong upward trend against the Nifty 50. From November, the Nifty Junior is up 65% in less than seven months, outperforming the small cap index (up 44%) and the Nifty (up 24%). Over a longer period, the Nifty Junior has consistently outperformed, with a 2340% increase over the last 20 years compared to the small cap index’s 2100% and the Nifty’s 1400%.

The Nifty Junior benefits from strong mid-cap stocks moving up into this middle tier, which are often in their rapid growth phase, offering significant returns. Once these stocks become large caps and move into the Nifty, their growth potential typically diminishes. Therefore, the sweet spot for high returns is often found in the Nifty Junior. By selecting the strongest stocks within this index, investors can achieve even better outcomes.

Market Overview

The market today is quite flat, with the Nifty up by just 0.3%. The past few sessions have shown minimal movement, which is unusual. Despite some previous selling from foreign institutional investors (FIIs), their big selling has ceased, and there was even a net buying figure yesterday. However, the Nifty lacks the momentum to climb significantly at the moment.

Nifty Next 50

On the other hand, the Nifty Next 50 is hitting new highs, closing at 79,100 today, showing a remarkable run from 60,500 to 70,900 in just over a week.

Nifty Mid and Small Cap

Mid caps are also performing well, making new highs daily. For the last four sessions, mid caps have consistently opened higher and continued to rise, closing today at 20,486, up 0.78%. Small caps are following a similar trend, up 0.81% today at 16,718.

Nifty Bank Overview

the bank Nifty remains as dull and sideways as the Nifty, possibly jittery around the 50,000 mark.

FIIS and DIIS

In terms of FIIs and DIIs (domestic institutional investors), FIIs bought 400 crores in the last session, while DIIs purchased 234 crores. This indicates that while FIIs are not buying big yet, they have stopped significant selling, which is good news. DIIs continue their trend of consistent buying over the past few months.

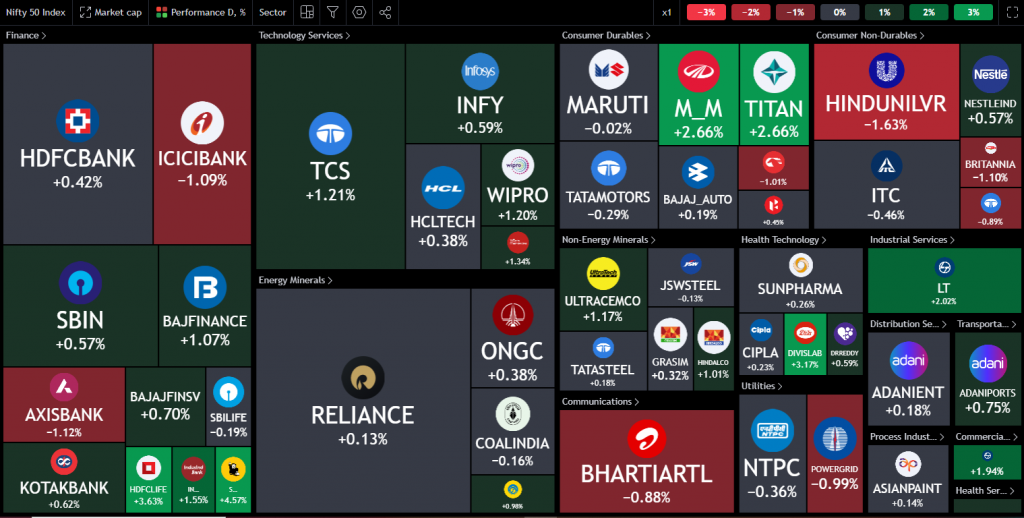

Nifty Heatmap

Today’s heat map shows a mixed bag of stock performances. Stocks like Mahindra & Mahindra, Titan, Divi’s Lab, L&T, HDFC Life, and IndusInd Bank were among the gainers, while ICICI Bank, Axis Bank, Bharti Airtel, Power Grid, Levers, and Britannia saw declines. In the Nifty Next 50, there was more green than red, with significant moves in public sector enterprises (HAL, BEL, PFC) and real estate (DLF), as well as capital goods (Siemens, ABB). Some FMCG stocks (Dabur, Marico, Godrej CP) and commodities, cement, and power stocks saw down moves.

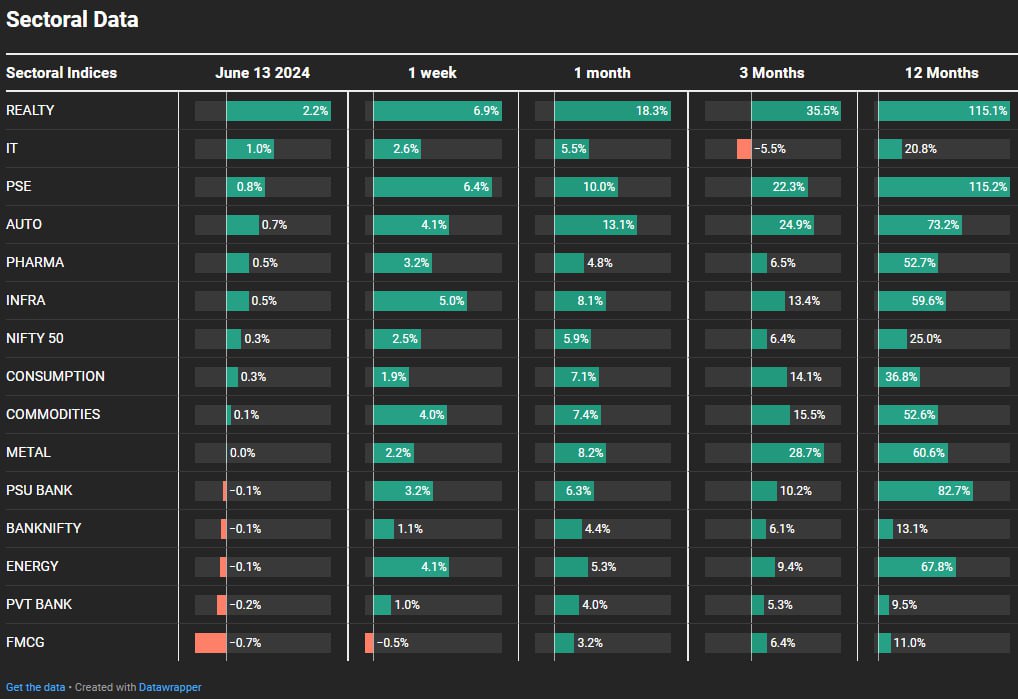

Sectoral Overview

Sectoral trends continue with real estate taking the lead, up 2.2% today, and showing a substantial gain of 115% over the past year. Public sector enterprise stocks also performed well, up 0.8% today and 115% over the year. Autos, pharma, infra, and consumption sectors had mild gains, while metals, PSU banks, energy, and private banks were flat. Private banks, in particular, have been the weakest link, up only 9.5% over the last twelve months, indicating a lot of capital has gone into them without significant returns.

Sectors of the Day

Nifty FMCG Index

FMCG stocks have also been relatively weak, up 11% over the past year, which, while not terrible, lags behind other sectors. FMCG stocks, despite a strong weekly move recently, are softening and facing resistance.

Nifty REALTY Index

The real estate index continues its strong upward trend, indicating more potential gains.

Stocks of the Day

Macrotech Dev

In the stock spotlight, Sobha and Macrotech Developers (Lodha) have shown impressive rallies. Sobha doubled from 1000 to 2100 in a short period after hitting an all-time high, demonstrating the importance of evaluating stocks continuously rather than holding onto them based on past prices. Macrotech Developers followed a similar pattern, doubling from 750 to 1500 quickly after reaching a high.

Gold Chart

Gold is currently flat at 71,500, experiencing volatility due to recent US inflation data and the FOMC meeting. Although there was initial excitement over lower-than-expected inflation, the FOMC’s cautious outlook on interest rate cuts led to gold retracing its gains.