ACC, Adani Energy, Adani Enterprise, Adani Green Energy, all Adani stocks are up. Specifically, after the fourth phase of polling, the market seems to be giving a thumbs up to whatever poll outcomes and exit polls estimation is there, which is a very, very good sign for the markets.

Market Outlook

Nifty, as seen on this chart, has successfully taken support and has moved up to 22,200. So now we are again just three odd percent from the all-time high. It is very much a case that this will go and retest the previous high.

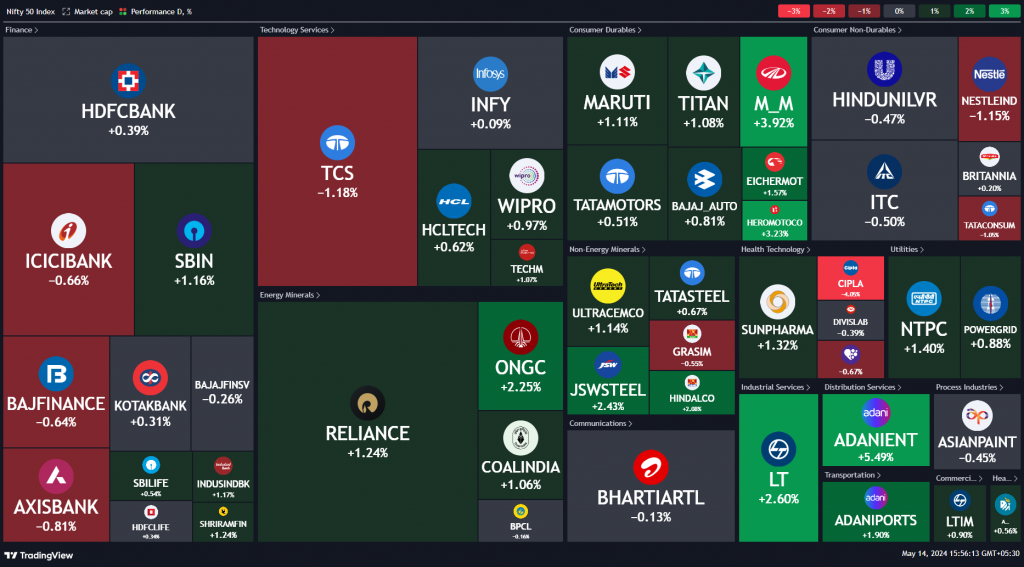

Nifty Heatmap

Nifty heat map is largely green. Not only Adani stocks went up, but also a lot of auto stocks, Reliance ONGC, Coal India, State Bank, NTPC, Sun Pharma, and a host of other stocks went up, some down. Cipla made moves after a good move yesterday. Nestle was down, TCS was down, ICICI bank was soft, and Axis bank was down. L&T also moved up.

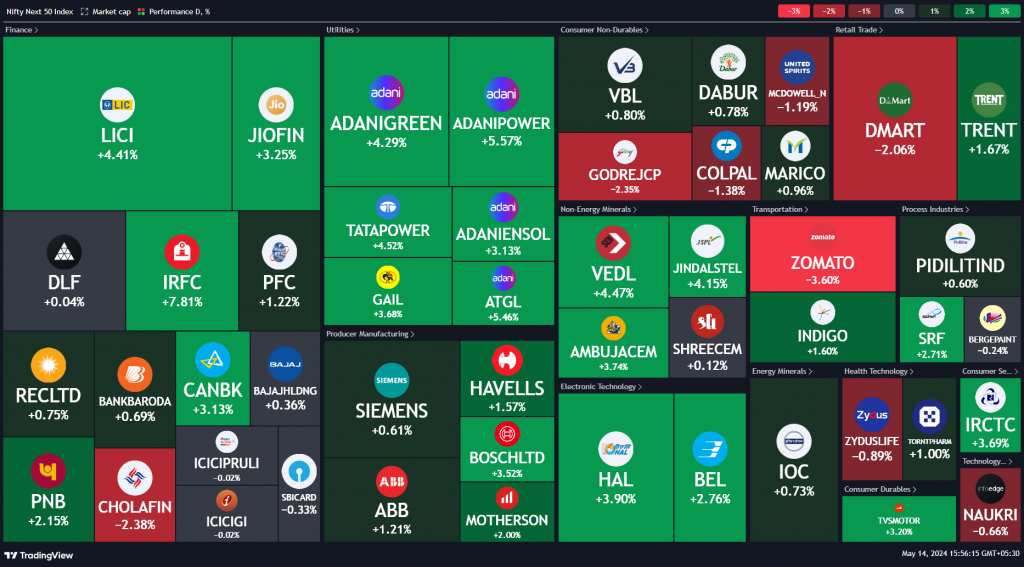

Nifty Next 50 heat map is looking more robust. There were fantastic movers like IRFC going up almost 8%, Adani stocks, LIC, GE Finance, HAL on big upgrade, BEL, TVS Motors, and IRCTC, all going up. Zomato down for the second day post the results. Dmart also down 2% and some selling in FMCG. FMCG was the weak link of the market today. CFMCG was right at the bottom of the pack at minus half a percent. Overall, in the last month, FMCG has moved up slightly.

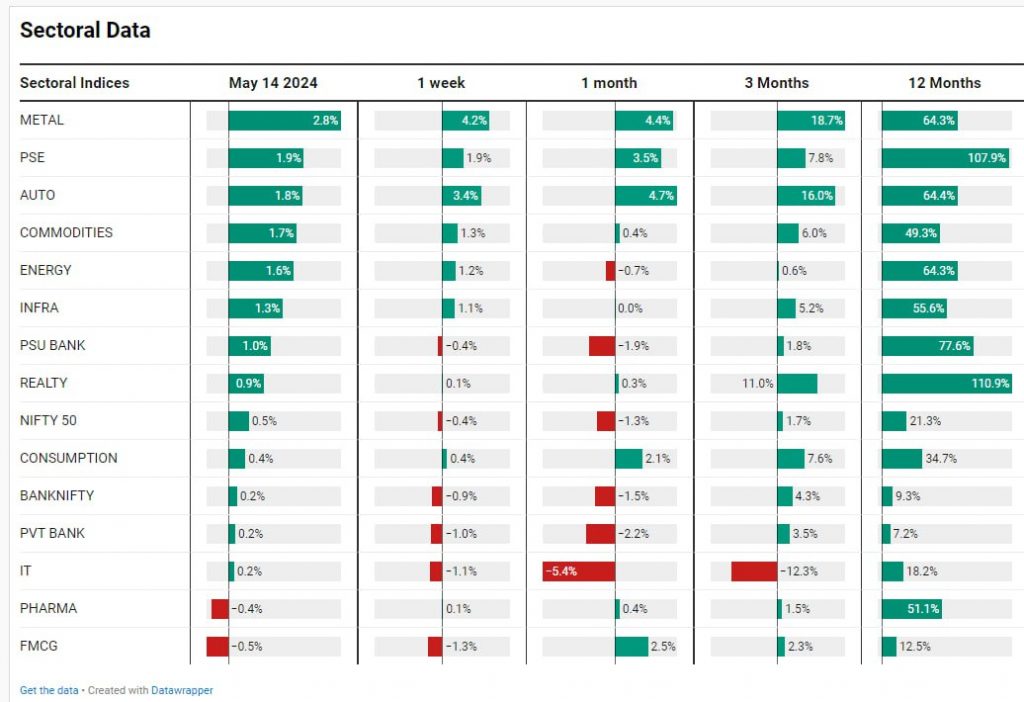

Sectoral Overview

FMCG was the weak link of the market today. CFMCG was right at the bottom of the pack at minus half a percent. Overall, in the last month, FMCG has moved up slightly.

So whenever the market moves into a defensive mode, it goes into FMCG, pharma, and whenever it moves out and goes towards risk-on kind of sectors or risk-on type of phase, then you will see these three sectors take a backseat, which exactly is happening. This is another very important indicator that the market has started running again. And my sense is that before election results are out, we will be at a new high.

Metals were up 2.8% in a single day, now up 4.2%, becoming the best performing sector for the week. Public sector enterprise stocks were up 1.9% for the week. Autos were up 1.8% today, up 3.4% for the week. These were the three major movers today. Commodities, energy, and infrastructure also moved, nullifying the previous losses. Some sectors are still in a loss for the week.

But overall, if you see in the past month, only IT stocks and private banks have not performed well. Nifty itself is down 1.3% over the past month, but autos, metals, and public sector enterprise stocks are gaining on a monthly basis. On a three-month basis, again, metals and autos are moving rapidly ahead, and real estate as well. Over twelve months, real estate has beaten all other sectors in this particular period.

Nifty Mid and Small Cap

Robust moves were seen with two long-legged candles regaining the breakout trend line and going up just about a couple of percentage points from new all-time highs, looking very strong. Small caps also showed two long-legged candles, with a hammer-like situation going up and closing near 15,300. The weakness is done for now, and only fresh downs can happen now. If there is any breaking news about election trends before the election results are out, which is another 20 days away, there will be more volatility for sure. But for now, for these few days going forward, I think a reasonable bottom has been made.

Nifty Bank Overview

Nifty Bank is also gradually recovering, although not as fast.

Nifty Next 50

Nifty Next 50, of course, is the best index going forward, looking very strong with no issues here.

Nifty FMCG Index

FMCG had bounced remarkably strongly when the market was falling. Now that the market is rising based on other sectors, FMCG is again taking a backseat. But nevertheless, it is beyond this congestion zone and hopefully, it will also join the rally soon.

Nifty Auto Index

Nifty Auto Index closed at an all-time new high, which is just simply amazing that Nifty is still away from its all-time highs, but Nifty Auto Index is leading the markets to a new high.

Nifty PSE Index

Nifty Public Sector Enterprise Index also has this breakout line, has hovered around it for the last two, three sessions, and now, taken support and wanting to go up also. So always look at a lot of trend lines, a lot of support lines. A lot of times, they do make a lot of meaning.

Nifty Metal Index

Nifty Metals Index also moved up very sharply in two days, from nearly 8800 bottom yesterday to nearly 93,400 today, almost 5% kind of moves in two days on this metal index.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz