Market Outlook

Today, the Nifty took a significant dip in the morning, falling nearly 1%, before staging a partial recovery, surpassing its early highs, except for the Bank Nifty. Initially, it seemed the market might contain some of its losses, but a wave of selling in the second half led to a close below the critical pivot point of 22,300, indicating short-term chart damage despite news that Israel is not counterattacking.

This movement stems from a war-like situation and declines in the US markets, highlighting that markets often just need an excuse to fall, regardless of the actual events.

Nifty Heatmap

The Nifty and several other indices endured losses, signaling short-term market weakness. The heat map was overwhelmingly red, with only ONGC bucking the trend with a 5.3% rise. Major banks and tech firms like HDFC Bank, ICICI Bank, TCS, and Infosys were down, with no significant safe havens as most sectors saw declines. Reliance was flat, while some steel, power, utility, and pharma stocks experienced marginal losses or remained steady.

However, some stocks like Nestle, Maruti, and Aditya Birla Hindalco managed gains. The Nifty Next 50 fared worse, amplifying the broader market’s decline with sharp falls in stocks like DLF, IRFC, and Adani Green among others. Public sector stocks like GAIL and Hindustan Aeronautics were somewhat spared, though others like PFC, Bank of Baroda, and REC faced significant drops, with no sector fully escaping the sell-off. Energy and public sector enterprise stocks were least affected but still closed down about 1%.

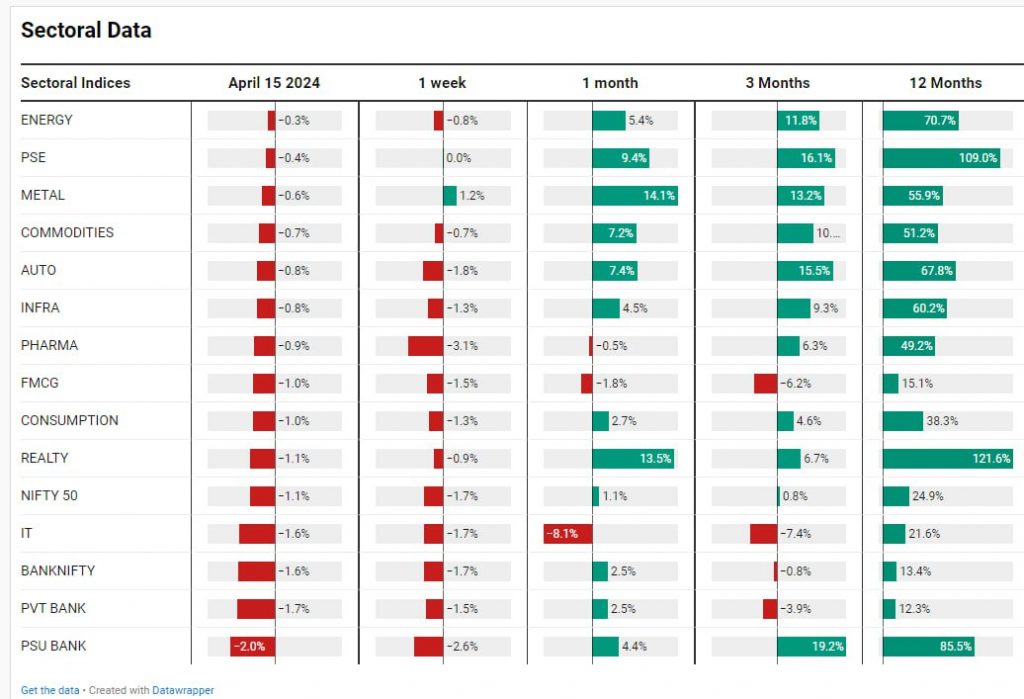

Sectoral Overview

Energy and public sector enterprise stocks were the least hit, but everything was got, was hit about 1% or nearabouts there. Nifty itself closing 1.1%. So a significant sort of loss of confidence in the market suddenly mid caps gapped down, but recovered from where they had reached in the morning and closed at not so bad situation. Although this, this rally that had come was due for some, for some correction

Mid & Small Cap Performance

Mid caps initially gapped down but recovered to close in a not-so-bad state, although a correction was overdue. Small caps also experienced a frightening start, dropping from 15,300 to 14,800, but they managed to climb back above 15,000. Both mid and small caps retained their intraday gains, despite some damage.

Nifty Bank Overview

The Nifty Bank’s chart looks unfavorable, failing to sustain a breakout from a few days ago, now likely seeking support around 47,000, hinting at possible further declines.

Nifty Next 50

The Nifty Next 50 gapped down and remained low, although this index had been performing well and could afford some losses. It, along with the Bank Nifty, is expected to lead any potential market recovery.

Nifty PSU Bank

The PSU Bank index also showed some weakness, potentially indicating distribution, though it’s premature to conclude firmly.

Nifty IT Index

IT index, including Infosys, broke major support and closed at a precarious point, indicating potential for sharper declines.

Infosys

Infosys, in particular, disappointed as it broke support levels, hinting at a move towards further declines, with a possible head and shoulders pattern suggesting a deeper drop.

Nifty Oil & Gas Index

The Nifty Oil and Gas index was one of the few sectoral indices to close in the green, largely thanks to ONGC’s 4-5% gain, keeping it near its all-time high, which is a positive sign

Today was not an encouraging day in the markets, which often move in a pattern of advancing and retreating. It’s essential to view this in the context of the recent market rise and adjust our expectations accordingly. While it’s not conclusive that the market has topped or is on a downtrend, it appears to be taking a breather. We’ll watch for where it consolidates and turns around.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz