Market Outlook

March 22nd, a day that brought some optimism back to the market. We saw a bullish engulfing pattern, suggesting a strong counter-move against the recent downturn. The market attempted to close the gap from the morning, surpassing yesterday’s high before experiencing some sell-off towards the end. However, distancing itself from the dangerous neckline of a false breakdown, there’s a hopeful outlook that we might be steering towards new highs, despite some lingering uncertainty in the market.

Nifty Heatmap

Hello and welcome to the Weekend Investing Daily Byte of March 22nd, a day that brought some optimism back to the market. We saw a bullish engulfing pattern, suggesting a strong counter-move against the recent downturn. The market attempted to close the gap from the morning, surpassing yesterday’s high before experiencing some sell-off towards the end. However, distancing itself from the dangerous neckline of a false breakdown, there’s a hopeful outlook that we might be steering towards new highs, despite some lingering uncertainty in the market.

Today’s market was vibrant with green, with significant recoveries noted in power, utilities, infrastructure, banking, and some IT names, alongside automotive sectors. This broad-based recovery was dampened slightly by IT stocks, which suffered due to Accenture’s disappointing performance in the U.S., affecting Indian IT firms significantly. Infosys, TCS, Wipro, and HCL Tech all recorded declines.

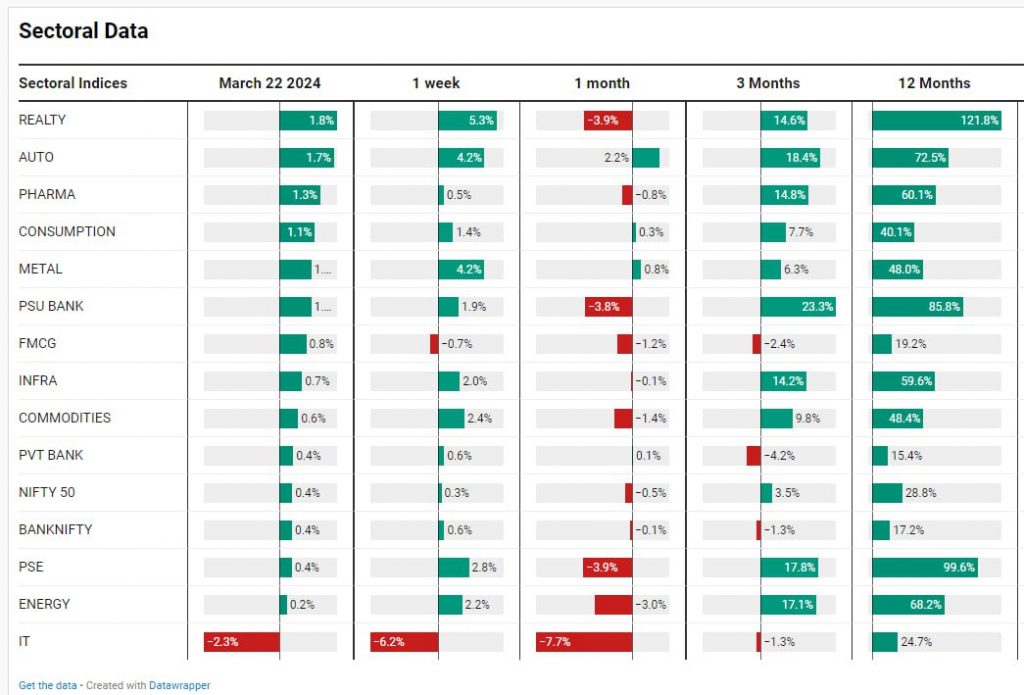

Sectoral Overview

Sectorally, real estate, autos, and pharma led the day’s gains, contributing to a substantial recovery over the past week, especially in real estate, which has seen a remarkable 121.8% growth over twelve months. This rebound indicates that the sectors driving this rally are regaining momentum, promising more growth.

Mid & Small Cap Performance

Mid and small caps showed resilience, with mid caps moving ahead of previous support levels, suggesting a robust recovery underway.

Nifty Bank Overview

Nifty Bank remained neutral.

Nifty Junior

Nifty Next 50 outperformed, nearing its previous high and showcasing the silent yet significant strength driving the market forward

Nifty REALTY

Real estate’s resurgence as the rally’s frontrunner reinforces the market’s underlying strength, suggesting potential for retesting previous highs and continuing the growth trajectory.

Nifty Auto

The auto sector’s near return to its all-time high speaks volumes about the underlying strength in the economy, as reflected by the robust demand in the automobile market. This sector’s performance is a testament to the consumer demand and economic resilience, despite broader market uncertainties.

Nifty IT

IT faced a challenging day, eroding gains from the last three months and raising concerns among investors. The sector’s sharp drop, influenced by global IT sector performances, may signify a temporary setback, yet there’s potential for it to stabilize in the coming sessions.

IT’s sector’s precise response to closing the gap indicates the relevance of technical analysis in identifying market trends and potential reversal points. This precision highlights the importance of chart patterns in guiding investment decisions for discretionary investors.

Nifty USD/INR

The unexpected spike in the USD/INR exchange rate poses a new challenge, potentially signaling either reduced RBI support or increased foreign fund outflows. This sudden movement in currency markets could impact overall market sentiment and requires close monitoring.

As we approach a shorter trading week due to holidays, the market’s direction will be closely watched, with hopes pinned on continued recovery and a positive outlook as we move towards the elections. The strength observed in leading sectors like real estate and autos provides a solid foundation for optimism, underscoring the market’s ability to rebound and the economy’s growth prospects.