Market Outlook

The market was significantly down today, closing below a head and shoulders pattern that predicts a potential decline of about 600 points. The future direction may hinge on the Federal Reserve’s announcement this Wednesday night

Nifty Heatmap

currently, the market sentiment is negative, with an all-red heatmap highlighting the day’s losses. TCS, influenced by Tata Sons’ sale at a discount, led the downturn with a 4% drop. The IT sector, including Infosys, Wipro, and HCL Tech, showed significant weaknesses, alongside FMCG and Pharma sectors, with notable companies like ITC, Levers, Nestle, Britannia, and Tata Consumers also down.

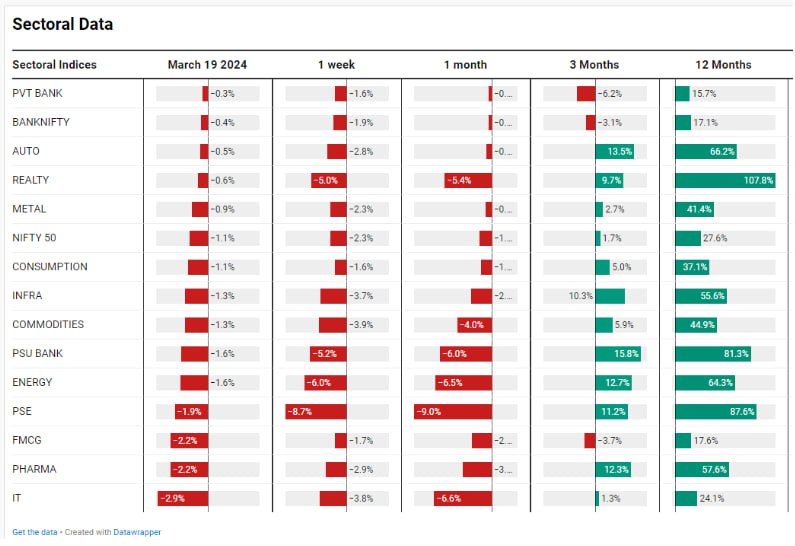

Sectoral Overview

Today’s performance across various sectors like Pharma, with Cipla and Dr. Reddy’s losing around 3%, and key players in Banking and Infrastructure experiencing declines, paints a grim picture. The only outlier was HDFC Bank, which remained stable. The IT sector faced the most considerable losses, with a 2.9% decline, while Pharma, FMCG, and Public Sector Enterprises also suffered around a 2% loss.

This week’s outlook is pessimistic, especially considering the last month and the last three months have started to turn red. Despite some sectors like Private Banking and FMCG showing positive signs over a three-month and twelve-month view, the overall market is bracing for potentially more downside.

Mid & Small Cap Performance

Mid caps, after a brief bounce, faced resistance at previous support levels and didn’t manage to break the downward trend. Small caps also showed a similar pattern, with the last two sessions unable to surpass the two-day high, suggesting a possibility for further declines.

Nifty Bank Overview

. Nifty Bank and Nifty Next 50 have struggled to find direction, with failed attempts to rally, indicating broader market pressure.

Sector Highlights

The IT index is particularly concerning, with a clear head and shoulders pattern indicating a substantial possible drop. Other sectors like FMCG are breaking down, signaling bad times as FMCG is typically a reliable sector in downturns. Public Sector Enterprises and the Real Estate index are also showing signs of weakness, with broken structures and the need to find new support levels.

The upcoming Federal Reserve meeting and Japan’s recent interest rate hike have set a cautious tone for the market, suggesting no imminent rate cuts. The market anticipates a dull period ahead, coinciding with the year’s end and a short trading week next week due to holidays.

For new market participants, the advice is to take it slow and avoid lump-sum investments during this volatile period. Long-term investors should remember that market cycles include periods of gain and retraction. Despite current losses, the medium to long-term outlook remains optimistic, with anticipation of a rally leading up to the elections, although this is speculative.

If you have any questions, please write to support@weekendinvesting.com