We are right there; the budget is tomorrow, and the economic survey was tabled today. The economic survey, always presented the day before the budget, assesses the entire economic growth, prospects, and situation, providing a basis for the budget proposals for the next year. Some concerning points were raised

Now, let’s discuss what was said in the economic survey and the expectations for the budget. My guess, purely speculative, is that we might see some impacts on Futures and Options (FNO) tomorrow. The persistent murmurs over the past three weeks, and even the last six months, about SEBI’s concerns regarding high FNO volumes and money moving from banks to speculation, suggest something significant may be coming. This chatter has grown louder, hinting at possible taxation changes or increased margins. However, I’ll be happy to be proven wrong. We’ll delve into this more in the second half of the blog.

Market Overview

Now, where is the market headed? The markets were reasonably flat today. We opened down due to weak overnight results from Reliance, but other parts of Nifty ensured a flat close. Despite some drubbing this morning, we recovered back to even. There has been remarkable Nifty management over the past 10-15 days, with different sectors balancing each other out to keep Nifty stable.

However, the market is stretched and hasn’t had a decent five-day correction since the 21,200 level on election day. The market might need a resting period, and the budget could be a catalyst for either a significant move up or down.

The budget could surprise us in two ways: no changes for the markets, which might lead to an all-time high tomorrow, or some form of detrimental action such as taxation or changes in the FNO format. Given the increasing noise around these concerns, I feel there is more room for a downside.

Nifty Next 50

Nifty Junior, however, very, very smartly, has bounced from its 40 day moving average. This is a good bounce, however, last three sessions were pretty steeply down. So we’ve basically come back to similar levels where we were at the beginning, at the top of the elections, and slightly gained on it today, which is a very fair place to be at in just one day before the budget.

Nifty Mid and Small Cap

Mid-caps have shown a good bounce from their 40-day moving averages, with decent recoveries from recent falls. Small caps also did the same, leading to an equilibrium situation between bulls and bears just before the budget.

Nifty Bank Overview

Bank Nifty, as you can see, has been very, very steady. No falls at all. 0.03%. Almost like a dead, dead man in ICU.

So this is where we are in terms of the expectations from the markets.

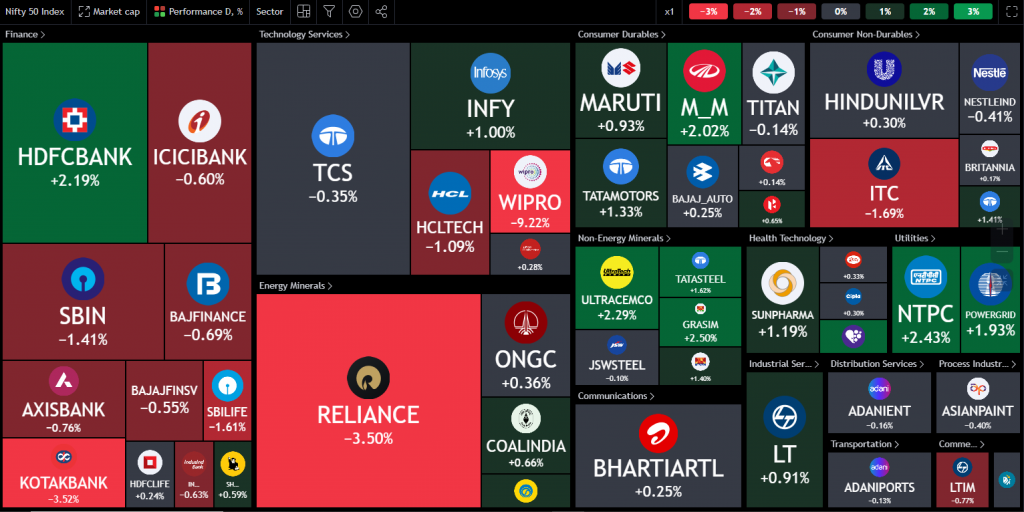

Nifty Heatmap

Looking at specific stocks, Reliance was the top loser along with Kotak Bank, and Wipro saw a significant drop. Despite these declines, Nifty remained flat due to gains in HDFC Bank and other heavyweights like Mahindra, Tata Steel, and UltraTech. The Nifty Next 50 saw gains in stocks like Hindustan Aeronautics, Vedanta, and Torrent Pharma.

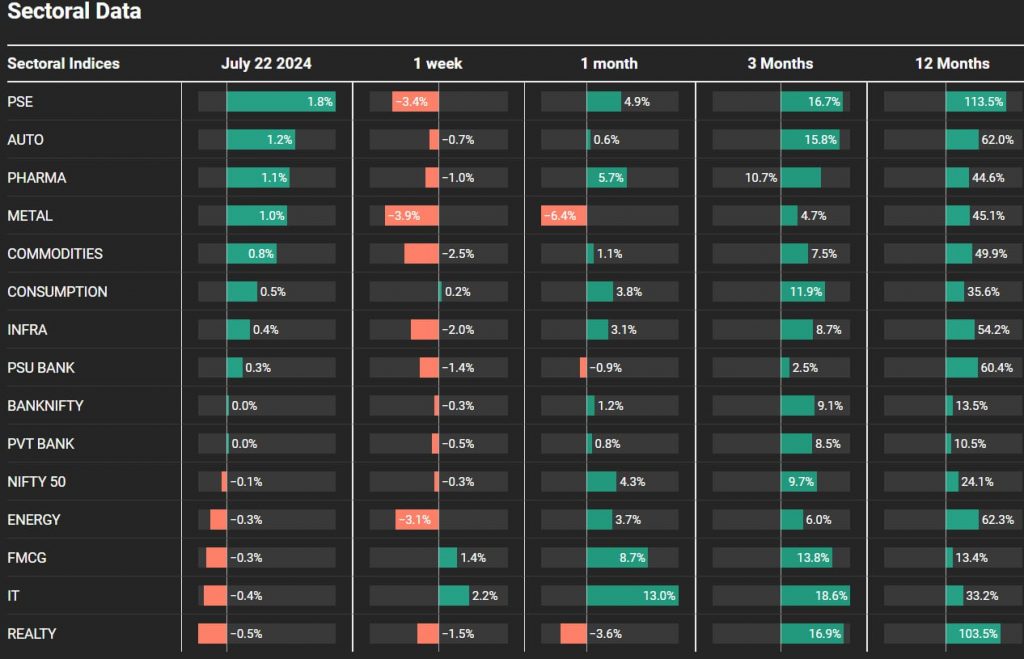

Sectoral Overview

In terms of sectoral trends, public sector enterprise stocks leaped up in anticipation of the budget. They are already quite extended, and it will be surprising if they have another big leg up immediately after the budget. Automotive stocks were up, hoping for favorable EV or hybrid policies. Pharma and metals also did well, while consumption stocks surprisingly moved up only half a percent, despite expectations of tax slab rationalization freeing up disposable income.

Infra stocks showed a modest gain, which could change post-budget announcements. PSU banks remained steady. The equity markets, especially real estate, could benefit from changes in long-term capital gains tax, while equity market taxation remains a concern.

Sectors of the Day

Nifty PSE Index

PSU Bank is still the best-performing sector but has not cleared the pre-election day high.

Nifty Auto Index

Auto index is consolidating in its current band and could see a significant move once this band breaks.

Stocks of the Day

RCF

One stock in the spotlight is RCF, which saw a 9.8% move. This stock, along with others in the fertilizer sector, has been moving significantly, possibly in anticipation of favorable budget announcements. Since April, RCF has risen from about 130 to 235, suggesting that the market is expecting significant news.

Story of the Day

n terms of the economic survey, it projects India’s growth rate to be near 8.2% for FY 24, indicating robust economic performance. Core inflation has dropped to a four-year low, but food inflation has increased, which is concerning. The survey’s comments on FNO suggest a possible regulatory crackdown, stating that market practices akin to leveraged bets in developed countries have no place in a developing country with low per capita income. This statement is quite alarming and suggests possible stringent measures.

The short-term outlook includes a projection by RBI of inflation falling to 4.5% in FY 25 and 4.1% in FY 26, with IMF forecasts aligning similarly. Lower global commodity prices and declining inflation rates indicate a positive outlook.

In terms of budget expectations, there are hopes for simplified income tax structures, adjustments to personal income tax slabs, and rationalized capital gains taxes. Infrastructure spending is always a focus, with anticipated boosts for roads, railways, and urban projects. Fiscal deficit control remains a target, supported by robust tax collections and RBI dividends. Key industry support includes incentives for manufacturing and exports, as well as support for MSMEs.

In agriculture and rural development, the focus is on expanding rural and farmer support programs. Healthcare and education also expect greater allocations and improvements. Sustainability, renewable energy, digital infrastructure, and tech initiatives are other key areas likely to see attention.