Market Outlook

Amit Shah recently stated that the market would shoot up after Lok Sabha elections. At that point, the market was down nearly 200 points. However, after Shah’s statement, the market retraced all the losses and even went into the green by about a quarter percent. This highlights the power of confidence that can be instilled in market participants.

Despite this positive movement, the market is still not entirely out of the downtrend. However, three days of holding the strong trend line is significant progress. A move above the two-day high would provide a lot of confidence, and momentum could start building again.

With less than 20 days until the final result, there’s speculation that the market might exceed expectations. While it’s uncertain whether this will come to fruition, there’s a gut feeling that the market could perform better than anticipated.

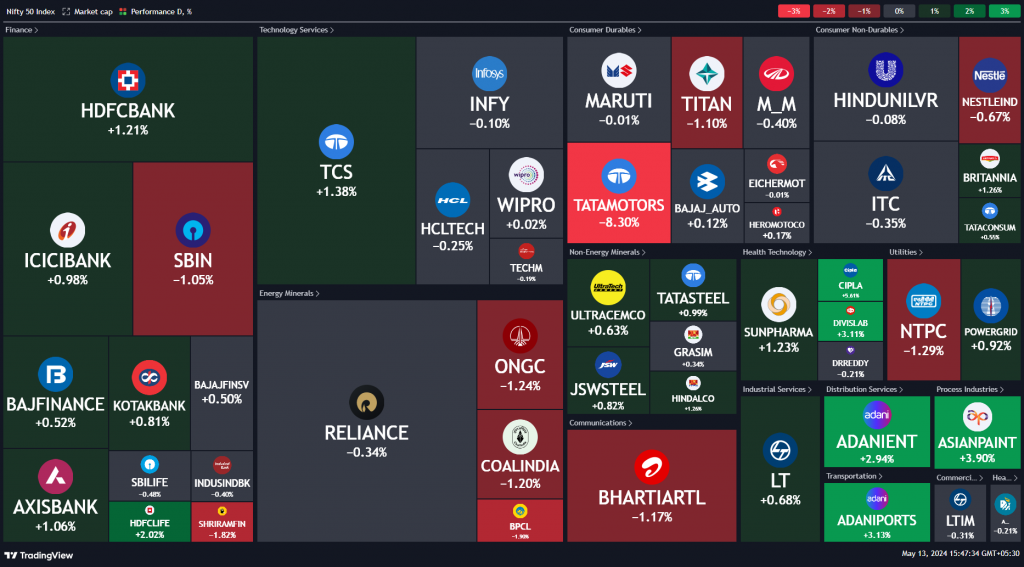

Nifty Heatmap

State Bank witnessed a 1% decline. Tata Motors saw an 8% drop after announcing its results, despite them being quite good. This sell-off on positive news is a common occurrence. Traders may take some time to exit their positions, and then the stock may recover.

Bharti Airtel, Coal India, ONGC, NTPC, and Nestle all experienced losses. However, Adani stocks and pharma stocks like Cipla, Divis Laboratories, and Dr. Reddy’s Laboratories surged ahead. HDFC Life, Asian Paints, and TCS performed well too.

The Nifty Next 50 index had a diverse mix of stocks performing positively. Zomato posted superb results, but the stock had already priced them in, resulting in a 3.4% decline. DMart fell by 2%. On the other hand, Siemens and capital goods stocks surged by 7% and 11% respectively.

Pidilite and Indigo saw gains of 1.5%. DLF and Bank of Baroda also gained ground amidst this mixed market performance.

Sectoral Overview

Pharma is leading the pack after a while, up by 1.8%, almost erasing all losses for the month and the past three months. Metals are now in the green, gaining 1.3%, and real estate is up by 1.2%.

The upturn in metals and real estate often signals a market turnaround. It’s likely that the market has turned, but confirmation will come with at least a two-day breakout.

Autos took a backseat today, mainly due to Tata Motors’ performance, leading to a 1.7% decline. PSU banks continued their fall, down by 1.2% for the day and 3.7% for the week.

Other sectors were a mixed bag, but private banking gained 0.9%, which had been lagging so far. IT also saw a gain of 0.4%, marking its biggest improvement in the past one to three months.

Nifty Mid and Small Cap

Today was a Chartists delight because yesterday’s breakdown in mid-caps was being challenged. It turned out to be a false breakdown as the market bounced back. Today, the breakout line was challenged again and closed higher.

I believe that above 18,600, there will be a lot of short covering in small caps. Additionally, there was a double bottom formed at 14,800, and most of the ground was recovered. So, above 15,100, there is a chance of recovery in small caps.

Nifty Bank Overview

look at where the support has come in today. Exactly at the support point at 47,000. So multiple charts are showing the same support, which is going to be very difficult to break down now. So it needs a really bad news now to break down this level in the very short term. So my optimism is that because so many charts have taken support at the trend line, it is likely that, you know, this current phase of down move is over.

Nifty Next 50

The Nifty next 50 is attempting to break the trend line but unable to close higher. A single move that can take it a couple of thousand points will nullify all the bearishness from here. People tend to become bearish very easily. Over my 29 years of experience, I’ve seen people panic and sell off their stocks, only to regret it later.

Getting out of the market and giving up is the worst decision you can make. Imagine if, on June 4th, the market exceeds everyone’s expectations with a 10% jump. If you’ve sold today, you’ll miss out on those gains. These short-term events occur only a few times a decade, so it’s essential to stay patient and not let volatility shake you.

If you believe in the India story for the next 10 to 20 years, why give up your position just because you think you might get a lower price? It’s important to focus on long-term wealth creation and not get swayed by short-term fluctuations.

Zomato

Zomato released fantastic results, but on the day of the announcement, there was a huge red candle. This indicates that despite the positive results, there was selling pressure. The stock had risen from 100 to 200, and many investors had already taken positions.

Now, some speculators or insiders are selling out, which is normal. It may take a few days for the stock to stabilize before potentially starting its upward journey again. The results were good, but it’s important to note that selling on news is common in the market.

As we say, ‘Bhav Bhagwan Che’ – The price movement reflects that the market had already anticipated the positive results. So, even though the results may have surprised some, the price had already factored them in.

Nifty PSU Bank Index

Nifty. PSU banks also making a sort of a long legged candle. But the move will have to be confirmed above, let’s say 7200. Right now it is in the middle of a range

Nifty Auto Index

Nifty. Auto index lost good ground today, primarily on the back of Tata Motors, gained most of it. I would say gained back half of the losses today. But it has been trading at very near all time highs, so one can look for a recovery and going back up.

Nifty Pharma Index

The pharma index is showing strong momentum, possibly the best chart at the moment. Over the past few sessions, including yesterday and today, it has recovered all the losses from the previous fall on Friday and Thursday. This is a positive sign, indicating the potential for further gains.

I believe it has the capability to challenge the levels around 19,219,300 once again. Overall, it was a very good day for the pharma sector, washing away many weak positions. Some traders likely rushed to close their short positions or cover them.

The significance of today’s low cannot be understated. If it gets broken, there may be some panic selling. Therefore, it serves as an important reference point for short-term traders. Nevertheless, the fact that the trend line held for two sessions is good news, suggesting potential stability in the near term.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz