Market Outlook

The markets have continued their downtrend for the third consecutive day. Unlike the previous sessions, today’s market did not drop further after opening, which is a relatively better scenario. We are nearing channel support, and while a drop of about 600 to 700 points has been a common occurrence over the last three to four months, the persistent concern is the potential breach of this channel, signaling a new downturn.

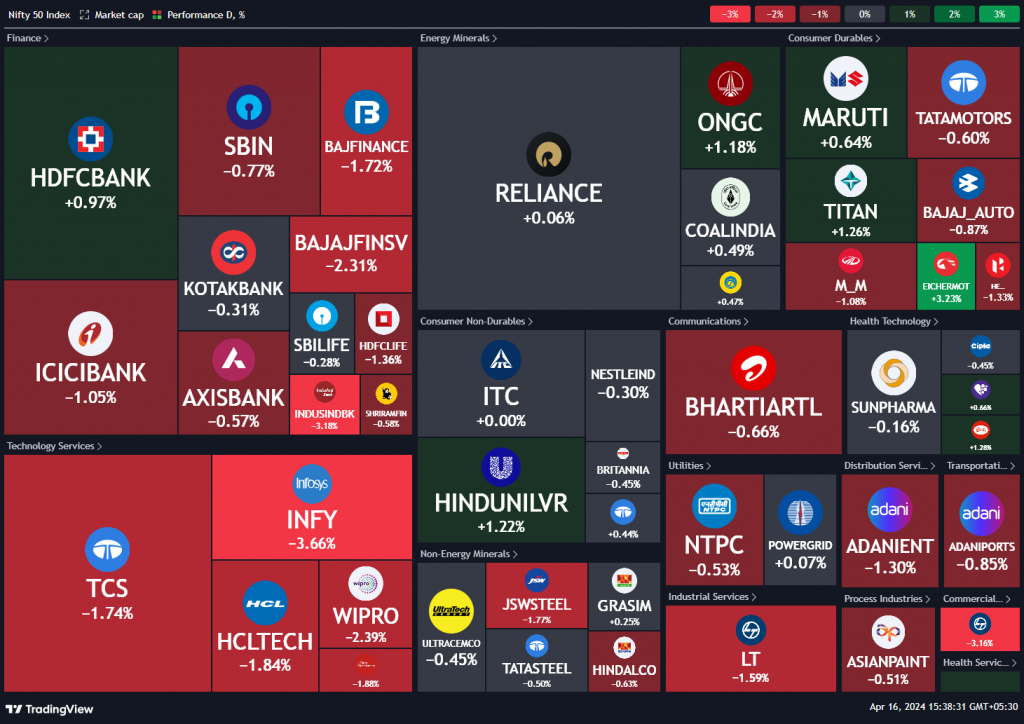

Nifty Heatmap

The Nifty heat map was predominantly red, suggesting that while the broader market held up better, Nifty stocks bore the brunt of the losses. Infosys, a major Nifty constituent, fell by 3.6%, followed by TCS at 1.7%, and L&T at 1.6%. Other significant declines were seen in ICICI Bank at 1%, Axis Bank at 0.5%, and State Bank at 0.7%. The Nifty Next 50 showed more resilience, with fewer declines, particularly among public sector banks and finance companies.

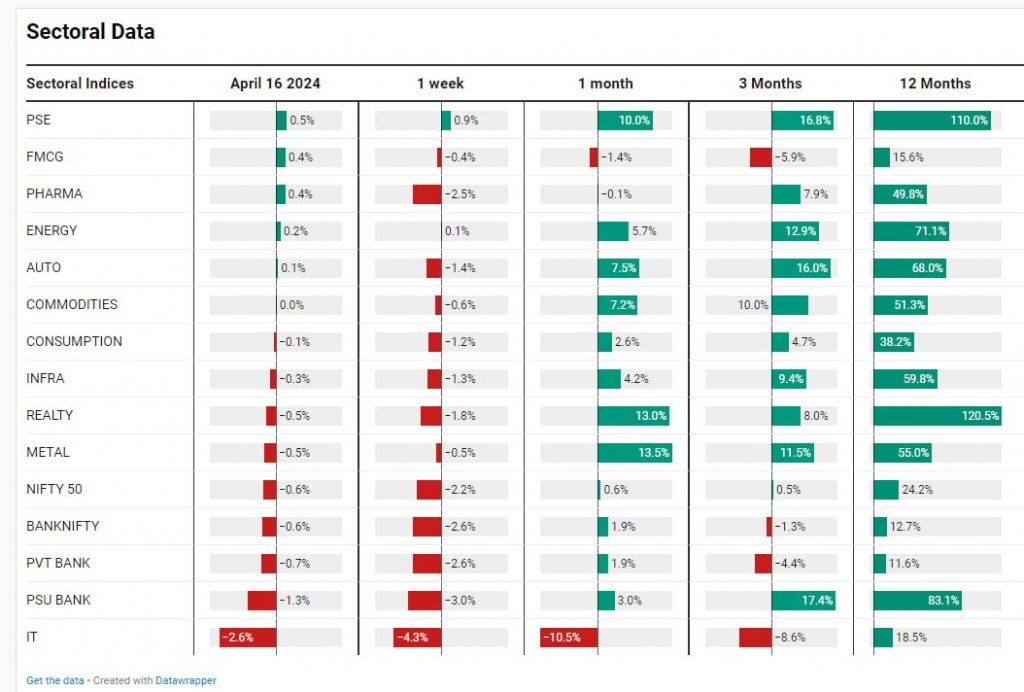

Sectoral Overview

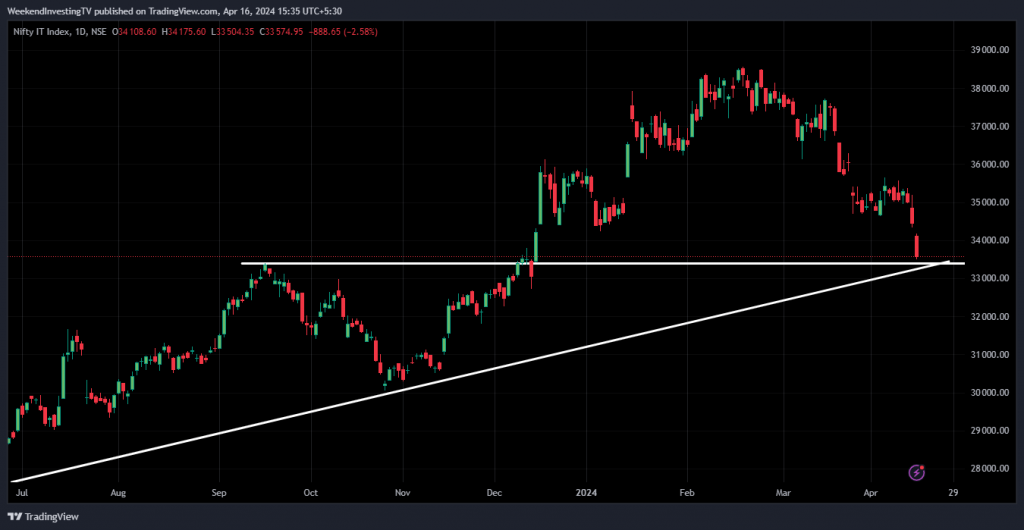

Sector-wise, public sector enterprises, FMCG, and pharma helped stabilize the market, along with the energy sector which remained flat. However, the IT sector led the downturn with a substantial cut of 2.6% on the day, totaling a 4.3% loss for the week and 10.5% for the month, marking significant recent declines. Public sector banks also saw a 3% drop this week, with private banking sectors losing 2.6% and metals along with real estate and infrastructure sectors also experiencing losses.

Mid & Small Cap Performance

Mid caps showed some stability, operating within the range of the previous day, which was a relatively positive sign compared to the larger Nifty stocks. Small caps even posted gains over yesterday, which was another positive indicator against the backdrop of larger cap struggles.

Nifty Bank Overview

Nifty Bank continued to lose ground, with another down day and a gap down, suggesting that it may need some time to consolidate and restart.

Nifty Next 50

The Nifty Next 50 closed very close to where it was yesterday, so no significant damage was done there.

US Government Bonds

The main concern driving the market appears to be the rising global yields, particularly the US ten-year yields. The prospect of interest rate cuts has diminished significantly from earlier expectations of five or six cuts this year to just two now, with uncertainty even around those. Rising yields typically put pressure on the Nifty and emerging markets, as seen from the historical correlation where Nifty struggled during periods of rising yields and gained momentum when they fell.

Nifty IT Index

The IT sector remains in a poor state with a potential approach towards trend line support from below.

Nifty PSU Bank Index

Nifty PSU Banks have shown consolidation

Nifty Oil and Gas Index

The Oil and Gas index has actually moved up, indicating that it might lead the next upward movement when market conditions stabilize.

Nifty FMCG Index

FMCG is doing relatively better, showing signs of consolidation

Disclaimers and disclosures : https://tinyurl.com/2763eyaz