Market Outlook

Today’s market experienced a day of consolidation, with the Nifty retesting its previous high and now consolidating near these highs, indicating a potential breakout ahead.

Nifty Heatmap

Despite a reasonably red heat map, with banks like Kotak Bank, ICICI Bank, and Axis Bank seeing declines, HDFC Bank was up for a second day, showing surprising strength within its group. Technology stocks such as Infosys, TCS, HCL Tech, and Wipro were down, reflecting a concerning trend for the IT sector. Conversely, the auto sector showed resilience with Bajaj Auto, Mahindra & Mahindra, and Tata Motors performing well. There were sporadic gains in other sectors like Adani Ports, NTPC, and Tata Consumers, with the Nifty Next 50 heat map displaying more green, indicating a varied performance across the market.

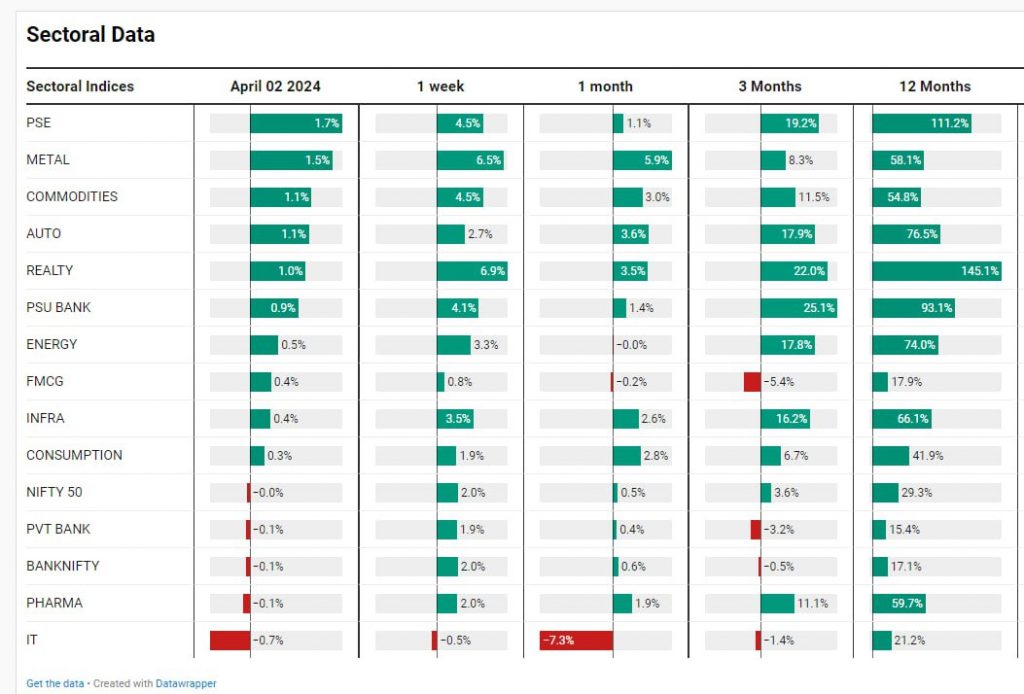

Sectoral Overview

Sector-wise, public sector enterprise stocks led with a 1.7% increase, closely followed by metals, real estate, autos, and commodities. Despite this, IT stocks faced a significant downturn, shedding 7.3% this week, largely influenced by global trends in the US IT sector.

Mid & Small Cap Performance

Mid-cap indexes have hit a new all-time high, showcasing one of the brightest spots in the market. Small caps are also making a strong comeback, now within striking distance of their all-time high, erasing past weaknesses.

Nifty Bank Overview

Bank Nifty has remained somewhat stagnant, though its stability is seen as a positive sign.

Nifty Next 50

The Nifty Next 50 index continues to lead the market, achieving new highs and showing rapid growth.

Nifty PSE Index

Nifty public sector enterprise stocks also coming back. So all the stocks, whether it is Hal, whether it is BFC, all these stocks are coming back which were kind of written off from, from last week back.

Nifty Metal

The metal index’s sharp rally and public sector enterprise stocks’ resurgence paint a picture of a market bracing for the upcoming election season.

Nifty IT Index

The IT index presents a concern with a potential for significant damage if it breaks its current consolidation pattern.

The expectation is that we may hit a market top as the election begins, with daily news and exit polls influencing market movements. However, the current trend suggests the market has already factored in the election outcomes, with only deviations from these expectations posing a risk to the trend.