Market Outlook

Nifty was up pretty much near where it had reached on Tuesday or Monday rather, and it was just a stone’s throw away from the new high. However, there seemed to be some tentativeness at this level every time. In the last two sessions, Nifty tried to go to 22,700 but was beaten back down. It seems that being near the all-time high brings resistance. Once it is cleared, it may fly again more easily.

Nifty Heatmap

On the other hand, Kotak bank was again thrashed, losing 3%. There is news of management changes, with the CEO departing, and BPCL along with power grid. All these public sector enterprise stocks were going up significantly. It seems there’s new liquidity continuing to pour into these stocks. Additionally, autos like Tata Motors and Bajaj Auto did quite well, along with Asian Paints, which saw a 3.5% gain after a long time.

Other stocks saw more muted gains, including Tata Steel, Grasim, Sun Pharma, ITC, and TCS. However, Axis bank lost some ground and ICCI bank lost about 1%, despite the rumor of management changes being denied.

The Nifty Next 50 heat map showed a different picture from the Nifty heat map. REC was up 9%, showcasing the strength of a utility power finance company. This highlights the importance of riding along with momentum, as demonstrated by the continued gains in various stocks despite baffling market behavior.

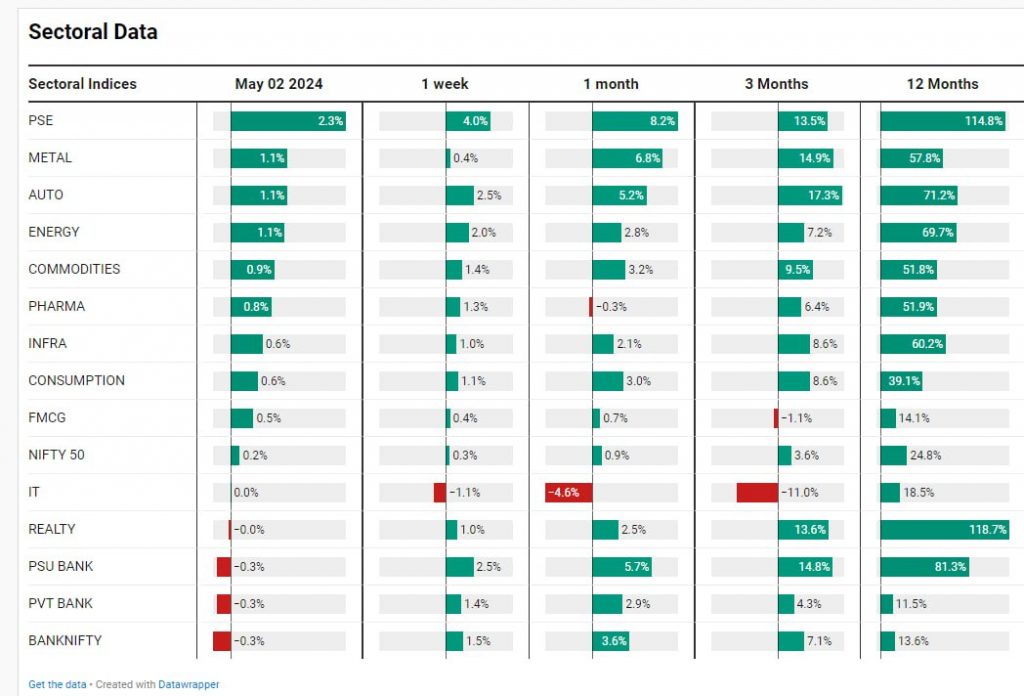

Sectoral Overview

In terms of sectoral overview, public sector enterprise stocks were up 2.3%, marking an 8% gain for the month. Metals, autos, and energy stocks saw gains of about a percent each, while PSU banks, although losing some steam recently, showed temporary phenomena coming off the back of two days of heavy gains.

Mid & Small Cap Performance

Mid cap stocks were rallying, with slight gains from yesterday, reaching nearly 19,000. However, small caps showed different behavior, remaining stagnant over the last four sessions, shifting the market’s focus onto larger caps.

Nifty Bank Overview

Nifty bank saw two sessions of consolidation after a significant previous increase, indicating potential follow-up buying in the near future.

Nifty Next 50

The Nifty Next 50 index continued its strong performance, reaching 66,000.

GOLD Spot

Gold, on the other hand, was undergoing correction after a rapid increase in value over two months. However, this correction presents potential buying opportunities for investors as the overall trend remains upward.

Recent Fed speak suggested a more dovish outlook, which could positively impact stock markets by easing liquidity.

Nifty Auto Index

Nifty auto index also made a new high, showcasing continued strength in certain sectors.

Nifty PSE Index

Public sector enterprise stocks are just going crazy while head and shoulders inverted. Head and shoulders is a very good reversal pattern, but sometimes in continuation also it does really well. So, I mean, this amazing run and then this consolidation for couple of months has given this platform for a relaunch of the public sector enterprise stocks.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz