Story of the Day

$5 trillion Surge

Another day, another bump up in the markets with small caps doing much better than large caps. The topic of the day is cashing in on India’s $5 trillion surge. If you haven’t noticed, India’s market cap of all listed entities has crossed the $5 trillion mark, up from less than a trillion just ten years back. We’ve been growing at a phenomenal pace, with the last couple of trillion added very quickly, which we’ll discuss later in the session.

Market Overview

Regarding market direction, the Nifty crawled up 0.39%, continuing the upward trend of the last five to six sessions. Today was another day of gradual gains, with the difference being that we maintained the gains until the end. It was a gap-up and a slight continuation on the higher side. The gains on Nifty were not strong, but credit is due to the bulls for maintaining this trajectory, effectively sending the bears into hibernation for now.

Nifty Next 50

Nifty Junior continues to outperform the Nifty significantly, up 0.63% today, indicating a strong trend above the breakout point.

Nifty Mid and Small Cap

Mid-caps also rose by half a percent. Although the move wasn’t substantial, the consistency over the last six to seven days has been phenomenal. Typically, after such consistent moves, a harsh correction day might occur, so one needs to be mentally prepared. Small caps had another gap-up, going nearly 1% up. On the election result day, small caps were around 14,100 and are now around 17,000, a gain of almost 3000 points or more than 20% in less than two weeks, surpassing many expectations.

Nifty Bank Overview

Bank Nifty also performed well, consolidating at 50,000 and suddenly moving to 50,500. Private banks did particularly well today, making the move on Bank Nifty appear highly confident.

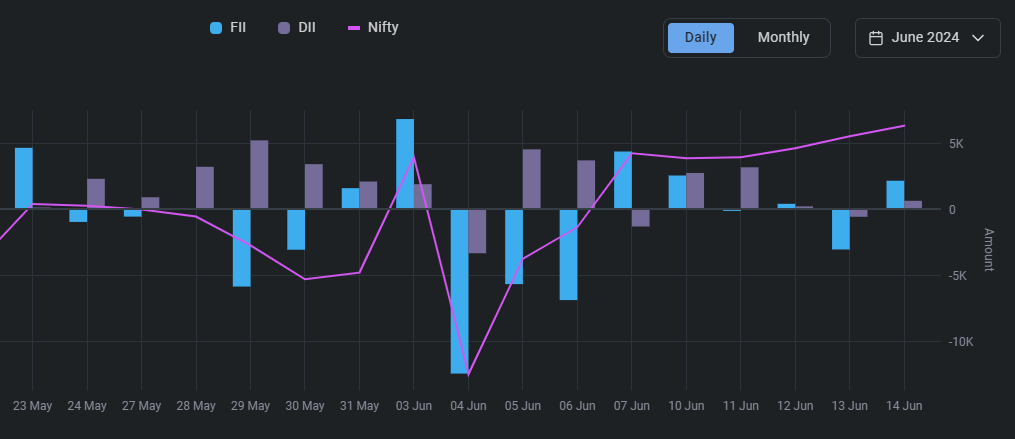

FIIS and DIIS

FII buying was strong in the previous session, with 2000 crores of buying after almost a week, and DII also buying. This indicates enough buying activity in the market and a lack of urgency for FIIs to sell, unlike earlier.

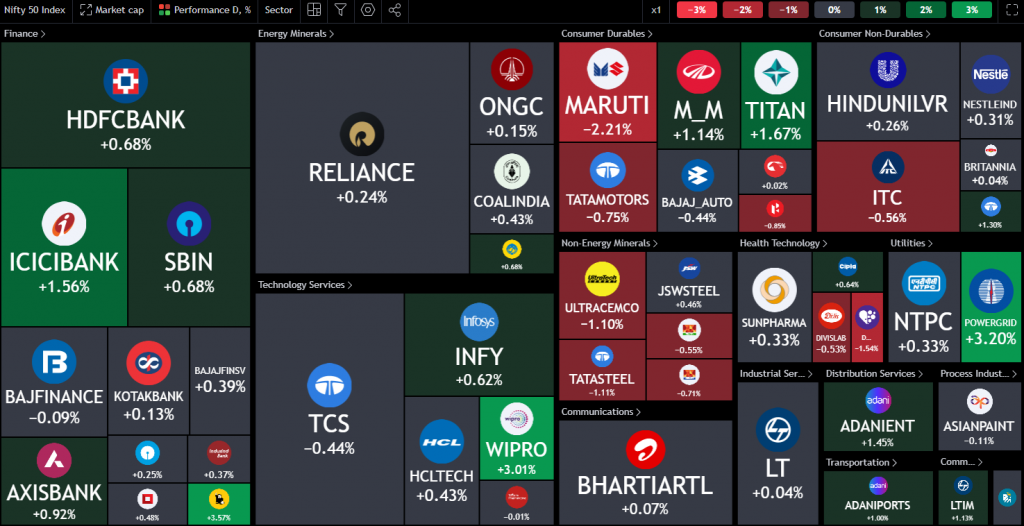

Nifty Heatmap

The heat map showed a mixed bag, with ICICI Bank, Axis Bank, and HDFC Bank all moving up. Private banking and some PSU banks also moved up, along with Infosys and Wipro in the IT sector. Meanwhile, stocks like Power Grid and Titan also gained, while Maruti and Tata Motors, along with FMCG, cement, and steel, gave up some ground.

In the Nifty Next 50, significant gains were seen in HAL, BEL, Geo Finance, Bosch India, Mother Son, Dmart, and Trent. Losers included ABB, Siemens, Zydus Life, and LIC. Some public sector stocks defied gravity, and while some may appear overstretched, momentum investors will continue to hold as long as the momentum persists.

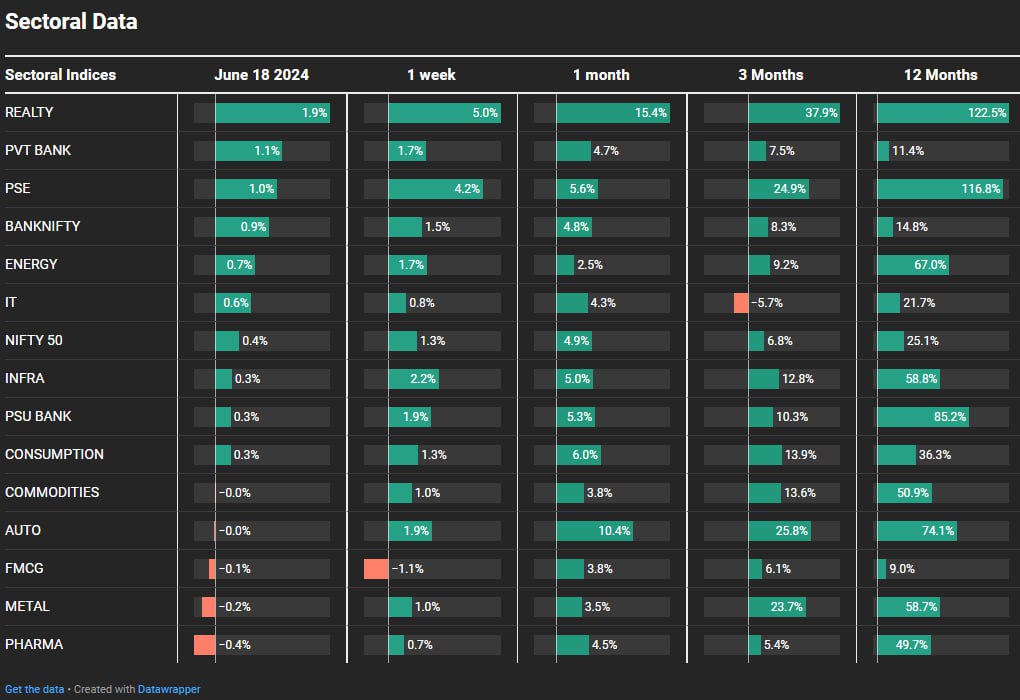

Sectoral Overview

Real estate once again proved to be the best performer, up 1.9% for the past week, 5% for the month, and 15% for three months, making it the top-ranking mover for various time frames. Despite skepticism at every stage, real estate stocks have continued to perform well, demonstrating the importance of allowing market prices to guide buying and selling decisions.

Public sector enterprise stocks also performed well, up 1% for the week, 4.2% for the month, and nearly 25% for three months, with a 117% gain over twelve months. Many investors gave up on these stocks at earlier levels, but they have continued to perform well, highlighting the need for a framework for entering and exiting stocks.

Autos, FMCG, metals, and pharma took a backseat today but are not down and out. Metals and autos, along with pharma, are still performing well, though FMCG has shown some weakness. Private banking, which performed well today, and FMCG have been laggards for the past year, affecting portfolios heavily invested in these sectors. Sector selection and automatic sector rotation are essential for a successful strategy.

Sectors of the Day

Nifty Realty Index

Real estate, as mentioned, is performing extremely well, with a significant gain since the election results, moving from 900 to 1150, up 20%. On a long-term basis, the real estate index has shown consistent higher lows and higher bottoms, indicating a strong trend.

Nifty Private Bank Index

The Nifty Private Bank Index did well today, despite HDFC Bank not performing as strongly. ICICI Bank and Axis Bank are leading in this space. Over the long term, the index has been slow since 2021 and range-bound for the past year.

Stocks of the Day

Cochin Shipyard

Cochin Shipyard was up 9.3% today, hitting a new all-time high. This stock has had an amazing run from Rs 230 to Rs 2300, highlighting the importance of having a strategy to sustain through such runs, possibly using trailing exits or moving averages. Many conventional portfolios miss out on such stocks due to fear of rising prices.

Gold Chart

Gold was flat today, down 0.37%, consolidating over the past few months. If it doesn’t break the bottom around Rs 70,000, a breakout above Rs 75,000 could lead to a rise to Rs 85,000 or Rs 90,000, making the rest of the year potentially very positive for gold.

Regarding India’s $5 trillion market cap, this chart from Bloomberg shows the significant growth from $1 trillion in 2007, fluctuating around $1 to $2 trillion until 2016-17. The breakout from this range led to consistent growth, with a sharp rise from $1.2 trillion in March 2020 to nearly $5 trillion in just four years. This rapid growth highlights the potential for continued market expansion.