Nifty IT Index

Today, we’re focusing on the rising volatility in the market, with the India VIX chart showing a continuous increase over the past couple of weeks, climbing from 10 to 21.5. Historically, the VIX has spiked before major events, such as elections and the COVID crisis, reaching 36 in 2014 and 28 in 2019. As we approach the election results, we can expect more volatility, with potential wild moves on the result day due to the unwinding of positions and option strategies.

Market Outlook

Today’s market opened with a gap down but quickly recovered. The Nifty’s chart shows that the open was equal to the low, a strong indicator of a short-term bottom. This pattern suggests a lack of hesitation in the market, with buyers stepping in immediately. The Nifty has been trading within a range, testing support around 21,800 and resistance near 22,800. We’re likely to remain in this range until June 4 unless prevailing narratives about the election outcomes lead to an earlier breakout.

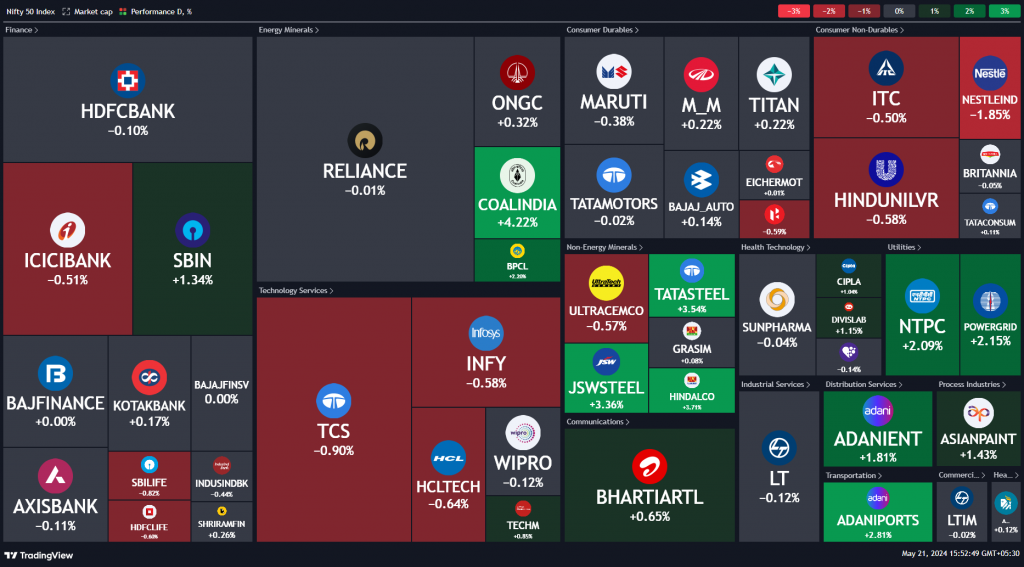

Nifty Heatmap

In the Nifty heat map, public sector enterprises, metals, commodities, and Adani stocks performed well. This indicates market optimism towards sectors expected to benefit from the continuation of the current government. Meanwhile, defensive sectors like FMCG, IT, and autos remained flat, and banking saw minor gains, with some green in PSU banks.

The Nifty Next 50 heat map was greener, with significant gains in Bharat Electronics, HAL, IRFC, Vedanta, and Jindal Steel. Naukri also rose by 3% after reporting strong results. Overall, the Nifty Next 50 has shown impressive movement.

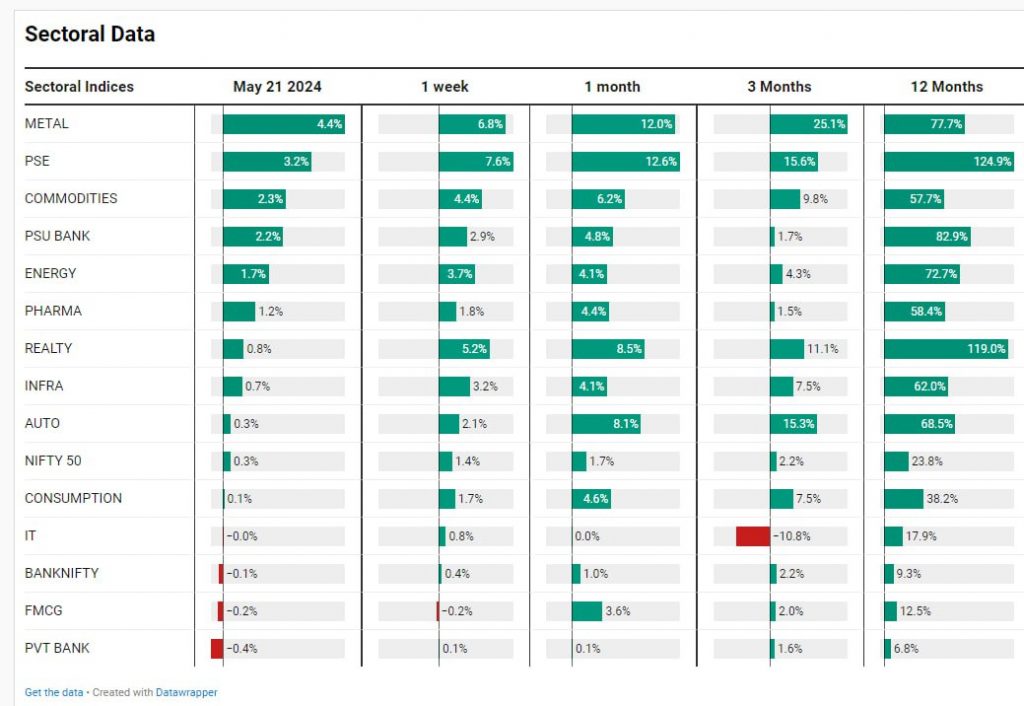

Sectoral Overview

The metals sector had an exceptional day, rising by 4.4%, contributing to a 12% gain for the month. Public sector enterprise stocks also surged by 3.2% today, and commodities were up by 2.3%. These sectors outperformed the broader market, which saw modest gains in energy and pharma, while sectors like banking, FMCG, IT, and consumption remained subdued.

The public sector enterprise index is up 125% for the year, and real estate has gained 119%, highlighting the impact of sector selection on portfolio performance. Structured strategy modes help in early identification and investment in these running sectors, unlike discretionary methods that may enter late.

Nifty Mid and Small Cap

Mid caps hit a new all-time high, outperforming the frontline index and indicating strong performance in the broader market. The large caps, however, might be under pressure due to continuous FII selling. Small caps also made a marginal new high, closing near all-time highs, showing robust performance.

Nifty Bank Overview

The Nifty Bank index appears tentative, forming a flag pattern that could break down, potentially affecting the overall market. Conversely, the Nifty Next 50 is hitting new highs almost daily, and the Nifty Energy index is attempting a breakout after a couple of months of consolidation.

Nifty Next 50

Conversely, the Nifty Next 50 is hitting new highs almost daily

Nifty Energy Index

Nifty Energy index is attempting a breakout after a couple of months of consolidation.

Nifty Commodities Index

The Nifty Commodity index is benefiting from strong performances in Chinese stocks, blasting through its previous highs.

Nifty PSE Index

The Nifty Public Sector Enterprise index shows a strong inverse head and shoulders pattern, confirming a breakout and continued upward momentum

Nifty Metal Index

The metals index has seen a significant rise, moving from 8700 last week to 10,000 today, indicating a robust market with no signs of weakness.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz