We had a fantastic close to a week where the markets were weak for the first three sessions. Then on Thursday, something magical happened, and the markets soared to a new all-time high, pulling along most parts of the market.

The week ended on an unexpected note, with a lot of surprises in the F&O markets on Thursday. Additionally, gold has hit an all-time high. There’s a sudden global trend towards interest rate cuts. The Fed is expected to cut by 50 basis points next week, if not 25 basis points. The EU has already cut for the second time, and maybe India will consider following suit. So, that is the hope.

But gold at a new all-time high—let’s discuss who is accumulating gold and why it’s important for every portfolio.

Market Overview

Just a small 0.13% dip in Nifty today, confirming that yesterday’s rally wasn’t just an expiry play or a flash in the pan. Otherwise, we would have seen the gains wiped out today. So this momentum might be here to stay for now.

On a weekly basis, Nifty has closed at a new all-time high of 25,356. At this point, no one can complain about the market’s gains.

Nifty Next 50

Nifty Junior was flat today after making some early morning gains, which were lost by evening.

Nifty Mid and Small Cap

Midcaps gapped up and stayed higher, closing 0.65% up. Midcaps seem to be building on the cup and handle pattern we’ve been observing.

Small caps also gained 0.88%, closing at an all-time high. There’s no respite for bears in this market. Horror stories have been circulating about Thursday’s options sell-off. Those selling options for Rs.5 or Rs.10, hoping for last-day decay, saw months or years of profits wiped out when some calls skyrocketed from Rs.1 to Rs.200. Without proper risk management, disaster is inevitable.

Nifty Bank Overview

Bank Nifty has moved much above a pivotal point, forming another cup and handle pattern. This is a good sign for the overall market, with Bank Nifty up 0.32%

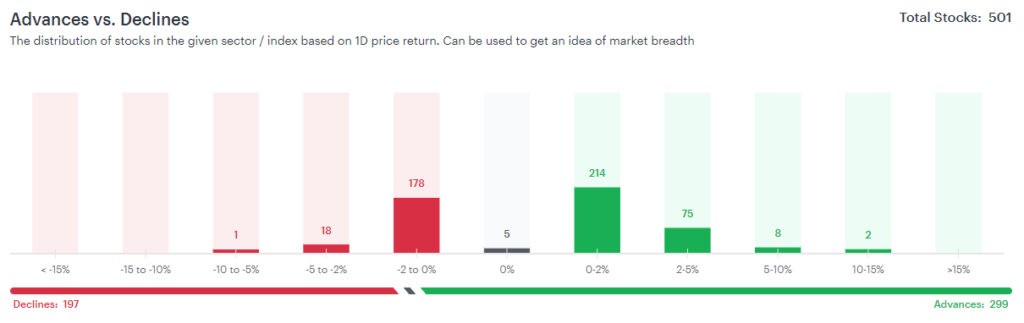

Advanced Declined Ratio Trends

The advances-to-declines ratio slightly favored advances, though not overwhelmingly. Given yesterday’s action, there’s nothing negative here.

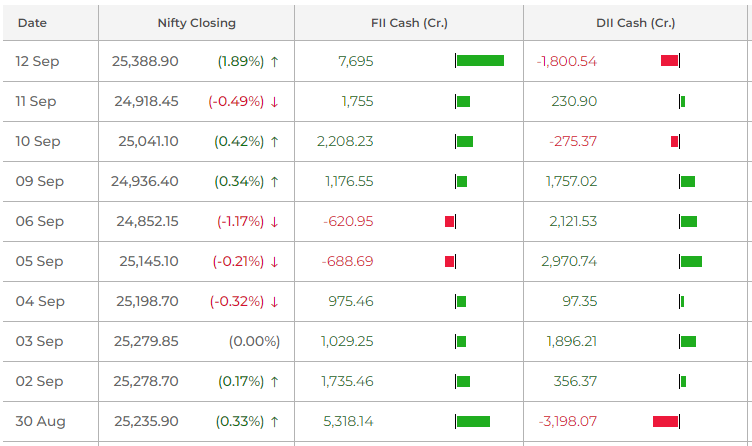

FII buying came in strong yesterday, at Rs.7,695 crore, with DIIs selling Rs.1,800 crore to them. Overall, institutional money continues to flow into the market, with FII numbers rising while DII numbers shrink a bit.

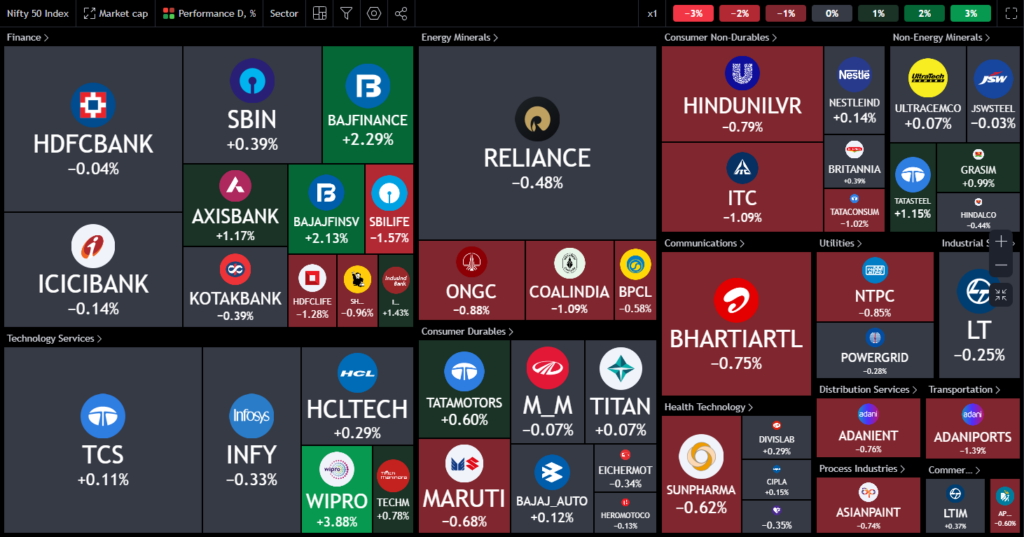

Nifty Heatmap

Bajaj Finance and Bajaj Finserv continued their climb, buoyed by the Bajaj Group IPO, which has attracted Rs.3.x lakh crore. Wipro was also up 3.88%. The rest of the Nifty remained relatively flat or slightly down. Axis Bank and State Bank made gains.

Looking at the Nifty Next 50 heat map:

Adani stocks saw losses after more Hindenburg claims surfaced. Zomato surprisingly dropped nearly 4%, which is unusual for such a strong stock. On the other hand, Vedanta, Jindal Steel, DLF, PNB, and Canara Bank made gains, signaling a strong comeback for real estate after a period of consolidation. Public sector enterprise stocks and banks lagged a bit this week, although some banks showed signs of recovery.

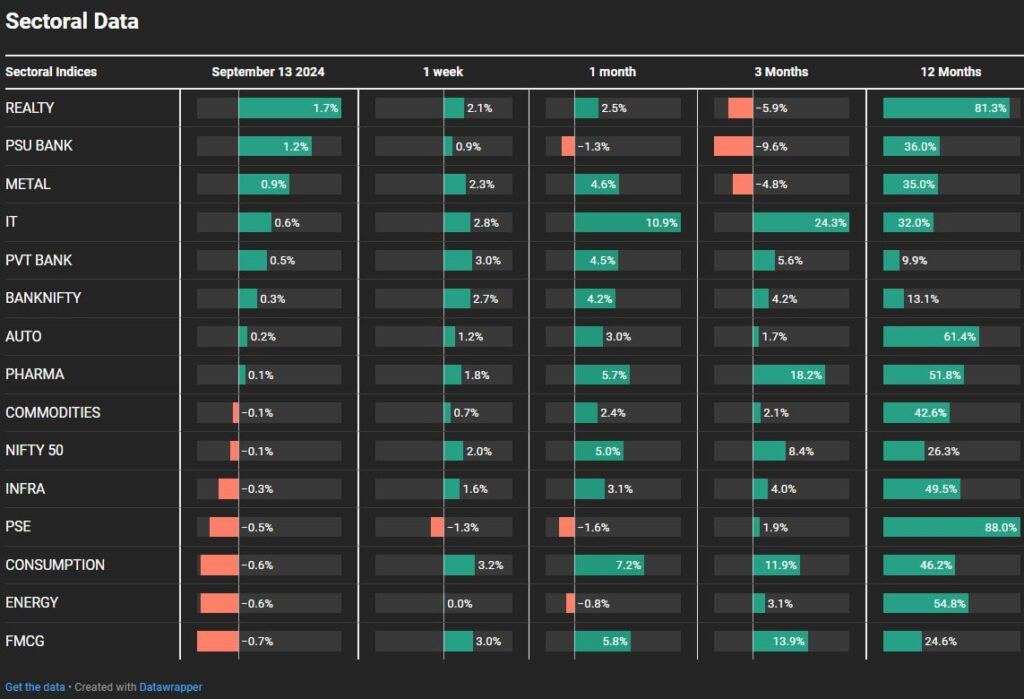

Sectoral Overview

Real estate led the gains, up 1.7%, erasing last month’s mediocre performance. It’s now up 10.9% for the month. PSU banks also wiped out their weekly losses. FMCG, energy, autos, pharma, and commodities took a back seat, while high-beta sectors like metals, real estate, and private banks were the primary movers.

Sectors of the Day

Nifty REALTY Index

Real estate saw a trendline breakout today, with DLF up 3%. Sunteck Realty, Macrotech Developers, Oberoi Realty, Godrej Properties, Sobha, Mahindra Lifespaces, and Brigade Enterprises all gained 1-2%.

Stocks of the Day

Jubilant Pharmova

In the spotlight today is Jindal Pharma, which rose 13.7%. Mid-cap pharma companies are emerging as dark horses in the market, after being stagnant for quite some time.

Story of the Day

Gold has reached new all-time highs in several currencies, including the dollar, euro, and INR. What does this mean? It indicates that the dollar is weakening, and gold, often seen as a contra to the US dollar, is being sought as a safe haven. Central banks, especially from Russia and China, are some of the largest buyers of gold. Interestingly, there are many under-the-radar transactions happening that we aren’t aware of.

The biggest buyers are from Asia—India, China, and Russia—with Saudi Arabia reportedly buying 160 tons of gold secretly. In contrast, European countries and the IMF have been selling gold.

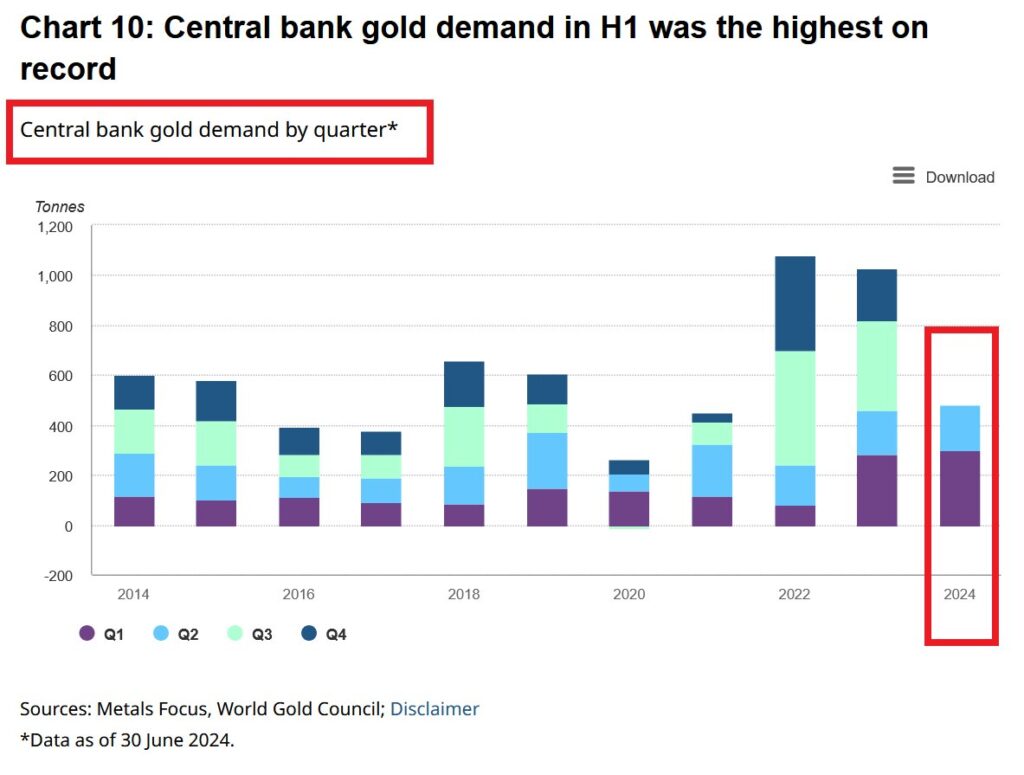

When you look at central bank gold demand over the last two years, Q1 and Q2 of 2023 and 2024 have shown phenomenal growth in demand, much higher than in previous years. With production at 3,000 tons and an additional 1,000 tons of demand coming from central banks, prices are bound to go up.

Here’s a fascinating chart from Peter Brandt, comparing gold to a basket of currencies (GBP, CHF, EUR). You’ll see that gold is breaking out versus these currencies. This suggests that gold’s upward movement is not just a reaction to the weakening dollar, but a global trend. We could see gold prices rise 10-20% from here.

Another interesting chart compares India’s money supply (M2) to gold prices. Over the last 20 years, gold has closely tracked the increase in the money supply. As the money supply grows exponentially, gold keeps pace, making it a hedge against the system’s excess liquidity.

For the last 50 years, gold’s CAGR in INR terms has been 11.75%, maybe closer to 12% now. Not only does gold compound at this rate, but it also acts as a hedge against other INR exposures—stocks, currency, real estate.

Now, this concept, the Exter’s Pyramid, is important to understand. While we’ve moved off the gold standard, gold is still the most solid asset in the central bank balance sheets. It can be repriced to improve balance sheets, much like revaluing goodwill or other intangibles in a company’s balance sheet. Gold sits at the base of the pyramid, supporting the entire system of derivatives, sovereign bonds, and other assets.

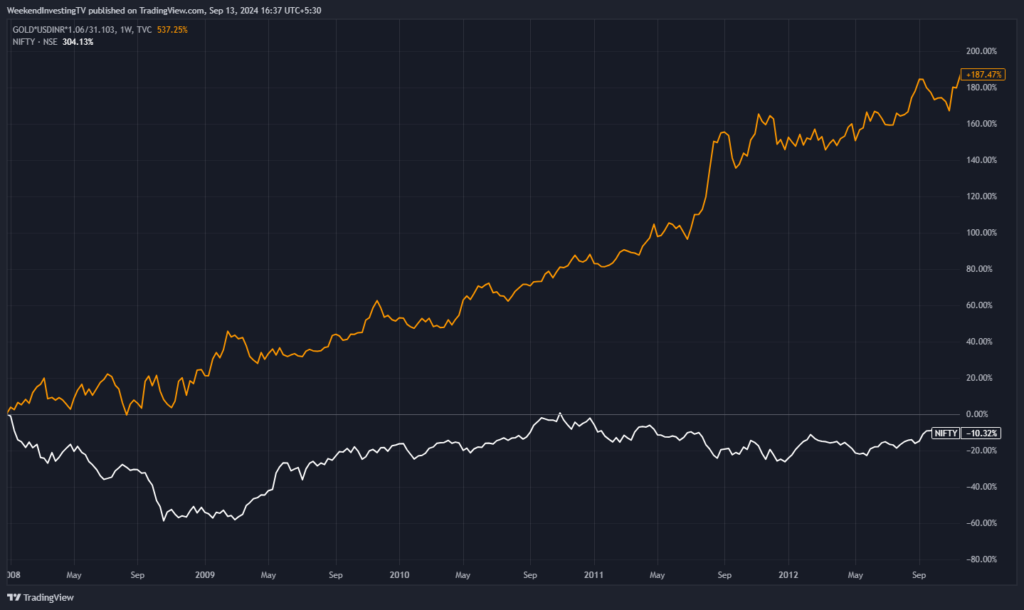

In India, during the 2008 financial crisis, while the Nifty crashed by 60%, gold rose. Over the next three to four years, while the Nifty did nothing, gold went up by 187%. During the COVID-19 crash, the Nifty struggled for two years, while gold increased by 73%.

So, how much gold should you own?

A simple rule of thumb: take your age and divide it by two—that’s the percentage of your net worth that should be in gold. You might think this is high, especially if you’re older, but it’s a good benchmark. However, consult your advisor for a more tailored approach.

In conclusion, gold is essential in today’s world of debt, inflation, and central banks running out of tools to manage economies. It’s the ultimate hedge. If interest rates are cut too aggressively, inflation will skyrocket; if rates rise, the economy will crash. You need gold as a hedge in this delicate balance.