Market Outlook

March is proving to be a challenging month, with Nifty showing indecision through consecutive inside bars, signaling a very indecisive market. The last few sessions have seen Thursday’s trading within Wednesday’s range, and this pattern continued with Friday and today, highlighting the market’s uncertainty about its next direction. This week is particularly data-heavy, with the Federal Reserve meeting on Wednesday night, which could introduce significant volatility on Thursday.

There’s speculation about a potential head and shoulders pattern forming on the hourly timeframe, which, if realized, could lead to a significant drop of about 600 points. Stability might only be reassured if the market surpasses Thursday’s high of 22,200, but as of now, it’s a toss-up regarding the market’s next move. However, it’s essential to remember that the strategies and the market will unfold in their own ways, independent of our speculations.

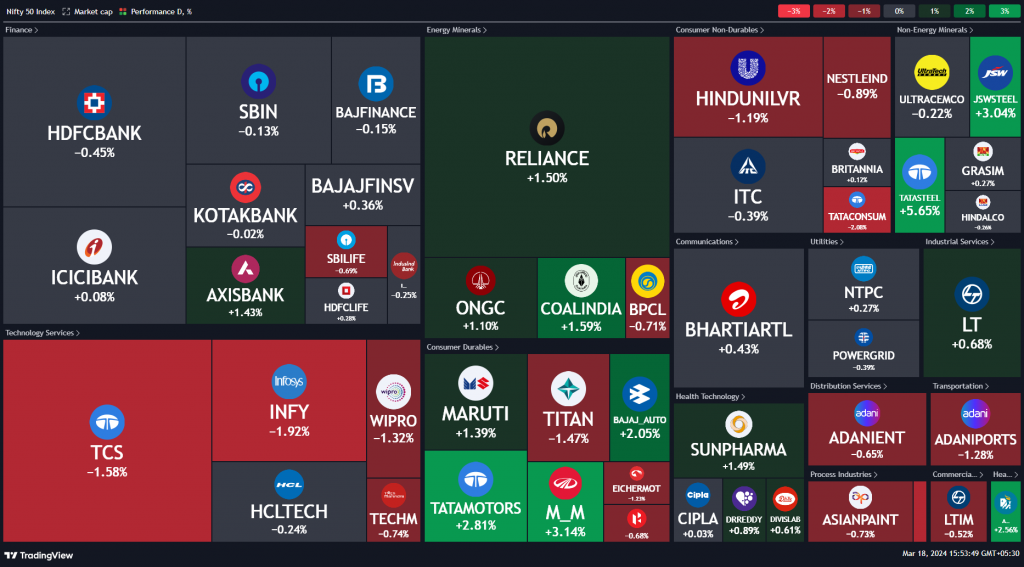

Nifty Heatmap

Looking at the broader picture, there’s no immediate cause for concern. We’re only a few percentages off from all-time highs, and even if deeper cuts occur in the coming weeks, a recovery in April leading up to the elections is anticipated. With election results now expected on June 4, the coming months might be choppy with speculative rumors, but a significant upward movement is expected.

Considering the sharp declines last week, today’s recovery, albeit modest, doesn’t rule out the possibility of further cuts. Short-term players should be cautious and monitor their stop-loss levels, while medium to long-term investors should trust their strategies to navigate through these fluctuations. History shows that markets recover, and liquidity often returns to support growth, even after short-term disturbances.

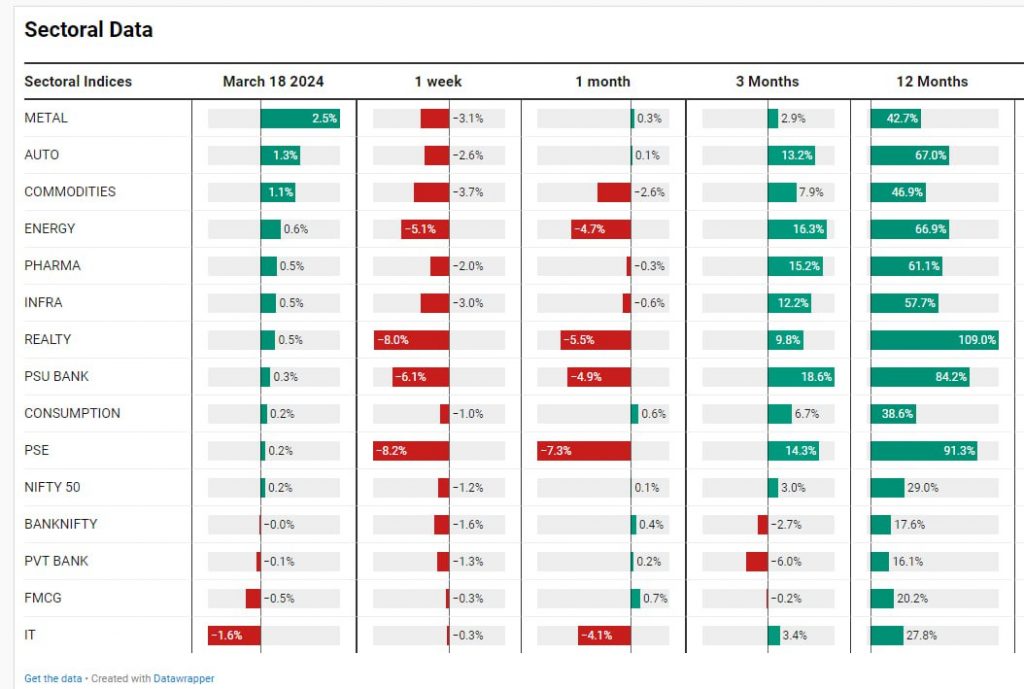

Sectoral Overview

Today, the auto and steel sectors showed notable strength, with companies like Tata Motors, Mahindra & Mahindra, Bajaj Auto, Tata Steel, and JSW Steel making significant gains. Conversely, the IT and FMCG sectors faced downturns, with key players in these industries seeing declines. The energy and infrastructure sectors, however, displayed resilience, adding some positivity to the market mix.

The modest recovery observed today does little to eliminate the possibility of further declines. Short-term traders should remain vigilant with their stop-loss strategies, while medium to long-term investors might do well to trust in their strategies’ ability to weather these fluctuations. Historical trends suggest that the market’s liquidity often ensures recovery from such disturbances.

Mid & Small Cap Performance

Mid and small-cap indices indicate a wait-and-see approach, with recent sessions not capitalizing on bounces and remaining flat. However, any significant corrections are seen as part of the market’s natural ebb and flow, especially following substantial gains in the past year.

Nifty Bank Overview

Nifty Bank’s recovery today is a positive sign, indicating that if the banking sector remains strong, it could support the overall market’s health. However, with the Federal Reserve’s meeting and the potential impact of global interest rate decisions looming, market volatility is expected to continue. Japan’s interest rate adjustments, after many years, add another layer of complexity to global financial markets and their interconnections with liquidity and investment flows.

Sector Highlights

Despite today’s mixed market movements, the metal sector stands out for its resilience, nearly recovering from the previous session’s fall. This could indicate a sector poised for further growth amidst the market’s broader uncertainties.

Sector Highlights

Nifty IT index has given up the gains it had made in the last two sessions. So Nifty IT index also looking for a right shoulder here below this 36,000 odd levels. I think Nifty IT will get clobbered very badly, but let’s hope it doesn’t go there.

If you have any questions, please write to support@weekendinvesting.com