Market Outlook

The day began with a substantial gap down in the markets, followed by a surprising rebound in the second half. Despite initial pessimism, the market managed to close at the same level as two days prior, indicating resilience.

The sudden recovery suggests that the initial market dip may have been a one-off event, possibly related to geopolitical tensions. Weak hands seem to have exited the market, restoring confidence and bringing it back to its original state.

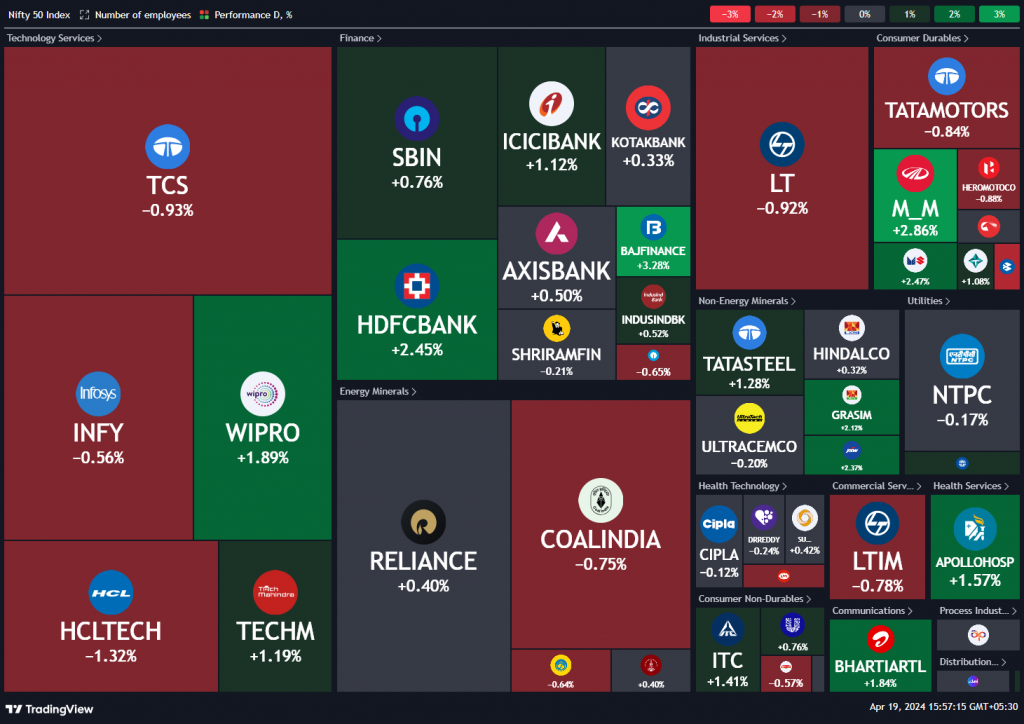

Nifty Heatmap

You can see HDFC bank led the Nifty along with Bajaj finance, Mahindra & Mahindra, Wipro and more than all these stocks, Infosys was barely down only half a percent. And just one day back there was a lot of talk about Infosys losing a lot of ground because of the results, etcetera. But that something has not played out.

Bharti, Airtel, Apollo Hospital, Maruti all doing very well today. State bank of India coming back, ICICI bank coming back. So I think very good signals from the market. LIC, Dmart, Trent, Zomato, HAL, Bel, Jindal Steel were the ones running in Nifty next 50 camp. Jio finance was down, ICICI Pruli was down, ICICI General Insurance was down. Pidilit, Indigo, IOC, PNB, some of them are down.

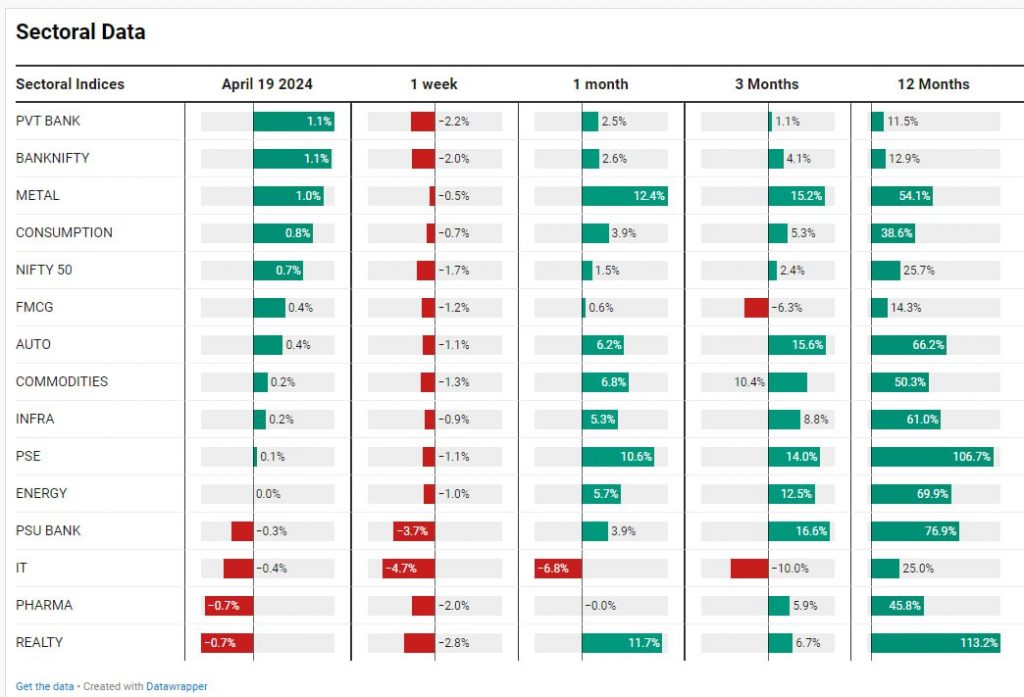

Sectoral Overview

Distribution real estate down 0.7% only, pharma down 0.7% IIT 0.4%.. These were the three sectors along with PSU banks, four sectors which were down. But you had very nice gains in private banking thanks to HDFC bank. You had very good gains in metals consumption stocks. FMCG autos were doing well, so some recovery in these sectors, but PSU banks, IT and pharma reality were lagging

Mid & Small Cap Performance

mid caps took the plunge this morning, but came back mostly, I would say, although it did not come back fully to where they were yesterday. So we’ve already lost nearly more than about 1000 points from the recent top to today’s bottom. So that has been a significant correction. Unless we are now falling into this downtrend, that’s a different matter. But it does seem like that the market is trying to catch up back towards the upper end.

Small caps showing the same thing the last three sessions. Small caps have not moved in terms of the closing price. They have moved all over the place intraday, but not moved in closing price and I think if small caps now cross this high. I think this correction that happened in March and this shake off that is happening now is a good setup for a long market going forward.

Nifty Bank Overview

Forward Nifty bank also a large candle today did not come down to the support here, but a large candle closing at two days high. So a good signal here as well. I think in the next week we could see again the recent highs getting challenged

Nifty Next 50

Nifty next Nifty also last four sessions have closed within a few points here or there. That also shows a good resilience on Nifty next 50 front.

Nifty Metal

Metals index of course is very, very strong with just 100 points from all time high. So metal index is probably where if you’re looking for discretionary trades, should look for those in metals.

Nifty FMCG Index

FMCG index also breaking down but closing higher. So in all fronts, the charts are looking like, you know, they have made some sort of an interim bottom and come back up.

Nifty IT Index

Nifty IT index, which had broken down in the morning and then I had earlier, I think a day or two back, also mentioned that this is a very crucial support here, has managed to crawl back into that support zone and stayed there. So maybe Nifty IT index also may have than the bottom

Disclaimers and disclosures : https://tinyurl.com/2763eyaz